Inflation Monitor – May 2015

Inflation Monitor Summary – Composite Ranking

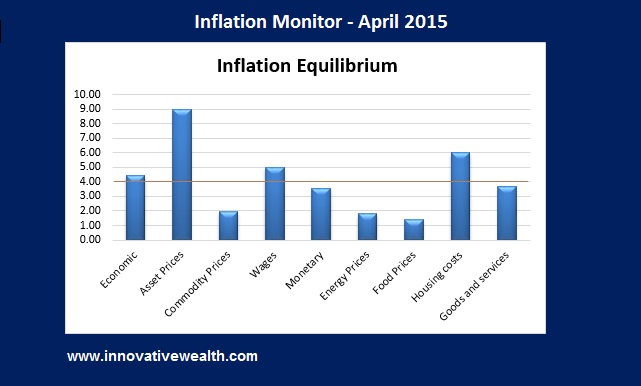

* The Inflation Equilibrium is a quick summary for the whole data series of the inflation monitor. If you don’t like statistics, this is the chart for you.

Inflation Monitor – May 2015 – Introduction

This month we were a bit slow getting this out due to some website upgrades. We expect that this June version of the Inflation Monitor will be out in 2 weeks so you will get a double dose of information.

May was a month of mixed results. Some data is showing some signs of life with inflation, but others show the decline of inflation continues… albeit slowly. Based on my estimates,2 Q3 and Q4 of this year should start to show some signs of economic slowdown. While we have started to see this in the earnings numbers, due to a lot of the hedging done by large public companies, the earnings may be less impressive when those hedges expire.

The quick rise in the US Dollar and lack of QE in the US may be too much for the US economy to handle. It typically takes a few months before these effects filter down into the economy. But I xpect later this year to see the results of those changes. There are many interesting data points to consider, but the PPI is one of the most interesting this month.

Other issues which are concerning…

The effects of debt have been slowly accumulating in the US over time and have put an increasing amount of weight on the growth of the US economy. It is hard to grow out of a recession when a large amount of your revenues go to paying off interest on your debt. Maybe this can put some perspective on the balance sheet of the US.

According to the GAO, the US has net worth of -17.7T, which is higher than the -16.9T last year. If you include the 42T in unfunded liabilities, this brings the total net worth of the US to -60T. That is not small amount of money to pay back. This is a little over $188,000 per person in liabilities. I think it is unlikely that this will get paid back in anything but inflation. What if the US cannot inflate away their debts like other countries have in the past? That will put the US in an interesting position. The available options are not pretty.

While there is constant discussion about how big of a problem this it… and it is, the reality is that this won’t be a problem until it is. By this I mean that the US, as the world’s reserve currency, has a special position in that they cannot default on their debt unless they choose to. Other countries do not have that luxury.

As long as the US Dollar is desirable to the rest of the world, we can continue to play this charade as long as we want. Then one day that will change and we will be in trouble. Until then, party like its 1999.

Enjoy this month’s Inflation Monitor – May 2015.