“The distinction between investment and speculation in common stocks has always been a useful one and its disappearance is a cause for concern. We have often said that Wall Street as an institution would be well advised to reinstate this distinction and to emphasize it in all dealings with the public. Otherwise the stock exchanges may some day be blamed for heavy speculative losses, which those who suffered them had not been properly warned against.”

-Benjamin Graham – The Intelligent Investor

Are you gambling with your money?

Investing is not gambling.

Gambling is exciting. Gambling is entertaining. Gambling can make you rich… or so you imagine, but the odds are against you. That is why it is called gambling. That is why casinos are such profitable businesses.

There are professional gamblers who play Texas hold ‘em for a living and do quite well. But they are not gambling, they are playing the odds, they have a system, and they know the probable outcome of their “gamble”. There is certainly a large amount of skill involved as well. Reading people, remembering prior drawn cards, and concentrating for long periods of time.

This does not apply to all games of chance, like the lottery. A friend of mine likes to say, “The state lottery is a tax on people who are bad at math.” If anyone ever looked at their chance of winning the lottery, they would not waste a nickel on it, certainly not the rent money. According to the Massachusetts state lottery, the odds of winning a jackpot in Powerball is 1 in 175,223,510. I assume those odds don’t account for potentially splitting the jackpot with one or more people.1

Investing is supposed to be boring

Investing is not gambling.

Investing is supposed to be boring. Investing is supposed to take a long time. Investing is not supposed to be fun. However, if investing is done properly, it can make you rich… it just might take you 20-30 years to get there, with a little luck. Any successful investor will tell you, the investment profits are not made in the buying and selling, they are made in waiting for the investment to prove itself.

Stocks are a hot potato

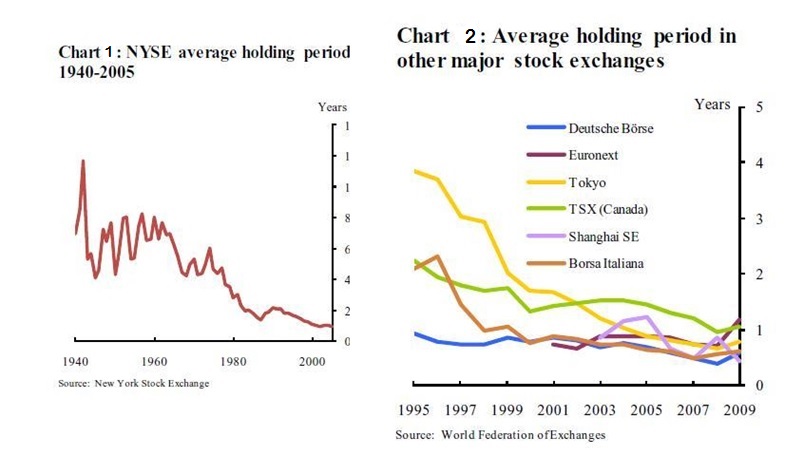

In recent years, investors have shown their inability to hold onto investments. In the 1960s the average holding period for stocks was around 8 years. As of 2010, the average holding period was around 6 months. [See chart 1]

This is not an American phenomenon. Global stock exchanges have the same investor patterns. In only the past 15 years, global exchanges such as the TSX (Canada), Borsa Italiana (Italy), and TSE (Japan) have reduced their average holding period for stocks down to approximately 6-12 months. [See chart 2]

Is buy and hold investing dead?

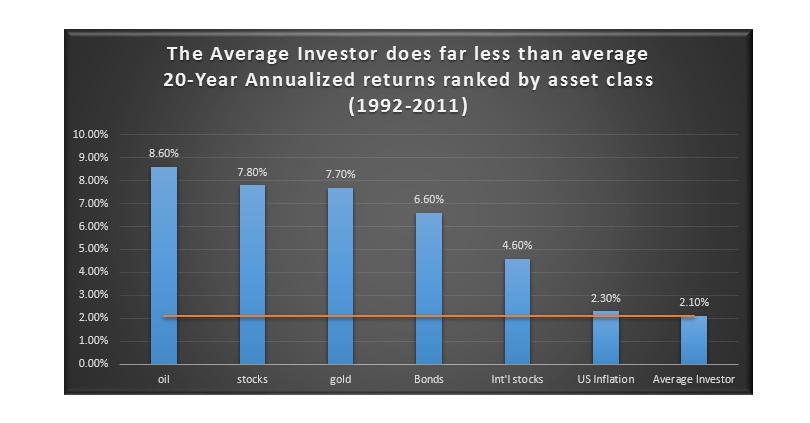

This short-term investing, or gambling shows up in investor performance. A recent Dalbar Study confirms that investors underperform their index as well. Anecdotal evidence has suggested this was the case for years, but now it is official. Individual investors need help. You can read more about this in my post, Why are individual investors are so bad at investing.

Correlation does not imply causation

I cannot say the correlation in the above chart is due to causation. If you have read my earlier post, correlation does not imply causation, you will understand why. However, it is obvious that something is causing the average investor to under-perform. Based on my experience working with people over the years, I can say a person’s willingness to “gamble” with their hard earned money is always surprising to me. The average investor’s under-performance is most likely due to their inability to control their emotions. This is hard to do considering that investing with fear and greed are two very powerful emotions to attempt to control. It even takes professional investors years to master them.

The Warren Buffett way

In one of Berkshire Hathaway’s Annual reports Warren Buffett made a statement that one of his criteria for buying a company is that if the stock market closed down for 10 years without the ability to sell his investment, he would still be happy owning it for those 10 years. That is exactly how an investor should consider their investment.

The best way to invest

From time to time we have clients who invest in private businesses. These may be franchises, start-ups, or just existing businesses looking for additional capital to expand their revenue or market share. When a person tries to evaluate a private business, that person has to assume that they are making a permanent investment in that business.

The publicly traded stocks traded on the New York Stock Exchange are capable of being traded five days a week multiple times a day. Most investors don’t think twice about selling a stock after holding it for a few days or weeks. Although this is a luxury, it may not be the most prudent way to invest.

Investing in a private company frequently has the drawback of making your investment in that company illiquid. That means you cannot easily liquidate the investment. It may take years, and require a liquidation event (merger, buyout, IPO, or private sale) to get your capital returned. Ultimately it means you need to make good choices where you decide to invest your money.

If an investor considers each investment they make to have a holding period of 5-10 years, I would suspect that their choices on where to invest their money would change substantially. Many of these technology companies, which have negative earnings, might have a very different audience of investors. This is not to say that an investor should never invest in a company with the hope that the company will someday become the next Microsoft, Apple, or Google, but certainly they would have a better understanding of the risks they are taking if they knew they were holding for long periods of time.

How to compete with the smartest investors in the world

When you invest in the stock or bond markets, you are competing with some of the smartest people in the world. Many of these people have 8-figure budgets for research and technology which dwarfs what is available for individual investors. This puts most investors at a disadvantage. One of the equalizing factors for individual investors is compounding over time. If you invest in a company which is growing at a rate of 10% per year, then you can reasonably expect a 10% return annually over time. Hence, you need to wait years, not months for this investment to grow.

The eighth wonder of the world — Compounding

Individual investors should embrace this concept of compounding over time. Warren Buffett is one of the most successful investors, who epitomizes this concept. He characterizes his investment timeline as “forever”. While he does make changes to his investment portfolio, he has owned stocks like Coca-Cola for decades. This has allowed for his investment to compound over time to where his original investment in the company approximately equals what he receives in dividends each year. This is a tremendous effect of compounding through buy and hold. Imagine you had invested $100,000 into Coca-Cola stock in April 1984 when it was trading at $1.20 per share. Today you would be receiving approximately $100,000 annually in dividends on top of the growth of the original investment which would be valued at around $3,300,000. That is the power of investing in solid companies and holding for long periods of time.2

Investing for the long term

There are other reasons to hold your investments for long periods of time. Holding for 10 years vs 10 months will minimize the tax impact of your investments. If you have done your research properly, it will allow the investment to prove itself in a tax-efficient manner. This is not to say that every investment should be held for 10 years or more. What is important is that investors should remove the “gambling” mindset from their thinking.

Is trading the same as gambling?

I also want to make a distinction between trading and gambling. There are people who make trades based on things like technical indicators or money flows, or other factors which are not based on fundamentals. Some of these people are very successful. However, I would equate them to professional gamblers. They are not “gambling” in the way that most people interpret the word. They know the odds and make “bets” based on extensive data and research. Just like a casino knows that the odds are in its favor. So the longer the casino plays a game, the more likely it will profit. These investors invest with a systematic approach to investing which is fine-tuned over many years to get the desired result. This is not easy to do for an individual investor.

The next time you decide to invest in a technology IPO with negative earnings, or a company with a P/E ratio of over 100, or even a stock “tip” you heard about from a friend, rather than trying to make a quick buck by acting on a tip or thinking you are smarter than everyone else because this one stock has a great story, take a trip to your local casino or buy a lottery ticket. At least then you will be clear on your intentions.

1. Massachusetts state lottery

About Innovative Advisory Group: Innovative Advisory Group, LLC (IAG), an independent Registered Investment Advisory Firm, is bringing innovation to the wealth management industry by combining both traditional and alternative investments. IAG is unique in that they have an extensive understanding of the regulatory and financial considerations involved with self-directed IRAs and other retirement accounts. IAG advises clients on traditional investments, such as stocks, bonds, and mutual funds, as well as advising clients on alternative investments. IAG has a value-oriented approach to investing, which integrates specialized investment experience with extensive resources.

For more information, you can visit www.innovativewealth.com

About the author: Kirk Chisholm is a Wealth Manager and Principal at Innovative Advisory Group. His roles at IAG are co-chair of the Investment Committee and Head of the Traditional Investment Risk Management Group. His background and areas of focus are portfolio management and investment analysis in both the traditional and non-traditional investment markets. He received a BA degree in Economics from Trinity College in Hartford, CT.

Disclaimer: This article is intended solely for informational purposes only, and in no manner intended to solicit any product or service. The opinions in this article are exclusively the author(s) and may or may not reflect all those who are employed, either directly or indirectly or affiliated with Innovative Advisory Group, LLC.