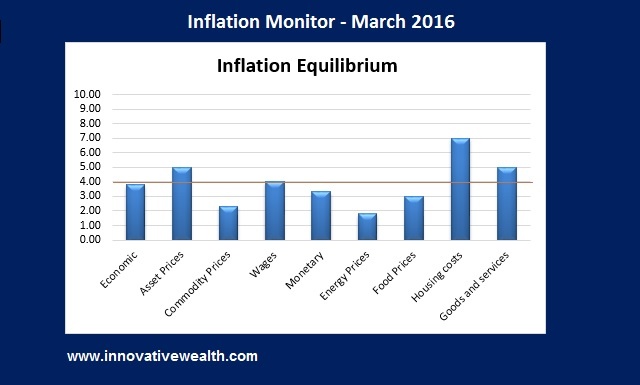

Inflation Monitor – March 2016

Inflation Monitor Summary – Composite Ranking

* The Inflation Equilibrium is a quick summary for the whole data series of the inflation monitor. If you don’t like statistics, this is the chart for you.

Inflation Monitor – March 2016 – Introduction

The first quarter of 2016 has been an interesting one. It started off with a significant bout of volatility and risk-off investing. Then after the stock market bottomed in mid-January and re-tested those levels a few weeks later, it has taken off like a rocket. It was almost as if the global economic troubles didn’t exist anymore. Unfortunately they do… It was almost as if someone (the Fed) waved their magic wand and all the problems of the world just disappeared.

Magic is a wonderful thing. Easter is coming soon. Kids are eagerly awaiting the day where they get chocolate eggs and toys from the magical bunny. What a wonderful thing to believe in magic and illusion.

While many of you don’t believe in the Easter bunny, you probably believe in magic. Earlier this year the markets swooned based on poor economic data, then the Fed told a magical story of how they are data dependent (but only when they want to be) and lowered rate hike expectations and without further consideration the market believed it and started to rise.

Spoiler Alert for those of you who still believe in the Easter bunny, he isn’t real, and neither is this stock market rally.

Sure the prices confirm that stocks and commodity prices have been rising in the past few weeks, but what has really changed? Have US or global economic conditions improved? The only thing that has changed significantly in the past 3 months has been the stock market. So does the Fed’s data dependency include stock prices? Maybe I missed that Fed meeting where they discussed how stock prices determined monetary policy.<end sarcasm>

The Fed’s stated target of four interest rate hikes in 2016 communicated to the public that US economic conditions were strong enough to attempt to return to historically normal rates… At least those were the expectations communicated by the Fed.

At the last Fed meeting, Fed Chairwoman and magician Janet Yellen indicated that the number of rate hikes may be closer to only two. Like magic, the markets rose to greet the new bullish expectations. Apparently four rate hikes was too much and two was just the right amount. The Fed has a notoriously poor track record of predicting the future of interest rates and inflation, but in this case there may be another motive.

The Fed has another magic trick in their act other than changing the fed funds rate and printing money. With a few carefully placed words they can change the direction of the stock market. All market participants want to know what the Fed says. They hang of every word uttered by Fed board members. Yet what the Fed actually does is very little. One meeting they predict 4 rate hikes and the next they reduce it to 2. They have not changed any of the underlying conditions, but like magic, they have made everything all right again in the markets.

This is one of the Fed’s greatest tricks…