| Index | Value | 1mo change | 1yr change | 5yr change | Inflation Score |

|---|---|---|---|---|---|

| Economic Inflation | |||||

| Consumer Price Index (CPI) | 233.71 | -0.47% | -0.09% | 7.83% | 1 |

| Producer Price Index (PPI) | 191.10 | -0.52% | -7.10% | 5.58% | 1 |

| 1 Yr Treasury Bill Yield | 0.22% | 0.02 | 0.10 | -0.13 | 2 |

| 10 Yr Treasury Note Yield | 2.08% | 0.24 | -0.64 | -1.65 | 4 |

| Real Interest Rate | 0.29% | 0.84 | 1.75 | 2.57 | 4 |

| US 10 yr TIPS | 0.25% | 0.22 | -0.31 | -1.26 | 2 |

| ISM Manufacturing Index | 52.90 | -1.12% | -2.58% | -5.20% | 3 |

| Capacity utilization | 78.90 | -0.25% | 0.38% | 10.50% | 3 |

| Industrial Production Index | 105.80 | 0.07% | 3.47% | 19.93% | 4 |

| Personal Consumption Expenditure Index | 12,106.80 | -0.32% | 3.60% | 21.06% | 4 |

| Rogers International Commodity Index | 2660.51 | 2.30% | -24.72% | -11.77% | 1 |

| SSA COLA | 0.00% | 1.70% | 3 | ||

| Median Income | $51,939.00 | 1.81% | 3.25% | 3 | |

| Real Median Income | $51,939.00 | 0.35% | -4.56 | 3 | |

| Consumer Interest in Inflation | Mild interest in Deflation | 2 | |||

| IAG Inflation Composite | Mild Deflation | 2 | |||

| IAG Online Price Index | -1.59% | -0.69% | 9.90% | 2 | |

| US GDP | 17710.70 | 0.63% | 3.70% | 21.62% | 4 |

| S&P 500 | 2117.39 | 4.78% | 14.72% | 89.78% | 5 |

| Market Cap to GDP | 125.10% | 118.50% | 85.20% | 5 | |

| US Population | 320,534 | 0.05% | 0.73 | 4.09% | 2 |

| IAG Economic Inflation Index* | Mild Deflation | 2 | |||

| Housing Inflation | |||||

| Median Home price | 199,600.00 | -4.73% | 6.23% | 21.04% | 4 |

| 30Yr Mortgage Rate | 3.71% | 0.00 | -0.59 | -1.28 | 4 |

| Housing affordability | 178.00 | 6.71% | 2.28% | 3 | |

| US Median Rent | 766.00 | 2.68% | 12.65% | 3 | |

| IAG Housing Inflation Index* | Stable | 3 | |||

| Monetary Inflation | |||||

| US Govt debt held by Fed (B) | 2,705.90 | 3.49% | 39.72% | 312.17% | 1 |

| US Debt as a % of GDP (B) | 102.49% | 1.21% | 0.88% | 17.97% | 2 |

| M2 Money Stock (B) | 11,812.70 | 0.76% | 6.28% | 39.21% | 4 |

| Monetary Base (B) | 3,848.73 | -4.66% | -0.08% | 79.75% | 2 |

| Outstanding US Gov’t Debt (B) | 18,141,444 | 1.78% | 4.55% | 47.36% | 4 |

| Total Credit Market Debt (B) | 58,715.58 | 1.27% | 3.58% | 12.50% | 4 |

| Velocity of Money [M2] | 1.53 | -0.52% | -1.92% | -11.15% | 1 |

| US Trade Balance | -41,752.00 | 8.44% | -7.49% | -12.38% | 1 |

| Big Mac Index | Expensive | 1 | |||

| US Dollar | 95.38 | 0.34% | 19.50% | 18.43% | 1 |

| IAG Monetary Inflation Index* | Strong Deflation | 1 | |||

| Energy | |||||

| Electricity (cents / KW hour) | 12.15 | -2.49% | 3.67% | 4 | |

| Coal (CAPP) | 53.06 | 0.00% | -15.78% | -14.90% | 1 |

| Oil | 49.52 | 4.06% | -51.81% | -37.98% | 1 |

| Natural Gas | 2.69 | 1.17% | -41.50% | -43.61% | 1 |

| Gasoline | 1.98 | 34.41% | -33.72% | -9.62% | 1 |

| IAG Energy Inflation Index* | Strong Deflation | 1 | |||

| Food and Essentials | |||||

| Wheat | 513.50 | 2.09% | -14.49% | -1.39% | 1 |

| Corn | 391.50 | 5.60% | -15.40% | 0.64% | 1 |

| Soybeans | 1035.00 | 7.67% | -26.62% | 7.20% | 1 |

| Orange Juice | 120.75 | 13.93% | -17.77% | 18.41% | 1 |

| Sugar | 14.79 | 1.44% | -5.19% | -50.54% | 1 |

| Pork | 67.80 | 0.22% | -36.55% | -6.13% | 1 |

| Cocoa | 3006.00 | 12.08% | 2.14% | 3.33% | 3 |

| Coffee | 141.30 | -12.72% | -21.70% | 7.70% | 1 |

| Cotton | 64.53 | 35.60% | -25.99% | -21.74% | 1 |

| Stamps | $0.49 | 0.00% | 6.52% | 11.36% | 4 |

| CRB Foodstuffs Index | 356.13 | 1.72% | 13.54% | 0.84% | 1 |

| IAG Food and Essentials Inflation Index* | Strong Deflation | 1 | |||

| Construction and Manufacturing | |||||

| Copper | 2.70 | 7.94% | -15.42% | -20.23% | 1 |

| Lumber | 296.70 | -8.00% | -15.49% | 11.79% | 1 |

| Aluminum | 0.79 | -3.18% | 5.85% | -18.15% | 3 |

| CRB Raw Industrials | 471.56 | -2.04% | -11.70% | -3.54% | 1 |

| Total Construction Spending (M) | 971,384.00 | -1.08% | 1.75% | 10.22% | 3 |

| IAG Construction & Manufacturing Index* | Mild Deflation | 1 | |||

| Precious Metals | |||||

| Gold | 1,213.00 | -5.39% | -8.64% | 8.47% | 2 |

| Silver | 16.58 | -3.80% | -22.06% | 0.30% | 1 |

| IAG Precious Metals Inflation Index* | Strong Deflation | 1 | |||

| Innovative Advisory Group Index | |||||

| IAG Inflation Index Composite* | Mild/Strong Deflation | 2 | |||

* If you would like a description of terms, calculations, or concepts, please visit our Inflation monitor page to get additional supporting information. We will continually add to this page to provide supporting information.

* Our Inflation Score is based on a proprietary algorithm, which is meant to describe the respective category by a simple number. The scores range from 1-5. One (1) being the most deflationary. Five (5) being the most inflationary. These scores are meant to simplify each item and allow someone to quickly scan each item or section to see the degree of which inflation or deflation is present.

* We have also added our own indexes to each category to make it even easier for readers to receive a summary of information.

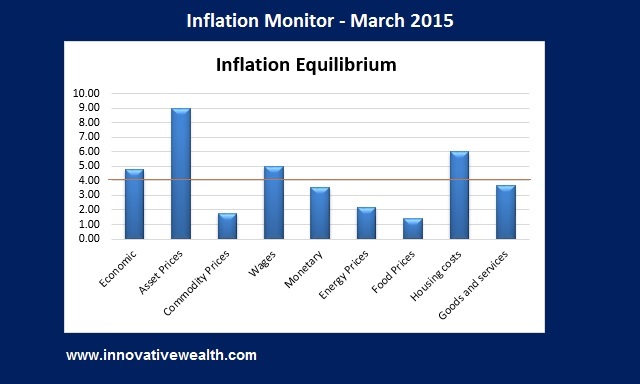

Inflation Deflation Composite Ranking

* The Inflation Equilibrium is a quick summary for the whole data series of the inflation monitor. If you don’t like statistics, this is the chart for you.

Inflation Monitor – March 2015 – Introduction

It is March and as of today, spring is finally here. It doesn’t feel like spring when the temperature is below freezing. I only hope that the weather warms up so I don’t have to wear a winter parka in April.

Boston finally broke the record for snowfall this year with 108.6 Inches. The prior record was 107.9 inches in 1872. This broken record was no reason to celebrate since the Governor had to call in the National Guard to help with the snow.

Boston’s lack of preparedness is much like the financial markets with deflation. Deflation has caught a lot of people off guard. A number of European countries currently have negative interest rates, Germany and Switzerland rates are negative out to 6 and 10 years. What the future holds with negative interest rates is anyone’s guess, but the idea of negative interest rates is a dangerous one if the trend continues lower.

Is the US stock market safe from global deflation?

The S&P 500 and US Treasuries are an anomaly in the global equity and bond markets. The US Treasury has the highest interest rate compared to any other developed country. The S&P 500 continues to rise despite the global deflation affecting countries and equity prices around the world.

The US economy and S&P 500 have shown some resiliency in the past few years. The economy is growing and seems quite stable despite the global tensions around the world. The US is an oasis, but can we keep up this progress?

Can the US decouple from the rest of the world?

While I cannot foretell the future, I do not see the US having the ability to decouple from the rest of the world economically. This does not mean the stock market will not rise another 300% without a major correction (although highly unlikely), just that the economy will start to slow. In case you have not heard this before, The economy is not the same as the stock market.

One reason it is highly unlikely that the US will decouple, roughly half of S&P 500 earnings come from abroad. The US dollar is up roughly 20% since last year’s low, suggesting that overall profits could be clipped by about 10%. This means we can expect that earnings should drop about 10% over the next 12 months. This is not a positive sign for the stock market.

Another reason for the potential of a decline in the stock market is that the rise in the US Dollar means that other countries will have stronger exports than the US further cutting into revenues. These concerns may take a few quarters to show up in corporate earnings, so I expect this to start to show up in the second half of 2015.

I also expect the Fed to raise rates around the same time in the second half of 2015. It will put some pressure on equity prices, but this will most likely be as much of a hike as the markets can stomach. 2015 will be another interesting year. The theme in the US is still deflation. Sign up to receive the Inflation Monitor each month if you want to keep pace with the deflation trend.

In this month’s Inflation Monitor, I have some very interesting charts to share with you. Enjoy.

As always, please contact me to send your feedback on how I can make this monthly Inflation Monitor a better tool or resource for you. Thank you for reading and I hope you enjoy this month’s issue – Inflation Monitor – March 2015.

Kirk Chisholm

Join our email list to receive the Inflation Monitor sent directly to your inbox.

Charts of the Month

Here are some charts I found interesting in the past month.

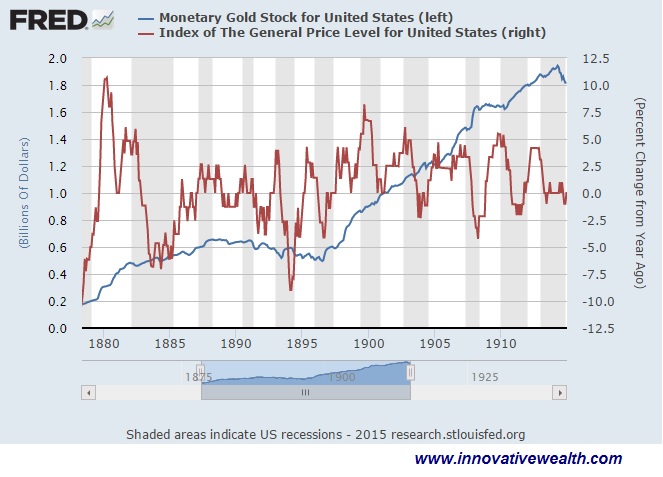

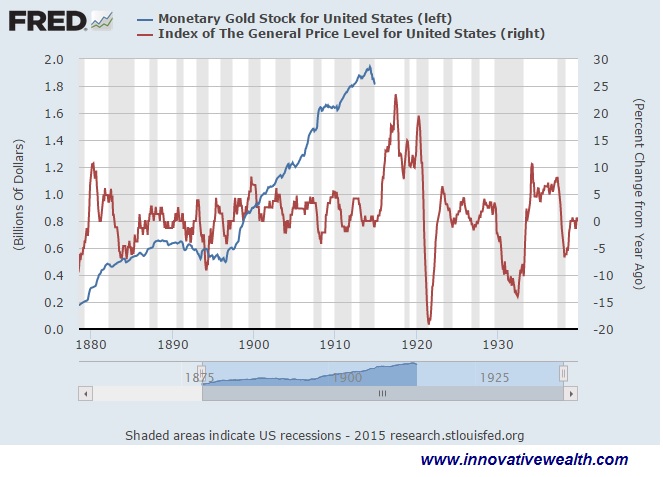

US Gold Stock Prior to the Federal Reserve’s Creation and Price Stability

David Wheelock at the St. Louis Federal Reserve recently issued a blog post, he tried to point out that general price volatility was higher under the gold standard than it is now. I addressed this topic is a prior issue of the December 2014 issue of the Inflation Monitor. The point is that if you don’t anchor a currency to something, then how do you value the currency? Numbers can be what you want them to be when there is no anchor.

I thought I would offer some insight into this by extending this chart a few more years into the future. David claims that pegging the US Dollar to gold caused more volatility in pricing than now, where it has no such peg. This chart should show you otherwise. It seems as if there is another coincidence which may have played a bigger factor.

One flaw in the chart is that it is incomplete. The numbers available on the monetary gold stock of the US end in December 1914. This date coincides with the creation of the Federal Reserve. What should be self-explanatory is that prior to 1914 the range of price volatility was stable. While it might have been higher than what we perceive it to be now, it was a stable range.

In 1914 that price volatility changed quite a bit. It looks like only a few months before this stable price range started to change. So the question should be what caused this price stability with the gold peg to change in December 1914?

I will also point out that there are a number of other factors which were different 100 years ago.

- Technology has made the flow of information and access to it more efficient.

- Experience for the past 100+ years has provided us with many examples of what works and what doesn’t work.

- Despite economists disparaging gold as a store of value, it continues to retain its value in purchasing power. We certain cannot say the same thing for the value of the US Dollar.

It looks to me as if gold is a more stable peg than the Federal Reserve’s IOU.

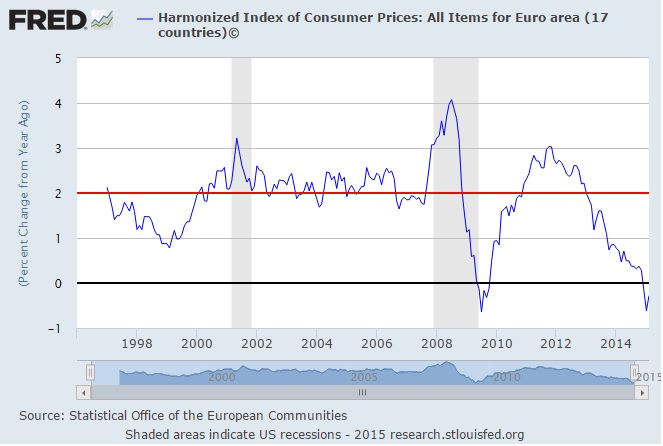

European Deflation

If the ECB target for inflation is 2%, how effective are they as an institution? Not very effective if you ask me. The real question is will negative interest rates boost inflation to pull them out of their rut?

It will be a challenging time for Europe as they try to pull out of their recession. However, the Euro has dropped over 23% in the past year, so if that doesn’t do it, I don’t know what will. Maybe a $0.90 Euro to the Dollar? We will know soon enough.

Gas Prices in Massachusetts

Once again Massachusetts gas prices are still elevated more than they should be. I’m sure the savings from lower prices will eventually be passed along to the consumer. Just not anytime soon. Average Gas Prices in Boston is $2.38… This station is in Belmont. The RBOB Gas Futures are priced at $1.7678. That is a nice spread selling gas.

With oil and gas prices down to levels we saw over 15 years ago where we had under $2.00 gas, how long will it take for gas prices to reach those levels again? If you want to know when consumers will benefit from lower gas prices, I suppose we will have to wait and see.

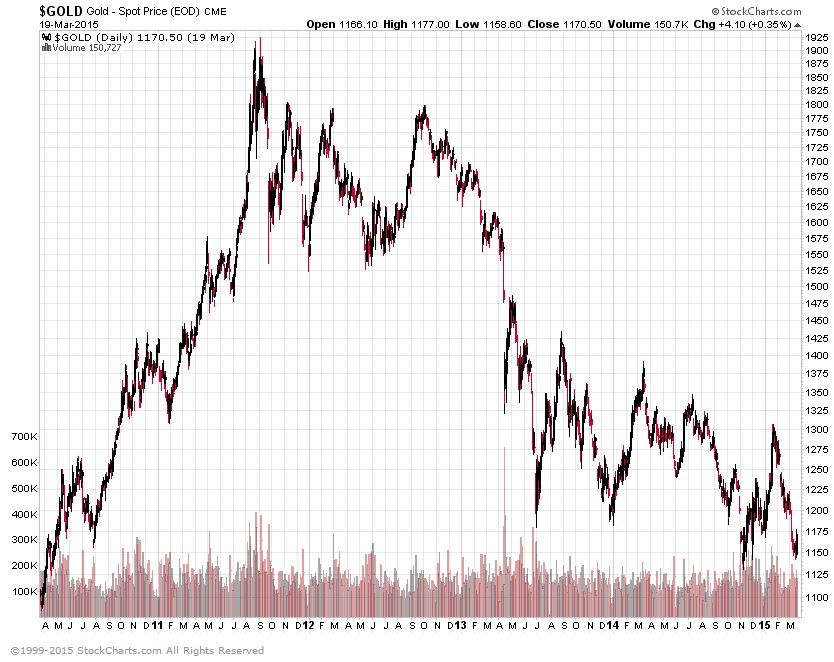

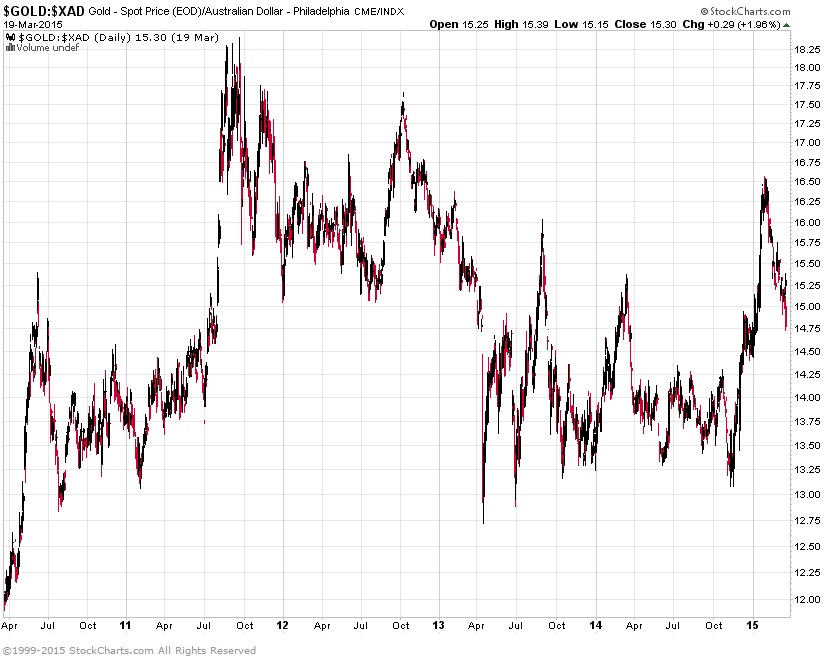

Gold prices are they strong or weak?

If you look at the price of gold you will notice the price has been weak over the past few years in all currencies but Yen. However in the past 6 months gold is much higher in every currency but the US Dollar. Even with the decline in prices in the past few months, the price is still much higher than it was 6 months ago.

Obviously, you will have to keep a close eye on the price of gold in US Dollars if you live in the US. What is interesting is how strong the US Dollar has been since the late fall of 2014. Gold experienced a big drop in price along with the price of oil, but oil continued to drop while gold bounced higher. There is a strong inverse correlation of Brent Crude and West Texas Intermediate crude oil to US Dollars according to Standard & Poor’s. The correlation is stronger than any other commodity. For reference, feeder cattle, sugar, and lean hogs are the least correlated.

Gold Priced in US Dollars

Gold Priced in Euros

Gold Priced in Yen

Gold Priced in Canadien Dollars

Gold Priced in Australian Dollars

US Dollar

I hope you enjoyed this month’s Inflation Monitor. See you next month.

Cheers,

Kirk Chisholm

The IAG Inflation Monitor – Subscription Service

We are initially publishing this Inflation Monitor as a free service to anyone who wishes to read it. We do not always expect this to be the case. Due to the high demand for us to publish this service, we plan to offer it free for a while and when we feel we have fine tuned it enough, we do plan on charging for access. Our commitment to our wealth management clients is to always provide complimentary access to our research. If you would like to discuss becoming a wealth management client, feel free to contact us.

If you would like to receive the Inflation Monitor in your email inbox each month, click here to join our subscription service.

Sources:

- Federal Reserve – St. Louis

- U.S. Energy Information Administration

- U.S. Post Office

- National Association of Realtors

- The Economist

- The Commodity Research Bureau

- Gurufocus.com

- stockcharts.com

- GasBuddy

* IAG index calculations are based on publicly available information.

** IAG Price Composite indexes are based on publicly available information.

About Innovative Advisory Group: Innovative Advisory Group, LLC (IAG), an independent Registered Investment Advisory Firm, is bringing innovation to the wealth management industry by combining both traditional and alternative investments. IAG is unique in that we have an extensive understanding of the regulatory and financial considerations involved with self-directed IRAs and other retirement accounts. IAG advises clients on traditional investments, such as stocks, bonds, and mutual funds, as well as advising clients on alternative investments. IAG has a value-oriented approach to investing, which integrates specialized investment experience with extensive resources.

For more information, you can visit http://innovativewealth.com

About the author: Kirk Chisholm is a Wealth Manager and Principal at Innovative Advisory Group. His roles at IAG are co-chair of the Investment Committee and Head of the Traditional Investment Risk Management Group. His background and areas of focus are portfolio management and investment analysis in both the traditional and non-traditional investment markets. He received a BA degree in Economics from Trinity College in Hartford, CT.

Disclaimer: This article is intended solely for informational purposes only, and in no manner intended to solicit any product or service. The opinions in this article are exclusively of the author(s) and may or may not reflect all those who are employed, either directly or indirectly or affiliated with Innovative Advisory Group, LLC.