Why are Individual Investors so Bad at Investing?

Individual Investors Need Help

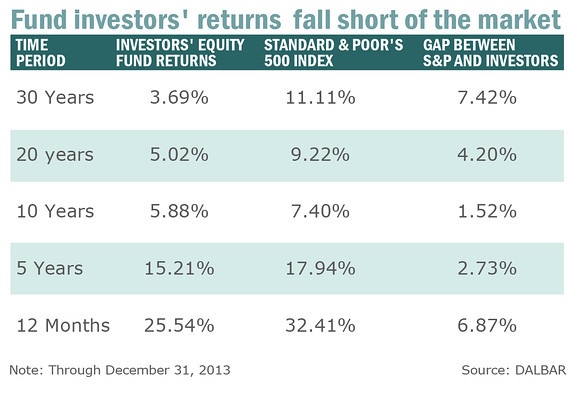

Individual investors as a group have no idea what they are doing. This has been made clear by a recent DALBAR study spanning 30 years all the way back to 1984.1 This period covers a number of bull and bear markets, giving investors a chance to learn from their mistakes. However it is clear that they are not learning the lessons of proper investing.

The S&P 500 is one of the most widely followed indices and is considered a benchmark for the US stock market. I would consider it a suitable benchmark for this study. These numbers compiled by DALBAR show that the return of the S&P 500 over the 30 year period ending in December 2013 is 11.11%. They also show that individual investors only measured 3.69% over that same period of time. This is a remarkable 7.42% difference annually. To put this in perspective, if you invested $100,000 in 1984 in the S&P 500 and earned 11.11%, today (30 years later) you would have $2,358,275. If you started with $100,000 and invested it over the same time period at 3.69%, you would have $296,556. That is a difference of $2,061,719. It should be clear from these numbers that individual investors have a problem.

Why are Individual Investors so Bad at Investing? Read More »