" Its tough to make predictions, especially about the future." - Yogi Berra

Is this the start of a high yield bond rout that many bond experts have been predicting?

Is the S&P 500 performance this year a good indicator of the overall market?

Will instability in the bond market spread to other asset classes?

What is the blueprint for the next financial crisis?

These are all questions that clients have asked recently and I thought this would be a good chance to discuss these issues as a wrap up of 2015.

Lets start by taking a look at what has happened this year, where we stand today, and try to pass some judgement on what could happen in 2016. Normally I don’t write about “predictions”. Yogi Berra was a wise man. However I think this post is relevant to the nature of the markets and the growing instability that is occurring under the surface.

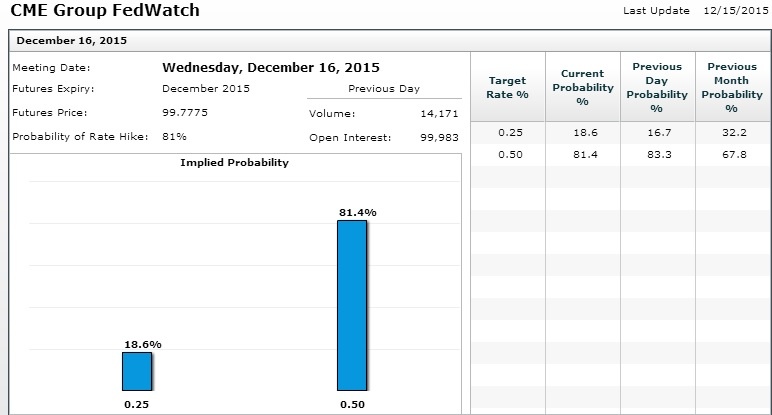

Normally I would write about this in the monthly issue of the Inflation Monitor, but since certain actions have progressed more quickly than most people realize, I felt it was especially important to discuss what is going on in a separate post. We also have the Fed meeting where it is highly likely that the Fed will raise rates.

So lets get to it.

Oil, Gas, and Energy Stocks

This year and the second half of last year was humbling for energy stocks and energy related commodities. So far this year, crude oil is down about -30%, natural gas is down about -39%, gasoline is down 13.73%, and the energy sector ETF (XLE) is down -21.65%. This is the second year in a row of bad performance from the energy sector.

Last year was worse for oil and gas prices with oil dropping about -44.5% and gas dropping about -32%. The rout in energy prices last year started in July but picked up speed in September. Despite the sharp drop in energy prices, many oil and gas companies hedged their production. These hedges allowed them to produce oil and gas at much higher levels than the prices we see today. So this drop in prices would not pose a serious threat until the hedges expired.

It is now more than a year from those higher prices. Global oil production levels are increasing due to other countries increasing their production levels. This is continuing to push down oil prices far below what most analyst expected.

Here's the problem. Let's say you run an oil company with a high level of debt. This debt level is based on an expected expansion in your production based on high oil prices. Without these high prices, the interest payments would be come unbearable. Then oil prices drop, reducing the revenues your company generates. How long will it take for your company to file for bankruptcy?

This is the question that many investors are asking. There are landmines all over the energy sector. Walk there at your own risk.

This is the first stage of the next financial crisis. The serious damage has been done, but it is not over yet.

High Yield Bond Rout

If you haven't noticed, this is a bad year for high yield bonds. Since March of 2015, high yield bonds have continued to drop most of the year. Year-to-date the performance of HYG (a high yield bond ETF) has been -12.02% (as of the close of 12/14/15). In comparison, the S&P 500 (SPX) is down -1.76% for the year. While high yield bonds and stocks are not the same, they do tend to have a correlation to each other where high yield bonds can be a forward looking indicator of trouble ahead.

Looking at performance, you might just shrug your shoulders and say, that is why I diversify. However you may not be aware of other problems happening under the surface that could cause problems in your portfolio.

Thursday of last week, the Third Avenue Focused Credit Fund entered a plan of liquidation, halting all shareholder redemptions. This means that investors could not pull their money out because too many of them wanted to sell at the same time. Last June the fund had $3.5 Billion in assets. Now it has about $788 Million.

If this was a stock mutual fund, it may not have been a problem, but since many high yield bonds are not very liquid, it would not have been possible to liquidate the fund without causing large losses, if it could be liquidated at all. Third Avenue's solution was to close the fund and freeze investor funds until they could be liquidated in a reasonable fashion. Who knows how long these investors will have to wait.

Friday of last week Stone Lion Capital Partners, founded by two Bear Stearns employees, suspended redemptions to their credit funds after receiving too many redemption requests.

Monday morning a $900 million high yield credit fund Lucidus Capital Partners announced that it was liquidating its entire portfolio and returning investor's money.

Now lets say you are an investor in the Third Avenue Focused Credit Fund, and you need to liquidate to cover some personal expense, or you need the income for retirement. You are SOL. So where do you get your funds? By selling something that you can sell. Many times these alternatives are solid investments, but when you need cash, you need it now.

This is how contagions start. When an asset class like high yield bonds are getting sold indiscriminately without regard for their value, smart investors will not sell, they hold and wait for better times to sell. If they need cash, they will sell an asset that is not in distress to raise the needed cash. On a massive scale, this is what causes other assets to drop turning a rout into a contagion. This happened in 2008. During that time you could find many stocks and bonds that were beyond cheap on any reasonable metric.

This is the second stage of the next financial crisis. We are still in this phase.

What are the risks of high yield bonds?

Here is a quick primer of high yield bond risks, so you are aware of what can happen in this sector. Investing in bonds means you are loaning the company money. You are acting like a bank. You loan them money and they pay it back over time with interest. If they do not pay it back, then they default on the bond and the bond holder would have a claim on the company assets.

Investing in bonds provides a binary outcome. Either the company pays back the principal and interest by maturity, or they don't. At maturity the owner of the bond will get back a defined amount (usually $1,000 per bond). The alternative is that the company cannot pay back the money at which point the company is in default.

These are some risks of investing in bonds. Some of these risks are more applicable for high yield bonds than investment grade. Click on each one to learn what they mean.

Interest Rate Risk (click for more information)

Reinvestment Risk

Call Risk

Liquidity Risk

Default Risk

Inflation Risk

Credit Risk

Future Stages of the Next Financial Crisis - Corporate Bonds, Stocks, Student Loans, Auto Loans, and Real Estate

“In the past seven years central banks have conjured more than $10 trillion of digital wampum. Still, prosperity eludes them.”

~ James Grant, founder of Grant’s Interest Rate Observer

Founder, Grant's Interest Rate Observer

For the past year, I have been frustrated by a lack of good investment opportunities in various asset classes. It was almost as if most assets were priced perfectly, leaving little room for appreciation or reasonable income. What this told me earlier this year is that another crisis or recession is inevitable. If there is no one left to buy, then prices stop going up.

Many investor need income. If they cannot get income from safer investments such as CDs or US Treasury bonds, they look elsewhere. This led a lot of investors to high yield bonds and other riskier investments. This in turn flooded other asset classes with inexperienced investors who drove the yields down and prices up.

As interest rates normalize, this should provide more opportunities in many asset classes, but not without certain disruptions. These over-priced assets will most likely drop in price and make it more attractive for disciplined investors to buy. While this would be how a normal market operates, if contagion takes hold of the markets, who knows what will happen.

If the high yield bond market conditions do not improve, other asset classes will start to be affected. Here are some related assets classes that you should take note of.

Corporate Bonds

“The risk is there could be a run on the bond funds, causing further downward price movement. . . . They’ve been searching for yield and throwing caution to the wind.”

Doubleline Capital

So far this year corporate bonds have returned -4.56%. For a safe asset class, this is not a desirable outcome. Most of that drop happened in April, May, and most recently in the fourth quarter with the high yield bond crisis. I suspect with such low interest rates, it would be hard to imagine corporate bonds appreciating much above their prices earlier this year.

If I was a betting man, I would guess that corporate bonds would be the next victim in a contagion, if the high yield bonds crisis gets worse. This is not because they are bad investments. High grade corporate debt is in high demand. People need income (as small as it is). This is why Microsoft was able to sell 40 years corporate bonds earlier this year. Yes... 40 year bonds. Petrobras, which was downgraded to junk bond status a few months ago, issued 100 years bonds in June. I don't even have words to describe my feelings on this. All I can say is that I know those investors are not happy right now.

Recently we have seen a few downgrades of corporate debt from investment grade to junk with more on the way. As these bonds transition from investment grade to junk, it causes a massive selling of these bonds by investors who are not allowed to invest in junk bonds. This would further continue the contagion. When investors need to raise cash, they tend to look at assets that are liquid. This includes corporate bonds, and stocks.

Stocks

2015 has been a deceiving year for stock investors. As of this week, the S&P 500 was trading flat (currently -2.24%) for the year. With the exception of the selloff in late August the index has been flat for most of the year. If you never invested outside the S&P 500, you might not know anything was wrong on Wall Street.

However if you take a closer look at what is happening, you would realize that the stock market is a dangerous place right now.

If you look beyond the S&P 500, you might notice some smart investors having trouble in a year which would have been safer to keep cash. Berkshire Hathaway is down -11.50% for the year. Warren Buffett, arguably one of the world's greatest investors, is well known for holding high quality stocks for long periods of time. Lets take a look at these well know names.

Stock Name | Stock Symbol | YTD Performance |

|---|---|---|

Kraft Heinz | KHC | -4.52% |

Coca Cola | KO | 0.34% |

International Business Machines | IBM | -17.05% |

Walmart | WMT | -31.27% |

American Express | AXP | -26.03% |

US Bankcorp | USB | -5.84% |

Wells Fargo | WFC | -2.59% |

Philips 66 | PSX | 14.46% |

Proctor & Gamble | PG | -14.28% |

DaVita Health Care Partners | DVA | -8.11% |

With the exception of PSX, the rest of his holdings look terrible when you are comparing it to the S&P 500 returns. His weighted return average for the top 10 holdings is -7.59% vs -2.24% for the S&P 500.

What is going on?

S&P 500 Performance

Here is a year-to-date chart of the S&P 500 stocks.

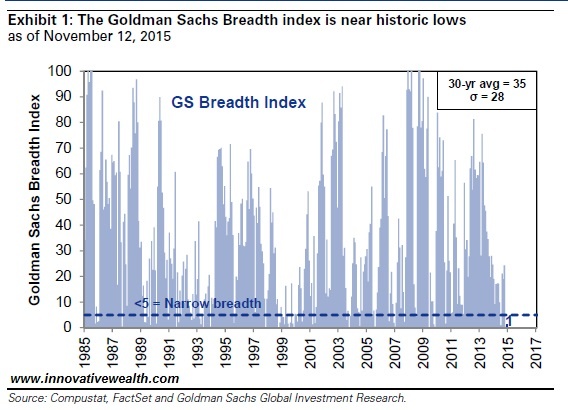

With so many sectors under-performing, how is the S&P 500 index trading around flat for the year?

The secret lies in the weighting of the index. The larger companies hold more weigh than smaller companies. So if a handful of the larger companies are doing well, it would seem the index is doing well. However the breadth of the returns is narrow. From a historical basis, it is at an extreme. This does not show a sign of strength. It shows weakness in the equity markets, despite the current price of the index. If you remove Amazon, Alphabet (formerly Google), Microsoft and Facebook from the index, you would see returns closer to Warren Buffett's performance.

Hedge Fund Returns - Year-To-Date 2015

During the third quarter of 2015, hedge fund assets dropped $95 Billion to $2.87 trillion. This is a drop of almost 25% in hedge fund assets. It is obvious investors are not happy with hedge funds returns. This is how some of the more well known names are doing this year.

Here are returns of some well known hedge funds as of September 30th 2015.

Fund Name | Fund Manager | YTD Return | As of period |

|---|---|---|---|

Third Point Offshore | Dan Loeb | -4.4% | (through September 30) |

Pershing Square Holdings | Bill Ackman | -9.60% | (through October 13) |

Marcato International | Mick McGuire | -11.60% | (through September 30) |

Paulson Advantage | John Paulson | -12.00% | (through September 30) |

Omega Overseas Partners | Leon Cooperman | -12.02% | (through September 30) |

Glenview Capital | Larry Robbins | -13.5% | (through September 30) |

Greenlight Capital Offshore | David Einhorn | -16.88% | (through September 30) |

Fortress Macro Fund | Mike Novogratz | -17.49% | (fund closing) |

This obviously does not epitomize the entire industry, but when a number of smart investors all get it wrong at the same time, it makes you wonder.

As a side note, Baron's just published its annual 2016 outlook. They did not have one of their strategists who predicted anything less than a positive return for 2016. Do you know what happens on Wall Street when everyone agrees? You can check out my post, 2014 Investment Predictions Summarized in One Picture, as an example of this. As you might guess, it didn't turn out as Wall Street expected.

Real Estate, Student Loans, and Auto Loans

“The excess liquidity has manifested itself in surging levels of subprime auto loans, student debt, corporate share repurchases, rising levels of margin debt, and record levels of mergers and acquisitions.”

Chief Strategist and Editor, Clarity Financial

It could be reasonably argued that the next bubbles are in auto loans and student debt. However it is hard to say when they will pop. The easiest way to track these two sectors is to watch SC (auto loans) and NAVI (student loans) for their performance.

Real estate on the other hand is not quite in the same position as other assets. Sure it is also priced to perfection with some cap rates in the range of 2-3 in places like New York and Miami (generally priced higher than before the real estate bubble popped in 2005-08), but most of these high prices are based on low interest rates. The real questions is real estate in a bubble and will interest rates rise in a meaningful way in the near future. I would have to say the answer is no, probably not for quite some time. Sure Janet Yellen may raise interest rates at the December meeting or even shortly after that, but I cannot imagine that interest rates will start rising to a point where it constrains investors.

We have a long way to go to reach interest rate levels which would significantly change the dynamic of the markets. It is certainly possible that slightly higher rates would be blamed for what is going on in the bond markets, but since rates have not changed for quite some time, it would be hard to make that claim with a straight face.

This does not mean that real estate prices will stay at these levels. If the potential financial contagion described above continues, most assets including real estate will drop in price. Don't expect the fire sale prices we saw in 2009-2010.

This post is already getting too long. I wanted to get this released in time, so I'll cut it here. There are a lot of other areas to cover as well, but I think these are the most pertinent to the current market condition.

Despite all of this information I just gave you, there is one thing to watch which could give you better temperature of the market conditions... The US Dollar. I discussed this briefly in last month's Inflation Monitor.

The US Dollar is in a bullish phase right now. If it continues, which a rise in interest rates should provide, then this will provide stronger deflationary pressures to the US economy. While the US economy may be relatively strong, putting too much pressure on it could bring the recession that many bears have been calling for.

Lets wrap up 2015 with some thoughts.

What should you do to prepare for the next stages of the Next Financial Crisis?

I'll tell you a secret...

I do not know the future

...and neither does anyone else.

Anyone predicting how things will progress in the next financial crisis is a fool. The nature of contagions is that the outcome is not knowable. The global financial system is interconnected in more ways than any one person could fully understand. All you can do is be prudent with your capital and your risk taking.

While some people see risks, others see opportunities.

I am certain of one thing. While I have spend most of this year looking for opportunities, the lack of them tells me that things cannot last in this state for long. There will most likely be a challenging period ahead of us, this challenge will also present a tremendous opportunity for those who are prepared for it.

If you are looking for a wealth management firm that is prepared for the challenges ahead, one that is looking at both risks and opportunities, one that is not constrained to only investing in traditional investments, we may be able to help you. contact us for more information.

The best way to reach us:

If you want to speak with one of us, you can contact us directly via this link.

If you want to follow up via email or social media, you can click on the buttons below.

About Innovative Advisory Group: Innovative Advisory Group, LLC (IAG), an independent Registered Investment Advisory Firm, is bringing innovation to the wealth management industry by combining both traditional and alternative investments. IAG is unique in that they have an extensive understanding of the regulatory and financial considerations involved with alternative investments held in self directed IRAs and other retirement accounts. IAG advises clients on traditional investments, such as stocks, bonds, and mutual funds, as well as advising clients on alternative investments. IAG has a value-oriented approach to investing, which integrates specialized investment experience with extensive resources.

For more information you can visit: Innovative Advisory Group

About the author: Kirk Chisholm is a Wealth Manager and Principal at Innovative Advisory Group. His roles at IAG are co-chair of the Investment Committee and Head of the Traditional Investment Risk Management Group. His background and areas of focus are portfolio management and investment analysis in both the traditional and alternative investment markets. He received a BA degree in Economics from Trinity College in Hartford, CT.

Disclaimer: This article is intended solely for informational purposes only, and in no manner intended to solicit any product or service. The opinions in this article are exculsively of the author(s) and may or may not reflect all those who are employed, either directly or indirectly or affiliated with Innovative Advisory Group, LLC.