Inflation Monitor – April 2015

Inflation Monitor Summary – Composite Ranking

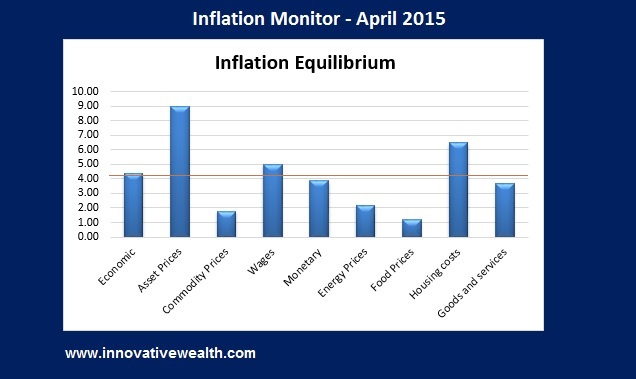

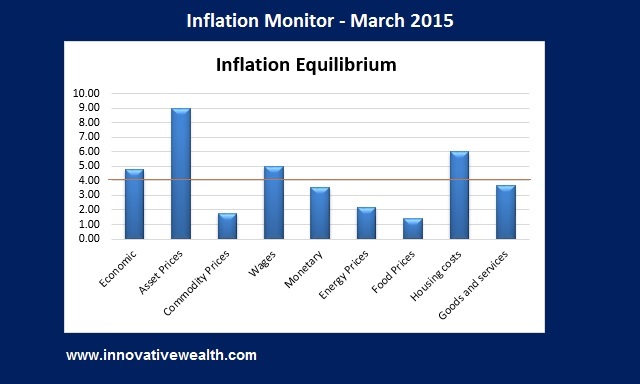

* The Inflation Equilibrium is a quick summary for the whole data series of the inflation monitor. If you don’t like statistics, this is the chart for you.

Inflation Monitor – April 2015 – Introduction

Spring is finally here and with it comes the warm weather. Unfortunately the warm weather has not been able to thaw out deflation or the wintery economic chill that has gripped certain parts of the US economy and many European nations.

The CPI continues to hit negative territory on an annual basis for the second month in a row. The PPI is well into negative territory as well. This does not bode well for the US economy.

Commodity prices have also continued to show weakness. The bright spot in the US economy is housing which has been climbing for the past few months and started to pick up its pace.

There are many excuses that have been proposed for these numbers: the heavy snowfall in the North East this past winter, the significant drop in oil prices, the rising US Dollar, and more. These are all valid reasons for the drop in the CPI, PPI, and other economic data. However what I find amusing is the commentators who claim the high oil prices were a good thing for the economy, now say that low oil prices are good for the economy… Well which is it?

The stock market is not the economy” – Author Unknown

This axiom is more important than any you will learn about the stock market. What it means is that the economy does not always lead or follow the actions of the stock market. While they are obviously related, they are not the same.

The US stock market is currently holding up well considering the negative economic data. While the two are highly correlated, they do not always act in unison. However I do expect the stock market to follow the economic trends in the second half of this year unless we see a sharp reversal in trend of the US Dollar and Oil.

In this months Inflation Monitor I have some very interested charts to share with you. Enjoy.

As always, please contact me to send your feedback on how I can make this monthly Inflation Monitor a better tool and resource for you. Thank you for reading and I hope you enjoy this month’s issue – Inflation Monitor – April 2015.

Join our email list to receive the Inflation Monitor sent directly to your inbox.

Kirk Chisholm