Inflation Monitor – July 2016

Inflation Monitor Summary – Composite Ranking

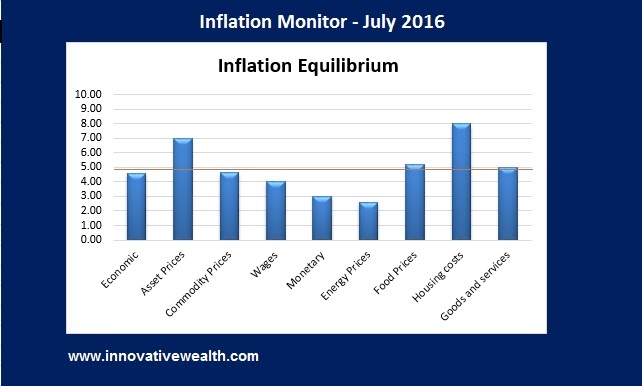

* The Inflation Equilibrium is a quick summary of the whole data series of the inflation monitor. If you don’t like statistics, this is the chart for you.

Inflation Monitor – July 2016 – Introduction

“Debt is future consumption brought forward. Once debt is incurred, consumption that might have happened in the future won’t happen, and it should come as absolutely no theoretical surprise that at a certain level of debt, growth and income begin to diminish. That is exactly what we are seeing in the real world, even if those who espouse the reigning economic paradigm (Keynesianism) are still in love with their beautiful theory.”

I hope you had a happy Independence Day. A day that is in remembrance of the US’ independence from Britan. How ironic that only 11 days prior to our independence day, the UK declared its independence from the EU. If you don’t know about the Brexit, you must have been living in the woods for the past month. Everyone has been discussing this monumental vote with varying degrees of opinion as to what it could mean.

I have not wanted to discuss it much prior to the vote, because despite what you hear on TV, no one really knows what will happen. Sure there are plenty of “smart” people who have an opinion about what will happen. Some think the world will end, or we will spiral into WW3, others think it is a great thing for the UK. Let me rain on the parade of all these “smart” people. No one knows what will happen. There are too many variables to count and although there are some very important issues that may come up due to this vote, this has never happened before, so we have no reference point of what could happen.

Many people have some relevant thoughts on the issue, but in terms of what will happen, it is mostly political, so unless you know the minds of all the various politicians involved with the UK, EU, and each individual country, you cannot make a thoughtful prediction as to the outcome.

Here are some of the relevant points you should consider.