Half a truth is often a great lie. - Benjamin Franklin

Do you want to be a great investor… Or do you just want to be average?

I assume you want to be above average or you wouldn’t be reading this. Everyone wants to be a good investor, but not everyone wants to do what it takes to be good. Getting a stock tip from your friend or reading an article online and letting it sway you to invest in some company you know nothing about is not the best path to investing greatness.

Can you imagine Warren Buffett reading the Sunday morning newspaper, finding a compelling article written about some new trendy stock and saying, "this article seems credible, lets put 500 million of my money into it and see how it does..." hard to imagine right?

Does your doctor read about a new procedure in the New York Times and try it out without researching it, practicing, testing etc? If he does, then you need a new doctor.

Doctors go to school for years to become highly-competent doctors. They study under other experts before they even operate on a live person. They do a lot of work before they take your life in their hands. Yet we as investors decide that we are going to compete against the best and brightest in the world and spend 1-3 hours a week reading about investing.

When you are investing, you are competing against Warren Buffett, Seth Klarman, Stanley Druckenmiller, George Soros and more. Yet many investors think they can just open the Wall Street Journal and pick stocks like the best investors in the world.

Silly notion right?

While ultimately it is your responsibility for what you do with your money, it is not entirely your fault that you are making these mistakes. Unless you are going to be a full-time investor, you will not have enough time to dig in and learn all there is to know about investing. Frankly, even if you are a full-time investor, it is still hard. I have been providing financial advice for over 20 years and I'm still learning new things every day.

The problem with learning about investing is that there is so much to learn and there are many investing myths and half-truths that are parroted by "experts" that we believe without doing further research to verify.

You have been duped. Yes, you have. Maybe not deliberately duped, but true, nonetheless.

How Wall Street Research Works

(This is how investment research and ideas spread on Wall Street)

One guy does the research on an idea, he tells his friend (i.e. he know the guy who did the research), his friend tells a friend (he knows the guy who knows the guy who did the research), his friend tells a few friends (they know a guy, who knows a guy, who knows the guy who did the research), The rest of the people hear about the idea at a cocktail party.

How Do Investing Myths and Half Truths Start?

Here is how it happens. Someone comes up with an axiom about investing. At the time it is true. Let's take my favorite... "Buy and hold is the best way to invest". During the 1980s and 1990s it was true. This was a good strategy during that time. But it is not an all-weather strategy. Yet people still talk about it as if it is. How well did that work from 2000-2013?

Times change and people don't and neither do their rules of thumb.

Many of these myths and half-truths were originally created by large Wall Street firms, mutual funds companies and investment banks. Most of the myths were not deliberately created to deceive investors. Many of them started out being true, but never reexamined. That is why they are half truths. Some theories did work, and now they don’t. Sometimes conditions change and people don’t update the saying. And sometimes they were not fully vetted and turn out to be wrong.

What makes half-truths particularly dangerous is that they are partially true. When the "truth" is explained, it makes sense, it seems logical, but when you dig into the data it is incomplete, or not fully thought through.

The problem is that we live in a society of superficial information (first level-thinking). We want the summary version or a quick headline to tell us what to do. People don't have enough time to do the deep research needed to vet a new idea. Without doing your own research, you won't know that it is only half-true until it is too late.

Investing Myths and Half Truths

One thing is for certain. If you are playing a zero-sum game, you need to be better than average if you want to succeed.

If you want to be better than average, the trick is you cannot think the same way that the average investor thinks. You need to think differently. That means incorporating, as Howard Marks says in his book The Most Important Thing, “second-order thinking” (i.e. Second-level thinking). You need to think independently of other investors if you want to have an edge in the markets. We talk a lot about this on the Money Tree Investing Podcast.

It takes great investors a lifetime to fine-tune their investing strategy. In most cases, they are constantly evolving their strategy to the ever-changing conditions. You don't survive on Wall Street for decades without having an agile mindset to change as market conditions change.

I hope to make a small contribution to your investing education by shedding some light on the top 10 investing myths and half-truths that can destroy your financial well-being.

Definitions:

- Investing Myths - These are theories that have been thrown around for years and people believe them even though they are not true.

- Investing Half Truths - These are theories that are only partially true, which frequently can be the most damaging. Either they were true at one point and have not been updated or they were only partially true because they were not fully tested or understood in their totality.

Myth #1: Buy and Hold is the Best Strategy

As discussed above, this is a half truth which has persisted through the 1980s - 1990s. If you used a buy and hold strategy during this period of time, you would have done well…In large part because the market went up during that entire time.

Sure, there were bumps in the road during those 2 decades, but the direction is unmistakably up. If you employed the buy and hold strategy with solid investments, you most likely made a lot of money.

I have spoken to many mutual fund sales reps over the years who (always had a chart supporting this theory) reinforced the thesis of buy and hold. They claimed that if you missed the five best performing days in the market you would have reduced your performance by 5%+ annually. Wow! that's compelling.

Somehow, they never had the chart available that showed what would happen if you missed the 5 worst performing days of the year. Curious... Based on my knowledge of the markets, I would guess it was greater than 5% annually... much greater.

Obviously, it benefited their fund if you used a buy and hold strategy... Actually, it benefits almost all of Wall Street's investments if you buy and hold.

I forgive them for showing the brighter side of statistics. I don't begrudge anyone for making a living, but can you see how this kind of thinking in half-truths can be dangerous?

Buy and hold can be a good strategy if used appropriately. It is just not an all-weather strategy.

Let's look at this from another angle

There is a theory that says you cannot time the market (see myth #6), so it is better to buy and hold for the long term. Usually this theory is combined with an example like Warren Buffett who never sells his stocks, or examples of stocks like Microsoft, Johnson & Johnson, or Coca Cola with long term strong track records of stock performance.

These would have been good stocks to buy 40 years ago if you had bought them… Did you?

Probably not, because you could not tell they were great stocks 40 years ago. Certain people were lucky enough to buy them when they were cheap and were fortunate enough to hold on to them for the long term, but that is a very small percentage of investors.

I'll ask the question… if very few people bought these stocks 40 years ago and continue to hold on to them today, was it a good investing strategy?

Yes… but only if it lines up with your investing style or psychology.

It worked for Warren Buffett (in part for other reasons), but his style is probably not the same as yours. You need to find an investing style that lines up with your investing philosophy. We will talk about this more below in myth #2

I frequently refer to the buy and hold strategy as “buy and hope” because most investors buy and hope it goes up. They don’t truly understand why stocks go up and down. Most of them read an article discussing why a certain stock is great, get convinced, and buy it hoping it will go up.

Hope is not a strategy.

If you don’t understand why, you are buying a stock, what price to buy at, and when to sell it, then you should not be buying the stock.

The 1980s and 1990s were kind to buy and hold investors, but the 2000-2012 period was not. You essentially lost 12 years of time because the market went up and down for over a decade and ended up in the same place… assuming you didn’t sell at the bottom of the market.

The buy and hold strategy works in bull markets but not in bear markets. If you are in a secular bull market, then this strategy might be a decent strategy, but don’t use it in bear markets. You can lose a lot of money.

Myth #2: You Can Invest Like Warren Buffett and Get Similar Returns

I remember the Nike commercial from years ago where they have a vignette of 10 kids saying “I am Tiger Woods”. It was brilliant marketing.

This an example of a half-truth. You are not Tiger Woods and will never be. The same mentality runs true for famous investors like Warren Buffett. You are not Warren Buffett. He is a unique individual with a certain investor psychology that matches his investing style. He understands his strengths and weaknesses well and understands how to optimize solid stock picking with strong insurance underwriting (one of the least discussed parts of his successful investing strategy at Berkshire).

It is highly likely that you do not run an insurance company and do not have a forever timeline with your stock picks. That is not to say that you are destined for failure with your investing. It is relatively easy to beat Warren Buffett’s returns due to his size. He even says he could get the great returns he had earlier in his career if he had a smaller pool of money to invest. (Size can cause problems for great investors.)

I have met investors who are getting 20%, 30%, 40% returns a year investing in all sorts of assets from real estate, tax liens, private company stock, horses, gold, cryptocurrencies, options, etc. They are successful because they are investing in areas that they are experts in. Peter Lynch was famously quoted as saying, “Invest in what you know.” It is one of the top rules every investor should consider when they are choosing their investing strategy.

The point is that you should not try to emulate certain investors… unless you have the same investing psychology. Each one of us is different and you need to figure out your own investing style that best suits you.

We interview a lot of successful investors on Money Tree Investing Podcast. What I have found is that each investor is different. The successful ones have focused on mastering their own investor psychology first. Then they take that knowledge and apply it to investing by finding a style that works best for them.

We will continue to discuss investing psychology on this show and how you can be a better investor by determining your investing psychology and the best style for you.

Myth #3: Your IRA or 401k Needs to be Invested in Stocks, Bonds or Mutual Funds

Did you know that approximately 5% of IRAs are invested outside the stock market?

If you did, then you are in the minority. Less than 10% of investors are aware that they can invest their IRA in assets other than stock bonds and mutual funds.

For those of you in the 90%, consider this to be a tax loophole of the rich. It is a secret that wealthy investors have been using for decades to shelter taxes from the IRS. One presidential candidate used it to shelter taxes and grow his IRA to over $100 Million dollars. Yes, you read that correctly. His IRA was worth over $100,000,000.

Wow. That is a powerful tax loophole.

Most investors have been told that they must invest in stocks, bonds, and mutual funds with their IRA or 401k. Who told them that? The companies that provide those services of course. Don’t hold it against them. They don’t advertise dental products either. Most companies only advertise the products they can sell.

If you read the tax code, it doesn't say want you can invest in. It only outlines what you cannot invest in.

This comes back to the Peter Lynch quote, "Invest in what you know."

If you are a professional real estate investor who owns and rents multi-family rental housing, then why would you invest in a company that sells smart phones?

There is nothing wrong with investing in any investment, but if you are good at what you do, then why would you invest outside your comfort zone in an area you know little about.

Investors do this all the time, and it is usually to their detriment.

If you are an expert real estate investor, then maybe you should consider investing your IRA into real estate… Not publicly traded REITs. Rather, rental property that is solely owned by your IRA.

Intrigued?

Fortunately, you are in the right place. We have one of the best resources online for investors to learn more about self directed IRA investing. If you want to learn more about self directed IRA investing, this is a good place to start.

You can also learn more about self directed IRAs by listening to my interview on Money Tree Investing Podcast.

There are some pros and cons to investing in the stock market vs outside the stock market. We will discuss some of these in the next myth.

Myth #4: The Stock Market is The Best Place to Invest If You Want to Grow Your Wealth

Hopefully, this is the last time I'll quote Peter Lynch in the same article. Peter once stated, "invest in what you know." He meant that you should invest in areas you know well, either professionally or from personal experience. Invest in things that give you an edge over other investors.

Unfortunately, most investors invest in areas they know very little about. More commonly, they performance chase hot stocks because they are going up, but not knowing why they are going up.

There are virtually an unlimited number of investments that can be made inside or outside your retirement account. Some of the best investments I have seen come with a bit of creativity, but all of them come with an understanding of how they work (second-level thinking).

I have seen people flip website domain names, invest in private company stock, fishing rights, air space rights, oil and gas properties, tax liens, private mortgages, horses, livestock, farmland, structured settlements, payday loans, and more. We have put together a big list of 75 alternatives you can use to stimulate some outside the box investing ideas.

There is nothing wrong with investing in the stock market, but you should invest in your strengths not your weaknesses. Be creative and come up with some investments you can make where you have an obvious edge.

The exception to this rule is when you have a professional investment advisor or fund manager doing the investing for you. They will have an expertise that is different than yours.

Myth #5: Inflation is The Enemy - You always need to be invested to make money in the markets

A half truth is a whole lie. - Yiddish Proverb.

Most investors are stuck in the mindset that they need to be investing in stocks to grow their wealth, or more commonly stated, that they don’t want to lose purchasing power to inflation. While this is partially true, it is another half-truth.

Think about it this way.

This statement makes a few assumptions.

First, it assumes that being in the market right now is better than being in bonds, cash or another option. Essentially it is trying to predict the future. (False)

Second, it assumes that positive inflation is a constant. (False)

Third, it assumes that you cannot time the market. (False)

Fourth, it assumes all points in time have equal risk reward relationships. (False)

One of the best rules anybody can learn about investing is to do nothing, absolutely nothing,

unless there is something to do. Most people... they always have to be doing something... They can’t just sit there and wait for something new to develop.

– Jim Rogers

I have heard a number of interviews with Jim Rogers where he will say that he just waits till there is a pile of cash sitting in the corner and he goes and picks it up. Meaning that he waits for obvious asymmetric risk trades and bets big.

Which would be the better strategy? Make one or two asymmetric risk trades a year or 100 lower probability trades?

Obviously, this is a leading question, and this style of investing is not for everyone, but it begs the question, why do you always need to be fully invested in the market?

I label this a half-truth because depending on your investing style, this may or may not hold true. If you are a buy and hold index investor, then yes you need to be invested all the time. You are relying on certain probabilities and trends to happen, and if you are not knowledgeable to make smart decisions when it comes to trades, allocations, position sizing, etc, then being fully invested may be the best approach for you.

The reason this myth is a half-truth is that there are many investing styles where not being invested is very important. Take Warren Buffett for example. Frequently, he will sit on large piles of cash waiting for the right conditions to invest. Then when he sees a good deal, he will invest to buy the entire company if possible. This happened in 2007-08 and after the global financial crisis he made a lot of big investments into companies that were struggling and made great returns. You can never have enough cash in a crisis.

The point is that you should take each of these investing axioms with a grain of salt. Don’t take a partial truth and apply it to everything. Engage in some second level thinking.

The other part of this investing myth and half truth is the part about inflation. While inflation has been consistently positive since the 1950s, it is not always going to be the case. I expect we will experience deflation in the future and then we will have a whole new set of problems.

The important thing to consider about inflation is that while it is constant, it has small effects on your wealth over time. If you are strategic about your investing, then you should worry less about inflation.

It is easy to keep pace with inflation by investing in CDs or treasuries or investing in hard assets such as real estate, but the level of your wealth will determine whether you need to keep pace with inflation or if you need to exceed it. If your net worth is $100,000 then you may need to grow your wealth. If you are worth $100,000,000, then you might want to consider keeping pace with inflation to preserve your wealth.

Having your money in cash (or cash equivalents) for 1-2 years is not a bad thing if you are worried about economic conditions. It only becomes a problem if that 1-2 years turns into 10-20 years.

The important thing to remember is to make informed decisions. Don't feel like you need to be fully investing 100% of the time because you are worried about inflation.

Myth #6: You Cannot Time the Markets

This is a half truth that is born out of the “buy and hold” strategy.

I know what you are thinking. You are thinking that I am full of it because no one knows the future. And you would be correct in this assumption. That is why it is a half truth.

You cannot know the future, and because of that, you cannot time the markets…. However, that is first level thinking. This is the thinking of a novice investor. Let me give you a few examples.

Victor Sperandeo made an average of 70%+ a year for a 11-year period without a down year. Was he lucky?

Stanley Druckenmiller has made over 30% annually for decades without a losing year.

Ray Dalio, one of the largest hedge fund managers has returned 13% a year net of fees.

If the markets were efficient, these returns would never be possible. Even the probabilities of this happening to one person are astronomical, let alone to multiple people.

Obviously you can time the markets... You just cannot predict the future.

This is a very important point.

Knowing the future is impossible. No one does.

Timing the markets is very possible. Many people do it every day. The above examples are only a few people who successfully do it every day.

Let's put a finer point on it in case there is some confusion.

We all look to the "experts" to tell us what is going to happen in the future. CNBC exists to do exactly that. Financial newsletters provide stock picks. Financial advisors claim to know what is going to happen. Everyone has a voice about the future, but no one knows what the future will be.

Yes, I called it out... The big elephant in the room. No One Knows The Future.

Don't you find it odd that we all want to know the future? We try to find every edge we can to figure out what the future holds, yet no one knows, and no one will ever know. It is natural to think this way. The problem is when you cannot separate fortune telling from portfolio management.

Here is the difference. if you are timing the markets because you think you know what will happen, you will be wrong a large percent of the time. That is trying to predict the future. It is also "first-level thinking".

If you are timing the markets by using probabilities and proper risk management processes, then it is entirely possible to beat the markets with market timing. This is second level thinking

Most people think that if you are correct 51% of the time, you will have a winning strategy. This is not the case. I can show you a strategy that wins 90% of the time and still loses money, and I can show you a strategy that only wins 30% of the time and is a highly profitable strategy. The success rate is only one factor in making successful trades. I talk about this in my post on Fear and Greed.

It is not the number of times you are right and the number of times you are wrong that matters. It comes down to how much you lose when you are wrong and how much you make when you win. If you make 100 trades and lose 80 of them and those 80 trades cause you to lose 5% of your portfolio and your winning 20 trades cause you to gain 20% in your portfolio, you will net 15%, and have a winning strategy.

This largely comes down to risk management. If you get the risk management down correctly, you can decide to time the markets or not. Either way risk management comes first.

It is not only the win percentage, although that is important. It is essentially about how much you win when you are correct and how much you lose when you are wrong.

Let’s take it one step further. Every time you buy or sell a stock, you are market timing. That may not be your intent, but that is the result. Every decision you make is timing the market because you have to make a decision, and no one times every investment perfectly.

When you are investing, don't think about market timing, think about proper risk management and asset selection.

A myth is a lie that conveys a truth. - C.S. Lewis

Myth #7: Active Fund Managers Are Better Than Index Investing

This is a half-truth because it depends on the manager.

Most active fund managers are capable people who can beat their comparative index. The best ones are better than indexing. However, the act of tying themselves to an index causes them to miss the grander goal of superior performance.

Simply put, the fund manager dilemma is Career Risk. Career Risk is how the fund manager defines their strategy based on the risk to reward outcome of their career. Here is how portfolio managers look at their career...

On the positive side, if the fund manager outperforms the index by a lot, they get rewarded by investors sending additional funds to manager and a small to moderate bonus in compensation.

On the negative side, if the fund manager under-performs the index by a lot, they get “rewarded” by getting fired, and investors pull their money from the fund.

If you analyze the fund manager's options, their best-case scenario from a risk-reward perspective, is to try to “hug” the index. Essentially to try to match the index performance minus fees. From a professional perspective, if they beat the index or under-perform the index by a little, they have “succeeded”.

This is not to say that they wake up in the morning and decide to consciously decide to do this, but that is how the incentives align.

We can criticize them for this behavior, but we as investors cause this to happen. We need to take personal responsibility for our behaviors, which ultimately cause their behavior. People call this performance chasing.

Here is what happens...

Joe the fund Manager has been successful for the past 10 years beating the index, so a lot of investors (chasing performance) put money with Joe. Then a recession hits. While Joe was doing well in the good times, the recession caused him to under-perform and lose more than the index when it dropped. Investors in the fund see this under-performance and start pulling money out of the fund. Then management, fearful of losing assets in the fund, decide to fire Joe.

If investors would invest long term (a full market cycle) with the same manager, it would allow them to make better decisions. This is a huge problem for funds managers. Many smart fund managers get hoodwinked by investors by them pulling funds when they need it the most.

This is different from a buy and hold strategy which we discussed above. This is picking a strategy and sticking with a strategy (assuming Joe is not just buying stocks and sitting on them long term)

Another factor that lines up against the fund manager is the size of the fund. Larger funds are harder to outperform. I remember having a conversation with a sales rep at Fidelity years ago who told me that at one point, Fidelity’s Magellan (one of the largest mutual funds at the time) fund could take up to 2 weeks to liquidate a position because their fund was so large. Think about it this way. If you knew a large fund manager was liquidating a position, wouldn’t you try to sell your shares first… giving them a worse price?

My point is that fund managers have problems that you and I do not have as investors.

Lastly, active fund managers have to fight against their own fees. It acts as a drag on performance. If they are charging 1% a year in management fees, then they will need to outperform the index by more than 1% to match the index returns.

If you are an amateur investor with limited experience and knowledge, you might be better off indexing than trying to pick a winner with active fund managers.

Myth #8: Low Fees Are The Most Important Thing When It Comes To Investing

This is another half-truth. Low fees are important. Certainly, you want to spend the least amount of money possible to get the best returns. However which scenario would you prefer…

Example #1: You invest in an index fund getting stock market returns of 7% a year and you pay .05% in fee annually. This would net you 6.95% annually. You also have market volatility so some years you might get 30% and some years you might get -30%, but on average you get 7%.

Is this the best investment option for your money?

Example #2: You invest into a piece of real estate and you are able to 15% returns a year but it costs you 5% a year, netting you with 10% annually in cash flow. Then you might get some appreciation (which will approximate the rate of inflation) of 2%. So you total return would approximate 12% and cost you 5% a year.

Which investment is better #1 or #2?

Obviously #2 is better if you are just looking at net performance. There are always other factors that come into play like liquidity, volatility of price, etc. But in example #2 you are getting a return that is 5% more than the index and it costs 100x the cost. Is it worth it?

Obviously yes.

Low fees are important if all else is equal, but it is not the most important factor in investing. Low fees should always be secondary to a solid investing strategy.

Myth #9: Diversification is The Best Way To Reduce Risk

Here is one of the more popular investing half-truths. It is commonly accepted as fact that you need to diversify your portfolio to reduce risk. While this is true in a sense, most of the most successful investors claim that you need to concentrate your investments into fewer investments. Their track record speaks for itself.

Warren Buffett is quoted as saying, "Put all your eggs in one basket and watch that basket."

What you need to know is that diversification was generated from the idea that if you diversified your investments into non-correlated assets, then you would reduce your overall portfolio risk. This is generally true. However, most people don't invest into non-correlated assets, so they are not taking advantage of this concept. They just assume that if they invest into 8 different mutual funds they will be protected.

In 2009, I did a study on asset correlations and found something interesting. When the markets are acting normally, many asset classes will operate somewhat independently. However, when the markets sell off, everything sells off together. In essence, all assets highly-correlate when the markets drop. Are you seeing the half-truth?

While markets go up diversification works. When markets drop, diversification doesn't work.

Wait! Isn't that the whole point of diversification?

Yes, it is.

Investing in non-correlated assets when the market is going up is a lot less important than protecting your losses when the market drops. However, this is exactly what is happening, and most people don't see it.

This was not always the case. There was a time when non-correlated assets did provide some protection to your portfolio. However, a follow up study that we did showed that the institutions (large mutual funds, hedge funds, pensions, etc.) were causing these assets to correlate more than they naturally would. In essence, the institutional money managers' search for non-correlated assets was causing them to correlate.

What is the solution to this? Either find assets that do not correlate when the markets sell off (which can be hard) or worry less about the diversification and focus on risk management through other means. This is a whole topic in of itself which we will touch on in a later episode of Money Tree Investing.

Myth #10 Stocks Are More Risky Than Bonds

This is truly one of the more dangerous myths right now. This goes into the same bucket as real estate always goes up, inflation is a constant, and money doesn't buy happiness (sorry, it does).

Here is the problem. It's called "recency bias". We as humans have a cognitive bias which causes us to focus on the recent past or a trend and assume that it will continue. It is an illusion. No trend goes on forever, but we continue to get duped because it is easier to believe it than to disbelieve a notion with recent data to “prove” otherwise.

As an example, around 2006-2008 there was a belief that we were running out of oil and that prices would skyrocket and generally people wondered what we would do if the current trend persisted. This assumes that we have limited resources and that nothing will change... of course it does and did.

Around the time we thought we would run out of oil, we came up with a new technology, "Fracking", that allowed the US to extract more oil than we thought possible at prices lower than we thought possible. Now the US is one of the top oil producers in the world and oil prices are lower than they were over 10 years ago. This is all due to technology that no one expected would happen. We expected the trend to be higher prices forever. No one was predicting this in 2005.

The point is that trends change, and we continue to get duped.

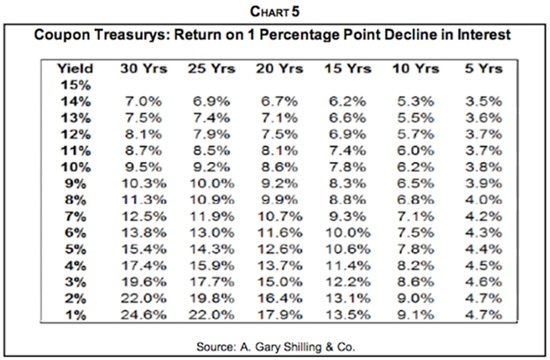

We believe that stocks are riskier than bonds. Generally they are, but not always. Globally we have had some of the lowest interest rates of all time. This trend started in 1980 when the bond market yields peaked and have dropped for 37 years. This was a massive bull market for bonds. Investors made a lot of money in bonds during that time.

Here is a bit of trivia. What was the best performing investment asset class during that time period… if you said equities, you would be wrong. No, the best performing asset was 30 year zero coupon treasuries.

Shocked? I was when I first heard this.

If you are not familiar with how bonds work, bond prices have an inverse relationship with yields. As yield drop (similar to 1980-2015) bond prices go up. As yields go up (as they have been recently) bond prices go down. So in essence, you want to be in bonds when yields are dropping and out of them when yields are rising.

2017 marked the end of the 37 year long bond bull market (according to Jeff Gundlach, considered to be the best bond investor today). So if bond yields are rising, then it is risky to invest in bonds because you could lose money on the bond prices. Additionally, you are getting 2% or less in yield, so there isn't much room for error with bond prices.

Bonds are riskier to own when yields are rising… which they have been doing lately. Do you think that owning bonds is a “safe” investment? Think again.

This is not to say that bonds are not important for portfolios. They are important, but if you think that owning bonds is conservative, you might want to think again.

Conclusion:

I hope you benefited from learning about the top investing myths and half-truths that plague our industry. We will continue to expand your knowledge and understanding of how the industry truly works in the podcast. If you want to sign up for the podcast, you can get notified when new episodes come out and you can also be eligible for free gifts from our guests and sponsors.

Looking for More Information About Self Directed IRAs???

Get this Free Report, 9 Common Mistakes Investors Make Using a Self-Directed IRA.

About Innovative Advisory Group: Innovative Advisory Group, LLC (IAG), an independent Registered Investment Advisory Firm, is bringing innovation to the wealth management industry by combining both traditional and alternative investments. IAG is unique in that they have an extensive understanding of the regulatory and financial considerations involved with alternative investments held in self directed IRAs and other retirement accounts. IAG advises clients on traditional investments, such as stocks, bonds, and mutual funds, as well as advising clients on alternative investments. IAG has a value-oriented approach to investing, which integrates specialized investment experience with extensive resources.

For more information, you can visit: Innovative Advisory Group

About the author: Kirk Chisholm is a Wealth Manager and Principal at Innovative Advisory Group. His roles at IAG are co-chair of the Investment Committee and Head of the Traditional Investment Risk Management Group. His background and areas of focus are portfolio management and investment analysis in both the traditional and alternative investment markets. He received a BA degree in Economics from Trinity College in Hartford, CT.

Disclaimer: This article is intended solely for informational purposes only, and in no manner intended to solicit any product or service. The opinions in this article are exclusively of the author(s) and may or may not reflect all those who are employed, either directly or indirectly or affiliated with Innovative Advisory Group, LLC.