I decided to write this post because over the years while working with clients, I have come across the same common mistakes using a self directed IRA over and over again. Some of these mistakes are from a misinterpretation of the rules, some are through a lack of knowledge in certain areas, and the most common one being unaware of the capability to invest in alternative investments inside a self directed IRA. While most of the rules are easy to find, unfortunately, they don’t all appear in one place. I wrote this post to help address these common mistakes using a self directed IRA.

What is a self directed IRA?

I want to define “self directed IRA” for people who are unaware of the definition. A self directed IRA is an account with preferential tax treatment, which is capable of investing in alternative investments. These alternative investments could be assets such as real estate, tax liens, private mortgages, gold & silver, horses, livestock, farmland, medical equipment, and more. While a self-directed IRA can invest in traditional assets such as stock, bonds, and mutual funds, it is typically used to invest in alternative investments. For further information about what a self-directed IRA is, please read the following post about self-directed retirement accounts

1. I can invest in what???

Did you know that you could invest your IRA in a horse?

Not a horse ETF, or a horse stock, a real live horse.

If you didn’t know it then you are not alone. We estimate that 80%+ of the population is unaware that they can invest their self-directed IRA in alternative investments such as real estate, gold, tax liens, private mortgages, horses, livestock, farmland, and more. As of 2013, only 5% of the population had their self-directed IRA investments in alternative assets.1 This is not to suggest that everyone should invest in alternative investments, but certainly, more people should be aware of it. Peter Lynch famously said, “Invest in what you know.” We think this is sound advice for people looking at alternative investments in their self-directed IRA.

This is a big list of alternative investments that you might want to consider.

2. Prohibited Transactions

When investing in alternative investments inside your IRA you want to steer clear of any prohibited transactions. This is the one thing that can haunt any novice who has not invested in alternative investments in their IRA before. It even concerns sophisticated investors as well, since many transactions can be complex and involve many different parties.

A prohibited transaction is any transaction which causes the IRA to become disqualified. When a transaction becomes disqualified, the effect is as if you had taken the funds out of your IRA as a distribution. You will have to pay the taxes on those funds as well as any penalty for early distribution.

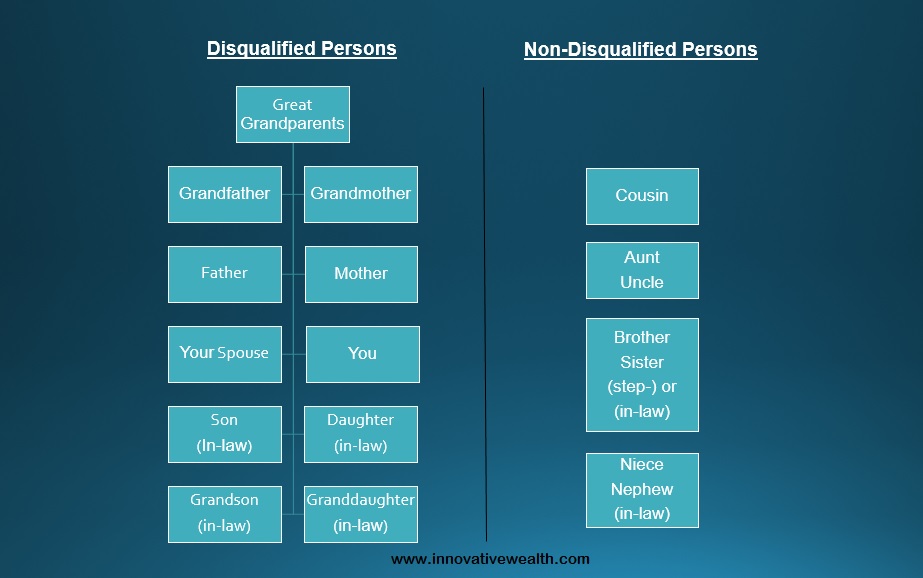

3. Disqualified Persons

A disqualified person is someone who cannot participate in your investment in any way without creating a prohibited transaction (see above). There are many ways this could happen, but that is beyond the scope of this post. One example of this is buying a piece of rental real estate in your IRA then renting it to your mother. This creates a prohibited transaction. Another example is buying a piece of rental real estate and then, when a tenant’s toilet breaks, you go and fix the toilet.

The Internal Revenue Code (IRC) makes it clear who are considered disqualified persons for IRAs. According to the IRS, “Disqualified persons include the IRA owner’s fiduciary and members of his or her family (spouse, ancestor, lineal descendant, and any of a lineal descendant).

These people are yourself, your spouse, mother/father, grandmother/grandfather, son/daughter (and their spouses), and grandson/granddaughter (and their spouses).

Exceptions to this are Brother/sister, aunt/uncle, cousins, step-brother/step-sister, and friends.

4. Investing in a LLC to avoid certain rules

I will make this statement once in this post, for anyone who is having happy thoughts about screwing over the IRS because they think they can find a way around the rules… Don’t do it. I don’t care how smart you think you are. Don’t do it. I guarantee they are smarter than you. Even if you happened to be smarter than everyone else who has ever invested in a LLC with their IRA, it is not worth the risk. Don’t do it. The IRS can be an unpleasant bunch if they think you are trying to avoid paying taxes illegally. JUST DON’T DO IT.

As my grandmother used to say, “Just because you can do something, doesn’t mean you should do it.”

I hope I made myself clear on that point. Good. Now that the unpleasantness is out of the way…

You should know that having an alternative investment inside an IRA is looked at the same way as if it was not in a LLC. Now there may be some advantages to having alternative investments inside a LLC in your IRA, but skirting the rules is not one of them. Some people like using a LLC because it minimizes the involvement of the custodian, or rather limits the amount of work they have to do for you, it can provide a level of protection, it can provide some secrecy about the individual investments, and it can make transactions simpler and more cost effective. While these things can be a benefit of using a LLC, it is not always the case. You should seek advice from a qualified financial advisor, legal advisor, or tax advisor if you are considering using a LLC inside your IRA.

5. Withdrawing money from an IRA to invest in an alternative investment

This mistake is typically made by people who are not aware of the option of investing in an asset inside their IRA or have been misinformed. I frequently speak with people who decided to take money out of their IRA to invest in a piece of real estate, a start-up venture, or some other investment. On occasion, a few have told me (after the fact) that they had heard you could use your IRA funds to invest in alternatives and this is why they withdrew the funds. Doh!

This action is unfortunate if not caught in time (You have 60 days to deposit the funds back into your IRA without being penalized, and it can only be done once every 12 months) because you will have to pay the taxes and potentially a penalty on the withdrawal. This is when having a knowledgeable financial advisor comes in handy.

If you are going to consider using your IRA to invest in an alternative investment, don’t take the funds out prior to making the investment. The point of a self-directed IRA is that you can participate in that investment inside your IRA. Always try to keep the investment inside your IRA, however, if it is not possible, then you can consider taking the funds out. If you are unsure, always seek professional help from someone who is capable of providing it in this area of expertise.

6. Choosing a self directed IRA custodian

When using a self directed IRA, it is very important to consider which self directed IRA custodian you will be using. If you are looking to invest in an alternative investment such as tax liens, then asking your discount broker-dealer or mutual fund company to do it for you might get a response such as, “Huh? You can’t do that.”

You will need to find a self directed IRA custodian that meets your needs for the asset and type of investing that you want to participate in. This is an important part of the process since it can affect both the investment’s return and process. Investing in a mutual fund at a discount broker is as easy as a few keystrokes on your computer. Investing in a piece of rental property is a lot more logistically complex. Please read our website which addresses choosing a self-directed IRA custodian, to learn more about this process. You can find a complete list of self-directed IRA custodians and administrators here.

7. A 401k is not an IRA

A 401k account and an IRA account are two separate types of accounts. They are not interchangeable. It is like comparing an apple and a watermelon. They are both delicious fruits, but also very different. An IRA is short for Individual Retirement Account. This type of account is controlled by you as the individual. You make the decisions about what to invest in and where the account should be held. No one else has a say in these decisions. This goes for all types of IRAs, Roth IRA, SEP IRA, or Traditional IRAs.

A 401k account is a similar type of account to the IRA in its taxation to the account holder, but it is generally controlled by the 401k plan trustee. For example, if you work for a large fortune 500 company like Verizon, the company will have appointed a 401k plan trustee. This person will make the decisions about what the 401k plan accounts can be invested in, where the accounts can be held, how much the company will provide as an employee match, the vesting schedule of those matches, the availability of a company loan, as well as other decisions. The 401k account holder’s decisions are limited to: choosing between the listed investment options, whether to take a loan from the account (if available), how much to contribute annually, and a few others.

8. Can I invest in an alternative Investment with my 401k?

Yes, but probably not. This question almost always comes up when I discuss alternative investments with people. If an investor is looking to invest in some type of alternative investment, they generally want to know if they can use their 401k account to invest in that asset. While it is possible, it is usually unlikely that this will be allowed. In the previous mistake, I pointed out the differences between IRAs and 401k accounts. One of the problems with investing in an alternative asset in a 401k plan is that the asset would have to be allowed to each participant in the 401k plan. This most likely will cause some concerns with the 401k plan trustee. The trustee has a fiduciary duty to all plan participants, and will probably not want to take on unknown risks. It doesn’t hurt to ask. It is not impossible that the plan trustee will allow certain alternative assets in a plan, but my experience tells me that it is unlikely to be considered. It is more likely that an alternative asset might be allowed if the company has a fewer number of employees, or if the 401k plan is a SoloK (a 401k plan with 1-2 employees).

Are there more common mistakes using a self-directed IRA?

While this is not an exhaustive list of mistakes, they are certainly very common ones which people make. I hope this helps you get a better grasp on the idea of investing in alternative investments inside your self-directed IRA. Of course, this complexity brings some new challenges to investors, but it also opens doors to new opportunities that you never knew existed. New ideas that you never thought possible before. The world is your oyster. Take advantage of it and make the most of your self-directed IRA.

Resources:

1. Investment Company Institute

About Innovative Advisory Group: Innovative Advisory Group, LLC (IAG), an independent Registered Investment Advisory Firm, is bringing innovation to the wealth management industry by combining both traditional and alternative investments. IAG is unique in that they have an extensive understanding of the regulatory and financial considerations involved with self-directed IRAs and other retirement accounts. IAG advises clients on traditional investments, such as stocks, bonds, and mutual funds, as well as advising clients on alternative investments. IAG has a value-oriented approach to investing, which integrates specialized investment experience with extensive resources.

For more information, you can visit www.innovativewealth.com

About the author: Kirk Chisholm is a Wealth Manager and Principal at Innovative Advisory Group. His roles at IAG are co-chair of the Investment Committee and Head of the Traditional Investment Risk Management Group. His background and areas of focus are portfolio management and investment analysis in both the traditional and non-traditional investment markets. He received a BA degree in Economics from Trinity College in Hartford, CT.

Disclaimer: This article is intended solely for informational purposes only, and in no manner intended to solicit any product or service. The opinions in this article are exclusively of the author(s) and may or may not reflect all those who are employed, either directly or indirectly or affiliated with Innovative Advisory Group, LLC.