“Self Directed IRAs are one of the best laws the US government has ever passed”

Can I invest in real estate with my Self-Directed IRA?

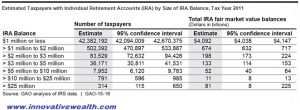

“Self Directed IRAs are one of the best laws the US government has ever passed”, an investor once told me. It is hard to argue that point. In 1974, congress passed the Employee Retirement Income Security Act, often referred to as ERISA, enabling US taxpayers to save money for their retirement in a tax deferred manner. The best part of this program (outside of the tax deferred nature of it) is that they allow you to self-direct your savings.

ERISA established the individual retirement account (IRA) as a staple in many investors toolbox for retirement savings. The IRA allows investors to invest in virtually any investment. While most investors think that they are restricted to stocks, bonds, and mutual funds, the choices are much more interesting. Some ideas that I have seen include: real estate, tax liens, private mortgages, dressage horses, farmland, sports franchises, timberland, physical gold and silver, raw land, private company stock, oil & gas LPs, franchises, and more. With all of these choices and more, you should have already come up with some ideas that could make for interesting investments.

Real estate and real estate related investments is definitely the most common asset type when it comes to self directed IRAs. Whether you are a professional investor or a novice, you probably have at least a basic understanding of how real estate works. Here are 10 self directed IRA tips for investors who want to invest in real estate with the IRA.

Read More…