| Index | Value | 1mo change | 1yr change | 5yr change | Inflation Score |

|---|---|---|---|---|---|

| Economic Inflation | |||||

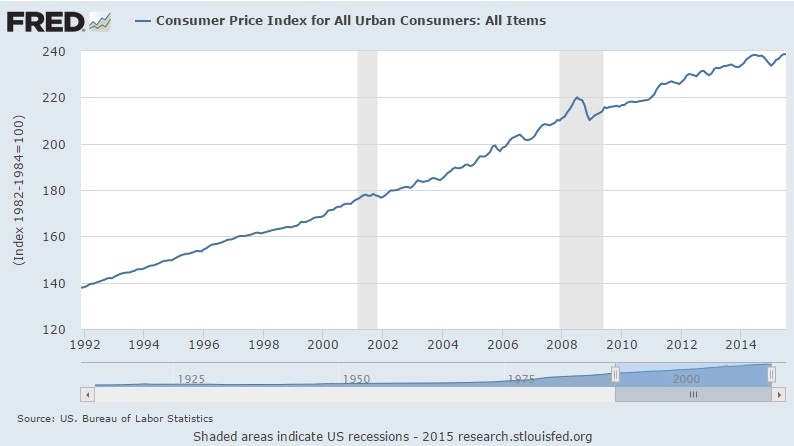

| Consumer Price Index (CPI) | 238.65 | 0.01% | 0.17% | 9.47% | 2 |

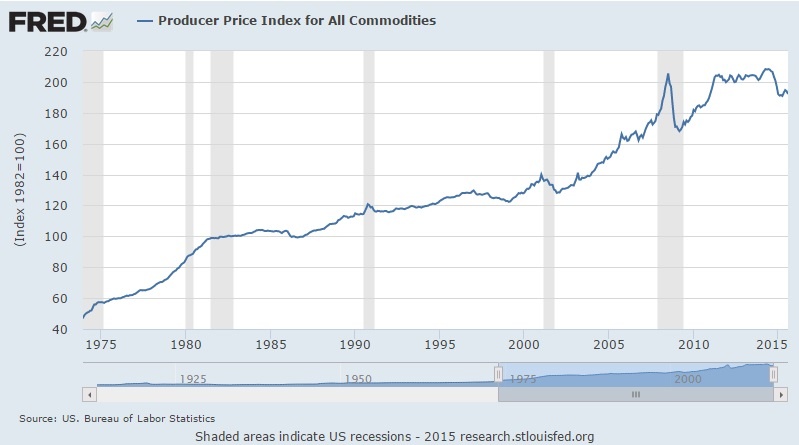

| Producer Price Index (PPI) | 192.20 | -0.93% | -7.15% | 3.95% | 1 |

| 1 Yr Treasury Bill Yield | 0.3% | 0.02 | 0.19 | 0.01 | 2 |

| 10 Yr Treasury Note Yield | 2.17% | 0.00 | -0.37 | -0.48 | 2 |

| Real Interest Rate | 0.13% | -0.03 | 2.01 | 1.08 | 3 |

| US 10 yr TIPS | 0.60% | 0.14 | 0.14 | -0.31 | 2 |

| Capacity utilization | 78.00 | 0.39% | -0.38% | 4.84% | 3 |

| Industrial Production Index | 107.48 | 0.56% | 1.32% | 12.95% | 3 |

| Personal Consumption Expenditure Index | 12,305.4 | 0.41% | 3.46% | 20.83% | 4 |

| Rogers International Commodity Index | 2395.59 | -.60% | -12.86% | -22.61% | 1 |

| SSA COLA | 0.00% | 1.70% | 3 | ||

| Median Income | $51,939.00 | 1.81% | 3.25% | 3 | |

| Real Median Income | $51,939.00 | 0.35% | -4.56% | 3 | |

| Consumer Interest in Inflation | Stable | 3 | |||

| IAG Inflation Composite | Slight Deflation | 2 | |||

| IAG Online Price Index | Stable | 3 | |||

| US GDP | 17902.00 | 1.43% | 3.66% | 20.24% | 3 |

| S&P 500 | 1913.85 | -8.78% | -3.98% | 70.56% | 4 |

| Market Cap to GDP | 115.30% | 120.10% | 81.80% | 5 | |

| US Population | 321,467 | 0.06% | 0.73% | 4.03% | 2 |

| IAG Economic Inflation Index* | Slight Deflation | 2 | |||

| Housing Inflation | |||||

| Median Home price | 234,00.00 | -1.02% | 5.60% | 28.50% | 4 |

| 30Yr Mortgage Rate | 3.91% | 0.14 | -0.21 | -0.52 | 4 |

| Housing affordability | 151.20 | -1.11% | -2.70% | 2 | |

| US Median Rent | 803.00 | 6.22% | 15.71% | 4 | |

| IAG Housing Inflation Index* | Mild Inflation | 4 | |||

| Monetary Inflation | |||||

| US Govt debt held by Fed (B) | 2,797.50 | 0.15% | 7.00% | 260.18% | 1 |

| US Debt as a % of GDP (B) | 101.40% | -1.45% | -0.70% | 12.73% | 2 |

| M2 Money Stock (B) | 12,075.40 | 0.58% | 6.09% | 40.73% | 4 |

| Monetary Base (B) | 4,001.49 | 0.19% | -2.30% | 98.69% | 2 |

| Outstanding US Gov’t Debt (B) | 18,151.998 | 0.00% | 2.95% | 37.50% | 4 |

| Total Credit Market Debt (B) | 59,045.73 | 0.45% | 3.43% | 14.00% | 4 |

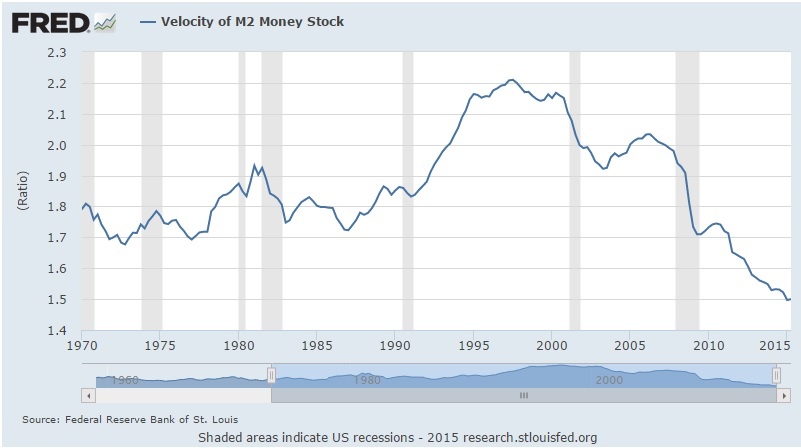

| Velocity of Money [M2] | 1.50 | 0.20% | -2.09% | -13.74% | 2 |

| US Trade Balance | -41,863.00 | -7.39% | -1.09% | -3.59% | 1 |

| Big Mac Index | Expensive | 1 | |||

| US Dollar | 95.89 | -1.49% | 15.84% | 17.56% | 1 |

| IAG Monetary Inflation Index* | Mild Deflation | 2 | |||

| Energy | |||||

| Electricity (cents / KW hour) | 12.93 | -0.15% | -0.39% | 3 | |

| Coal (CAPP) | 48.60 | -2.70% | -13.75% | -30.82% | 1 |

| Oil | 48.10 | 2.84% | -49.80% | -39.10% | 1 |

| Natural Gas | 2.69 | -1.03% | -33.65% | -45.21% | 1 |

| Gasoline | 1.46 | -13.01% | -44.15% | -31.03% | 1 |

| IAG Energy Inflation Index* | Strong Deflation | 1 | |||

| Food and Essentials | |||||

| Wheat | 484.50 | -2.76% | -13.94% | -30.01% | 1 |

| Corn | 374.50 | -1.90% | 2.13% | -7.93% | 3 |

| Soybeans | 885.00 | -5.80% | -13.30% | -11.98% | 1 |

| Orange Juice | 129.10 | 4.66% | -13.65% | -11.94% | 1 |

| Sugar | 10.70 | -4.04% | -31.19% | -45.41% | 1 |

| Live Cattle | 142.83 | -2.48% | -5.94% | 50.90% | 2 |

| Cocoa | 3110 | -2.90% | -3.12% | 0.94% | 2 |

| Coffee | 124.25 | -1.31% | -38.52% | -29.10% | 1 |

| Cotton | 62.96 | -1.79% | -4.98% | -19.98% | 2 |

| Stamps | $0.49 | 0.00% | 6.52% | 11.36% | 4 |

| CRB Foodstuffs Index | 358.33 | -0.64% | -15.39% | -4.88% | 1 |

| IAG Food and Essentials Inflation Index* | Strong Deflation | 1 | |||

| Construction and Manufacturing | |||||

| Copper | 2.34 | -0.74% | -25.94% | -29.41% | 1 |

| Lumber | 233.00 | -7.65% | -33.20% | 12.02% | 1 |

| Aluminum | 0.73 | 1.03% | -18.27% | -18.27% | 1 |

| CRB Raw Industrials | 441.44 | -1.58% | -16.33% | -13.25% | 1 |

| Total Construction Spending (M) | 1,083,378.00 | 0.70% | 13.74% | 34.17% | 5 |

| ISM Manufacturing Index | 51.10 | -3.04% | -12.05% | -11.90% | 1 |

| IAG Construction & Manufacturing Index* | Strong Deflation | 1 | |||

| Precious Metals | |||||

| Gold | 1,133.80.00 | 3.54% | -12.01% | -4.22% | 1 |

| Silver | 14.60 | -6.53% | -23.92% | -18.92% | 1 |

| IAG Precious Metals Inflation Index* | Strong Deflation | 1 | |||

| Innovative Advisory Group Index | |||||

| IAG Inflation Index Composite* | Mild/Strong Deflation | 1 / 2 | |||

* If you would like a description of terms, calculations, or concepts, please visit our Inflation monitor page to get additional supporting information. We will continually add to this page to provide supporting information.

* Our Inflation Score is based on a proprietary algorithm, which is meant to describe the respective category by a simple number. The scores range from 1-5. One (1) being the most deflationary. Five (5) being the most inflationary. These scores are meant to simplify each item and allow someone to quickly scan each item or section to see the degree of which inflation or deflation is present.

* We have also added our own indexes to each category to make it even easier for readers to receive a summary of information.

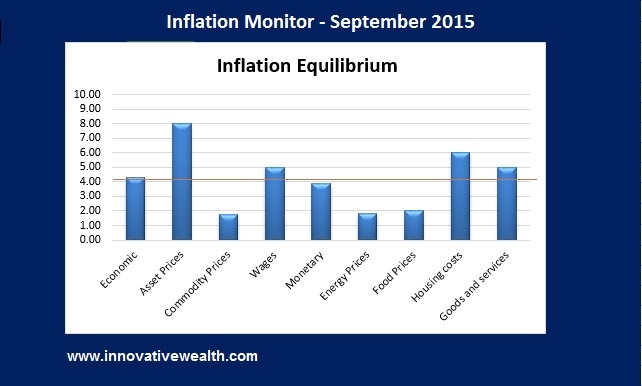

Inflation Monitor Summary – Composite Ranking

* The Inflation Equilibrium is a quick summary for the whole data series of the inflation monitor. If you don’t like statistics, this is the chart for you.

Inflation Monitor – September 2015 – Introduction

“Inflation is always and everywhere a monetary phenomenon in the sense that it is and can be produced only by a more rapid increase in the quantity of money than in output” – Milton Friedman

This is the 12th issue of the Inflation Monitor. During the entire year that we have published this report, the trend has been deflationary. This is contrary to what many economists and fear mongers are claiming. The main reason that we publish this report is that since 2008 we have noticed deflationary forces overwhelming the US economy. While the Fed has put up a good fight to keep it interesting, I have no doubt that they will not win this battle against deflation. And they should try to.

The US has created an enormous amount of money and this should have caused inflation, yet other than the stock market, this is not the case anywhere in the US economy. There are a number of reasons for this, but one thing is clear, the deflationary forces are strong, persistent, and necessary.

This past month, the stock market swooned and dropped a bit more than 10% in a matter of a few days. This includes a Monday morning flash crash, which caused some stocks and ETFs to drop 20-40%, and in some cases around 50% during the day. Some have claimed this is due to high-frequency trading computers, illiquidity, or China’s stock market, but what is clear is that the US stock market is unstable. Nothing in China should cause the market to act in this manner. Imagine if a real crisis hit. How would the stock markets react to that?

The above quote by Milton Friedman states that inflation is created by adjusting the money supply. This is a flawed statement. Inflation or deflation can be created a number of ways having nothing to do with the supply of money. Some examples of this that are highly relevant today are, disruptive technological advances, aging of the population, or heavy debt loads weighing on economic growth (i.e. excessive leverage). If technological advances and increased market efficiency are a natural occurrence, then shouldn’t deflation be a natural occurrence as well? And if the price of something is not falling over time, is it operating in a free-market? Something to ponder…

The Fed meeting in mid-September seems like an inflection point for the trend in interest rates. While the media is making this out to be a big deal, it isn’t. Think of it this way. If the Fed is going to raise rates, most likely they will be raising them in .25% increments. However since the current Fed Funds Rate is at 0-.25% (currently it is trading around 0.14%), the raise would amount to 11 Basis points (0.11%). Yawn….

While Janet Yellen has stated in the past that she would like to have more transparency from the Fed’s communications to the public, we will see if this holds true at this meeting. All of the data that the Fed has stated that they are relying on to make the determination of whether to raise rates has been trending in the positive direction. Meaning that the Fed should be raising interest rates at this meeting. Quite frankly they should be raising them quite a bit, but no one expects that to happen.

I don’t like making predictions about the future movements of the market because no one can know the future. In the infamous words of Yogi Berra,

“It is tough to make predictions, especially about the future.”

What I will do is state some of the possible outcomes from this meeting. The Fed could raise rates to a flat .25% ( a .11% raise). This has been predicted for quite some time, although with the recent volatility in the markets, some watchers have lowered the probability of the Fed raising rates in September in favor of a future month.

Another possibility is that the Fed could wait until a future meeting to raise rates. All the economic data that they claim to follow indicate that they need to start raising rates. So if they wait until a later meeting, then that puts Janet Yellen’s claims of transparency in question. Based on public data, there is no indication of inflation in the US, so there is no need to raise rates other than to normalize them at a rate higher than zero. Both the Fed and Wall Street collectively agree that rates must be higher than they are. These low rates are causing an enormous amount of misallocation of resources.

Another option is that the stronger US dollar could cause a recession in the US leading to another round of QE… which no one wants and has been proven not to work. While there is a recession in our future, it has not shown its head yet. Keep watching here for updates on when this could happen.

September’s meeting will be interesting.

I hope you enjoy this month’s Inflation Monitor – September 2015.

Kirk Chisholm

As always, please contact me with any questions or to send your feedback. Thank you for reading.

Join our email list to receive the Inflation Monitor sent directly to your inbox.

Charts of the Month

Leading Indicators

Dr. Copper

Dr. Copper is still weak, but we could see a start to it turning around. I’m not optimistic, but at least it is heading in the right direction.

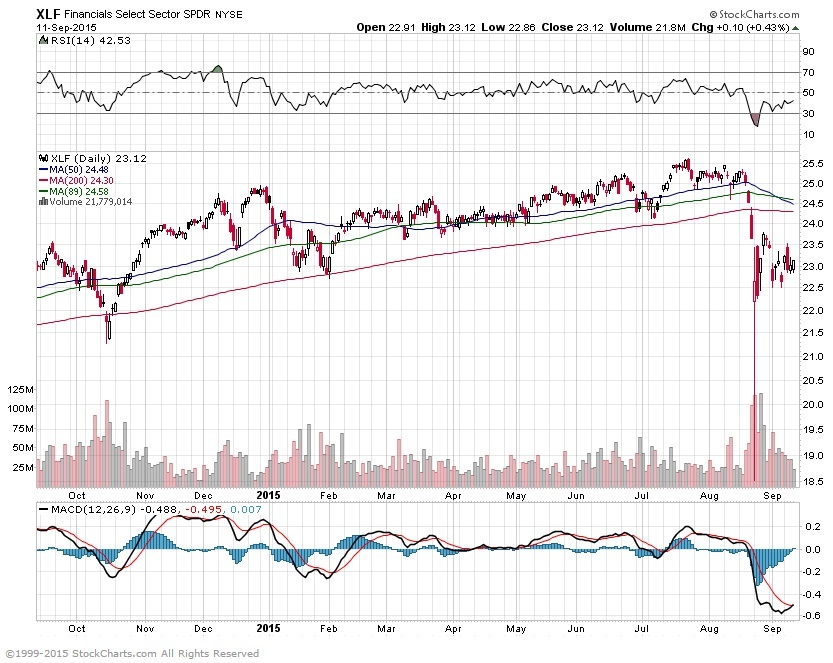

Financials

Financial have hit a rough patch.

Producer Price Index (PPI)

Consumer Price Ratio (CPI)

US Velocity of Money M2

This is a clear sign that inflation is not around the corner. Don’t bother even looking for it. Once again deflation is the active trend.

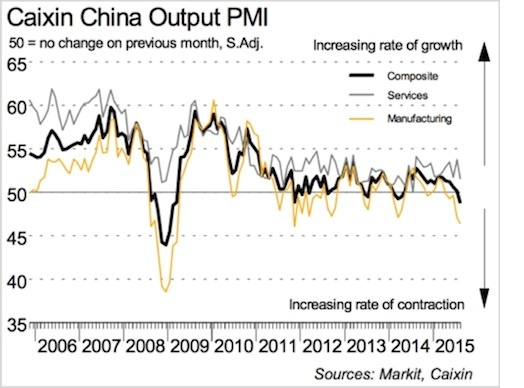

China

China has had a rough month. Their stock market has dropped by 35% from the peak but it is still range bound as it has been since 2008. they have devalued their currency a few times and made a number of significant changes to their stock market to stabilize it. The FXI is up off the low, but still in question. This is not a market which I would care to trade.

This shows China’s economy slowing down primarily due to manufacturing. China is making a serious effort to convert their economy away from manufacturing and more towards services, but this does not happen overnight.

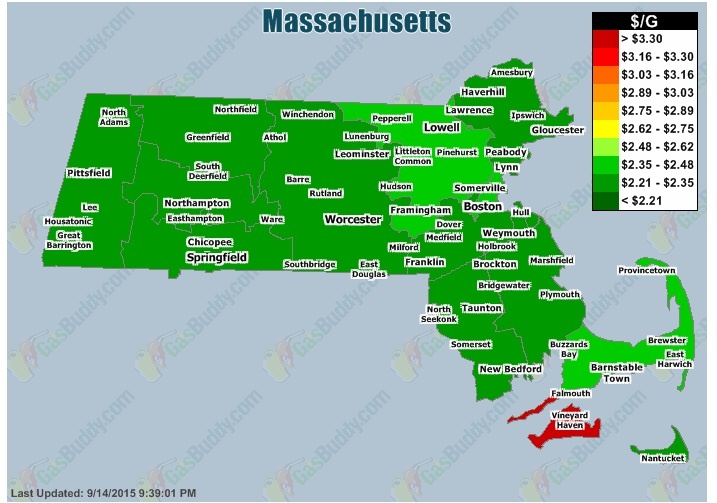

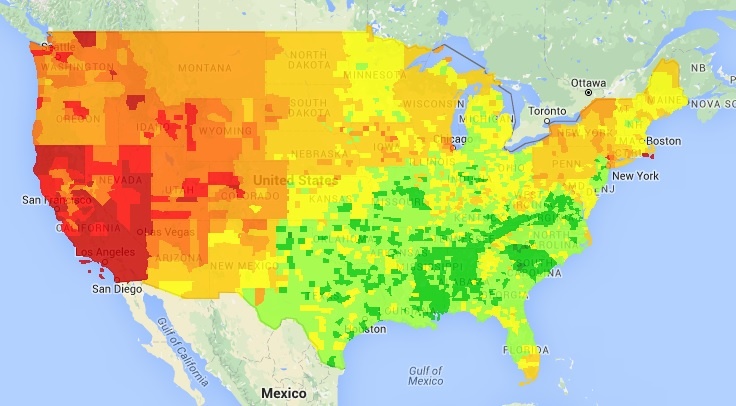

Gas Prices in Massachusetts

Gas prices have dropped a lot, but they are still higher than they should be if oil prices stay low.

Gas Prices in the US

This is US gas prices. As you can see, this month is not much different from last month’s chart.

Currency Relative Valuations to Gold

Gold prices are they strong or weak?

Gold has settled down near its lows. It is interesting that this coincides with the Fed meeting this week.

Gold Priced in Euros

Gold Priced in Yen

Gold Priced in Canadian Dollars

Gold Priced in Australian Dollars

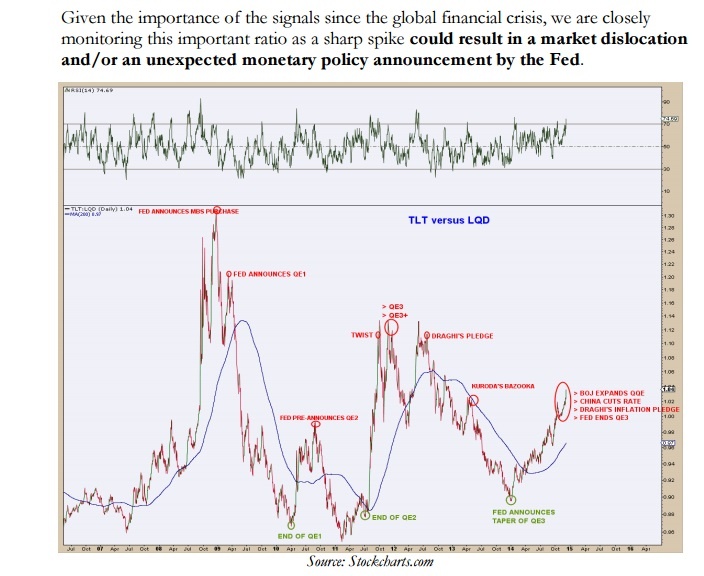

Bonds

10 Year Treasury yields have stopped dropping, but this month’s Fed meeting may change things. It will be interested to watch.

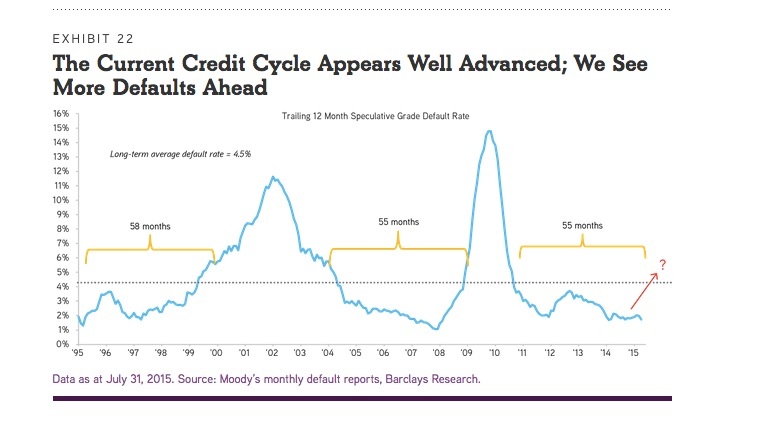

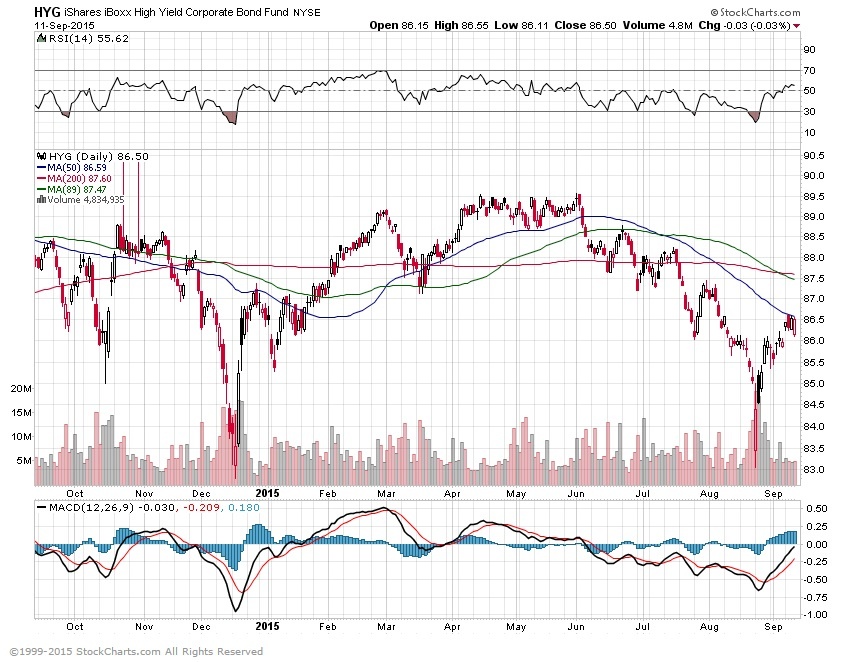

High Yield Bonds (Junk Bonds)

This can be a leading indicator for the equity markets. This is leading us in the wrong direction. This rebound might be a good sign, but unless things turn around, the stock market will be close behind. What is scary about high yield bonds is that the expected bankruptcies from the commodity sector has not hit yet.

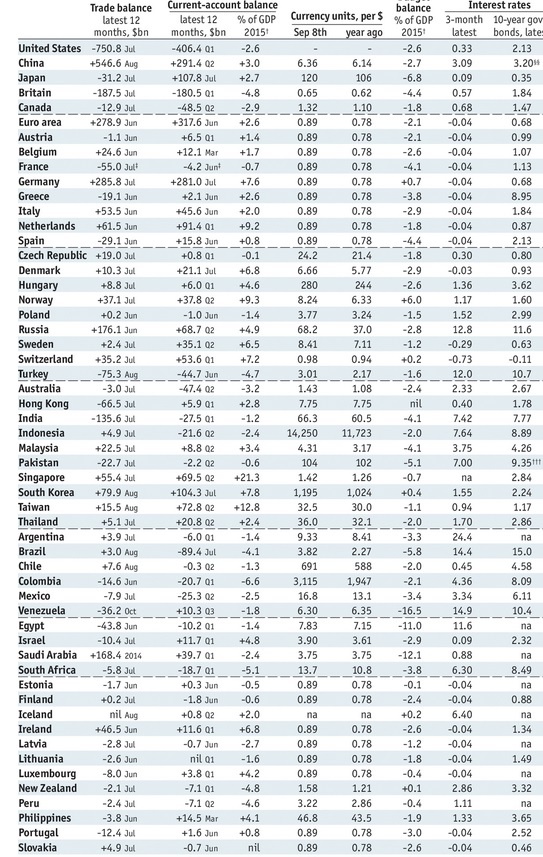

Just before I finished this issue, Standard & Poor’s downgraded Brazil sovereign bonds to junk status. The bond rankings given by rating agencies can move markets to some extent, but the change from investment grade to junk is significant. The reason this can be a big deal is that mutual funds, pension funds, and other pools of money which are not allowed to hold junk paper are now required to sell these bonds. Here is another chart to put things into perspective. Brazil’s 10 year bonds are yielding more than Greece (8.95%), Venezuela (10.4%) and Russia (11.6%). Is Brazil that bad? Probably not.

Baltic Dry Index

The Baltic Dry Index has continued to pick up in the past few months, but it still has a long way to go. While this index tends to be volatile, it is going in the right direction

I hope you enjoyed this month’s Inflation Monitor. See you next month.

Cheers,

Kirk Chisholm

The IAG Inflation Monitor – Subscription Service

We are initially publishing this Inflation Monitor as a free service to anyone who wishes to read it. We do not always expect this to be the case. Due to the high demand for us to publish this service, we plan to offer it free for a while and when we feel we have fine tuned it enough, we do plan on charging for access. Our commitment to our wealth management clients is to always provide complimentary access to our research. If you would like to discuss becoming a wealth management client, feel free to contact us.

If you would like to automatically receive the Inflation Monitor in your email inbox each month, click here to join our free subscription service.

Sources:

- Federal Reserve – St. Louis

- U.S. Energy Information Administration

- U.S. Post Office

- National Association of Realtors

- The Economist

- The Commodity Research Bureau

- Gurufocus.com

- Stockcharts.com

- GasBuddy

* IAG index calculations are based on publicly available information.

** IAG Price Composite indexes are based on publicly available information.

About Innovative Advisory Group: Innovative Advisory Group, LLC (IAG), an independent Registered Investment Advisory Firm, is bringing innovation to the wealth management industry by combining both traditional and alternative investments. IAG is unique in that we have an extensive understanding of the regulatory and financial considerations involved with self directed IRAs and other retirement accounts. IAG advises clients on traditional investments, such as stocks, bonds, and mutual funds, as well as advising clients on alternative investments. IAG has a value-oriented approach to investing, which integrates specialized investment experience with extensive resources.

For more information, you can visit: innovativewealth.com

About the author: Kirk Chisholm is a Wealth Manager and Principal at Innovative Advisory Group. His roles at IAG are co-chair of the Investment Committee and Head of the Traditional Investment Risk Management Group. His background and areas of focus are portfolio management and investment analysis in both the traditional and non-traditional investment markets. He received a BA degree in Economics from Trinity College in Hartford, CT.

Disclaimer: This article is intended solely for informational purposes only, and in no manner intended to solicit any product or service. The opinions in this article are exclusively of the author(s) and may or may not reflect all those who are employed, either directly or indirectly or affiliated with Innovative Advisory Group, LLC.