Wealth Management

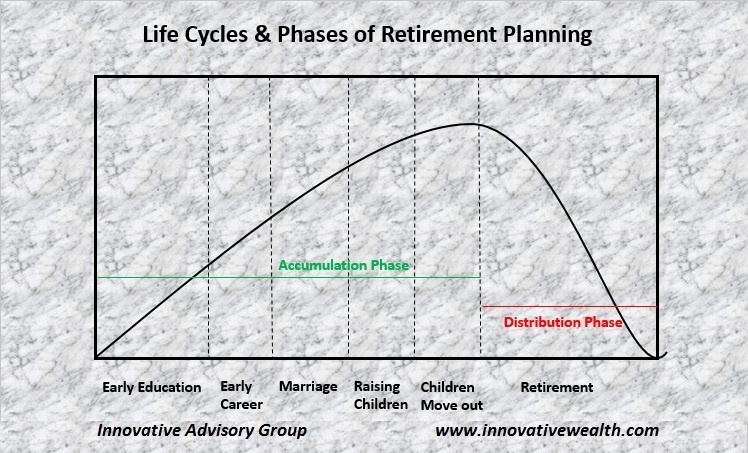

At Innovative Advisory Group, we emphasize that wealth management is a continuing process of accumulating, consuming, and transferring wealth. We see this as encompassing three separate but connected phases: Accumulation, Distribution, and Transfer. The impact of each stage will depend on the result of the prior stage. This means that if you plan properly in the accumulation phase, each subsequent phase will allow you more choices in how you choose to direct your wealth.

"Wealth Management" - The process of growing, protecting, spending, and transferring wealth.

Wealth Accumulation

The Wealth Accumulation phase is where a family’s wealth is built. This accumulated wealth will be necessary in order to meet future needs. The wealth may be inherited or earned, but in all cases, decisions need to be made for how to grow and protect that wealth through saving and wise investing. This is the most important phase since it sets the foundation for a family’s future.

The important components of the wealth management process in this process are Financial Planning, Portfolio Management, and Risk Management. All of these should be considered mandatory if you want to be a good steward of your wealth.

The Wealth Accumulation phase starts when you begin your work career and ends when you retire. This stage includes marriage, raising children, and planning for their education. Education planning is an especially important topic due to the skyrocketing costs of college.

Our experienced wealth managers can help you develop a financial plan for you and your family's future. This plan can include retirement planning, education planning and other financial goals which you have planned for.

After developing a financial plan, the next step is to develop a risk management strategy and build a legacy wealth portfolio. Our firm has decades of experience in managing portfolios for our clients. You can learn more about Our Portfolio Management here.

Wealth Distribution

During the Wealth Distribution or Wealth Utilization phase, the rate of growth slows for most people as the wealth begins to be used for retirement purposes. The amount saved and invested during the accumulation phase will determine how much can be spent during the wealth distribution phase and how much can be passed on during the wealth transfer phase.

Proper financial planning in the Wealth Accumulation phase will make this phase of your life much easier and more enjoyable. While it is important to stick to the financial plan which you have developed, it is also important to enjoy your retirement years.

When you are retired, your active income has most likely stopped. You will require passive income generation to sustain your retirement needs.

Our wealth managers have extensive experience and tools available to them to develop retirement income strategies for you. Even in an economic environment with low yields, we are able to develop strategies to make the most of your retirement investments. If you want to know more about our retirement income strategies, contact us.

Wealth Transfer

Wealth management also involves planning the transfer of wealth to family, charities, or other beneficiaries. It is important to put considerable thought into this phase well before it approaches. At Innovative Advisory Group, we can help you with all aspects of estate planning including coordination with your attorneys, accountants, and other seasoned professionals.

Because the needs and resources of each family are different, Innovative Advisory Group provides a customized approach to wealth management through our Financial Planning process. This provides a road map for individuals and families to help them navigate through future life stages and to reach their goals. It takes a lifetime to build wealth and only a short period to lose it... if it is not managed properly.

One of the most important things to pass on to the heirs of your wealth is your wisdom and experience necessary to manage it properly for future generations. Innovative Advisory Group can assist you with this process, so you can feel at ease that your heirs will continue to get the same wealth management guidance that you have received from us throughout your life.

Email us if you want to know more about our Wealth Transfer process.

Wealth Protection

Wealth management also means Wealth Protection. Our firm views wealth protection or Risk Management as the most important part of our wealth management process. Wealth is hard to build and easy to lose. That is why risk management is so important to us.

Risk management is one of our firm's core principals. It permeates our entire wealth management process. At Innovative Advisory Group, we analyze all investments for potential risks and ways to reduce those risks. Only those investments that meet our rigorous standards of quality will be recommended to you.

At Innovative Advisory Group, we bring a sophisticated, comprehensive, and holistic approach to wealth management, which involves individual clients and their families in a process that will assist them through the different life stages in the most effective way possible. Contact us to learn more about how we can assist you with your wealth management needs.