Half a truth is often a great lie. – Benjamin Franklin

Do you want to be a great investor… Or do you just want to be average?

I assume you want to be above average or you wouldn’t be reading this. Everyone wants to be a good investor, but not everyone wants to do what it takes to be good. Getting a stock tip from your friend or reading an article online and letting it sway you to invest in some company you know nothing about is not the best path to investing greatness.

Can you imagine Warren Buffett reading the Sunday morning newspaper, finding a compelling article written about some new trendy stock and saying, “this article seems credible, lets put 500 million of my money into it and see how it does…” hard to imagine right?

Does your doctor read about a new procedure in the New York Times and try it out without researching it, practicing, testing etc? If he does, then you need a new doctor.

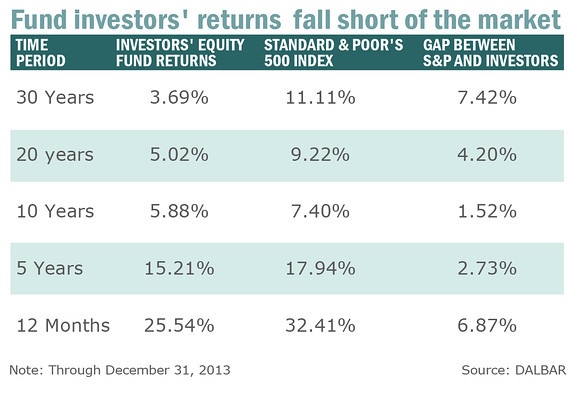

Doctors go to school for years to become highly-competent doctors. They study under other experts before they even operate on a live person. They do a lot of work before they take your life in their hands. Yet we as investors decide that we are going to compete against the best and brightest in the world and spend 1-3 hours a week reading about investing.

When you are investing, you are competing against Warren Buffett, Seth Klarman, Stanley Druckenmiller, George Soros and more. Yet many investors think they can just open the Wall Street Journal and pick stocks like the best investors in the world.

Silly notion right?

Read More…