| Index | Value | 1mo change | 1yr change | 5yr change | Inflation Score |

|---|---|---|---|---|---|

| Economic Inflation | |||||

| Consumer Price Index (CPI) | 239.26 | 0.47% | 1.13% | 6.38% | 2 |

| Producer Price Index (PPI) | 183.30 | 0.49% | -3.88% | -9.75% | 1 |

| 1 Yr Treasury Bill Yield | 0.59% | 0.03 | 0.35 | 0.40 | 2 |

| 10 Yr Treasury Note Yield | 1.85% | -0.02 | -0.34 | -1.15 | 2 |

| Real Interest Rate | 0.59% | 1.16 | 0.31 | 3.97 | 2 |

| US 10 yr TIPS | 0.31% | -0.20 | -0.39 | -0.76 | 2 |

| Capacity utilization | 75.40 | 0.67% | -1.95% | -0.40% | 2 |

| Industrial Production Index | 104.15 | 0.66% | -1.07% | 8.00% | 2 |

| Personal Consumption Expenditure Index | 12,645.80 | 0.95% | 4.11% | 19.02% | 4 |

| Rogers International Commodity Index | 2201.47 | 5.04% | -0.91% | -52.90% | 3 |

| SSA COLA | 0.00% | 0.00% | 3 | ||

| Median Income | $53.657.00 | 0.13% | 7.79% | 3 | |

| Real Median Income | $53,657.00 | -1.48% | -2.31% | 2 | |

| Consumer Interest in Inflation | Stable | 3 | |||

| IAG Inflation Composite | Strong Deflation | 1 | |||

| IAG Online Price Index | Slight Deflation | 2 | |||

| US GDP | 18229.50 | 0.36% | 3.29% | 19.63% | 4 |

| S&P 500 | 2099.33 | 0.86% | -0.59% | 63.08% | 3 |

| Market Cap to GDP | 119.40% | 122.40% | 90.10% | 4 | |

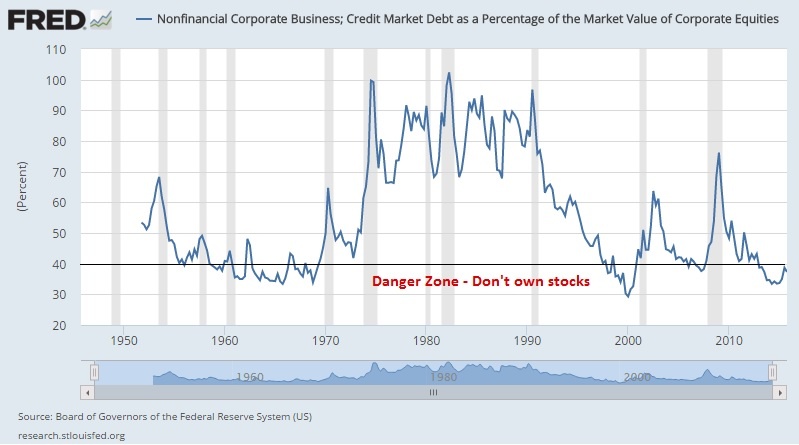

| Corporate Debt as % of Equity | 38.10% | 0.80 | 4.40 | -3.10 | 1 |

| US Population | 323,911 | 0.07% | 0.77% | 4.14% | 2 |

| IAG Economic Inflation Index* | Mild Deflation | 2 | |||

| Housing Inflation | |||||

| Median Home price | 232,500.00 | 4.97% | 6.31% | 44.32% | 4 |

| 30Yr Mortgage Rate | 3.60% | -0.01 | -0.24 | -1.04 | 5 |

| Housing affordability | 162.40 | -4.53% | -3.04% | 5 | |

| IAG Housing Inflation Index* | Strong Inflation | 5 | |||

| Monetary Inflation | |||||

| US Govt debt held by Fed (B) | 2,815.30 | 0.19% | 0.64% | 110.03% | 1 |

| US Debt as a % of GDP (B) | 105.73% | 1.56% | 2.88% | 12.08% | 2 |

| M2 Money Stock (B) | 12,742.50 | 0.64% | 6.43% | 41.25% | 4 |

| Monetary Base (B) | 3,854.74 | -1.15% | -2.55% | 48.94% | 2 |

| Outstanding US Gov’t Debt (B) | 19,264,939 | 1.81% | 6.13% | 35.00% | 4 |

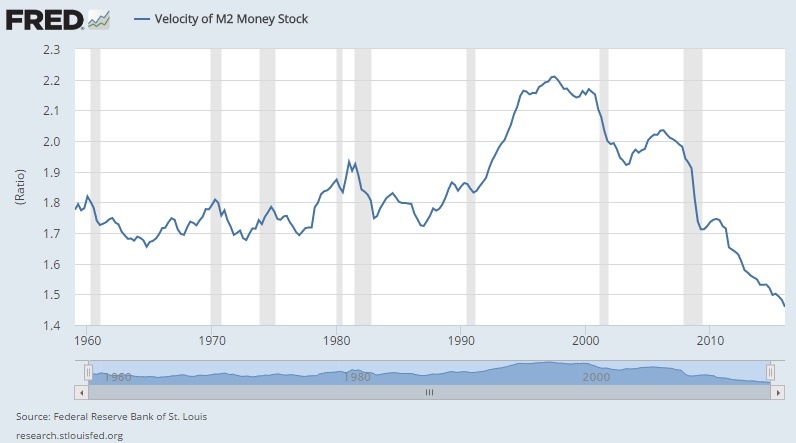

| Velocity of Money [M2] | 1.46 | -1.55% | -2.60% | -15.17% | 1 |

| US Trade Balance | -37,436.00 | -5.35% | 8.44% | 11.35% | 1 |

| Big Mac Index | Expensive | 1 | |||

| US Dollar | 94.62 | -3.66% | -4.16% | 24.01% | 1 |

| IAG Monetary Inflation Index* | Strong Deflation | 1 | |||

| Energy | |||||

| Electricity (cents / KW hour) | 12.58 | 4.75% | 1.94% | 3 | |

| Coal (CAPP) | 40.50 | -4.26% | -32.57% | -48.41% | 1 |

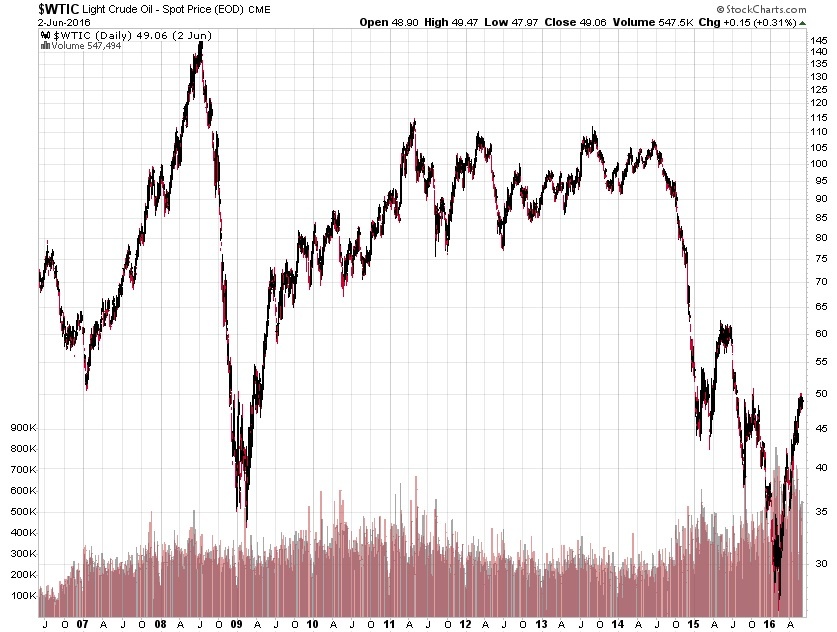

| Oil | 48.82 | 28.00% | -19.02% | -52.45% | 1 |

| Natural Gas | 2.29 | 16.68% | -12.54% | -50.87% | 1 |

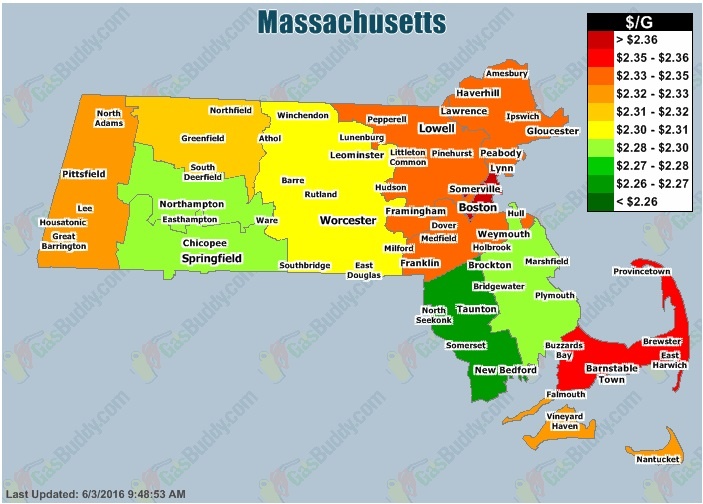

| Gasoline | 1.44 | 9.36% | -18.65% | -53.58% | 1 |

| IAG Energy Inflation Index* | Strong Deflation | 1 | |||

| Food and Essentials | |||||

| Wheat | 464.50 | 6.23% | -2.82% | -40.60% | 2 |

| Corn | 404.25 | 14.93% | 15.34% | -46.17% | 3 |

| Soybeans | 1078.75 | 18.64% | 15.87% | -21.69% | 4 |

| Orange Juice | 153.20 | 4.08% | 34.74% | -16.05% | 5 |

| Sugar | 17.37 | 12.79% | 44.15% | -25.06% | 5 |

| Live Cattle | 121.05 | -2.77% | -20.66% | 15.20% | 1 |

| Cocoa | 3037.00 | 3.26% | -1.72% | 1.23% | 3 |

| Coffee | 121.50 | -4.59% | -5.23% | -54.02% | 3 |

| Cotton | 64.08 | 9.99% | -0.42% | -60.29% | 3 |

| Stamps | $0.47 | -4.08% | 2.17% | 6.82% | 2 |

| CRB Foodstuffs Index | 363.95 | 4.12% | -2.49% | -27.52% | 2 |

| IAG Food and Essentials Inflation Index* | Stable | 3 | |||

| Construction and Manufacturing | |||||

| Copper | 2.09 | -4.70% | -23.50% | -50.16% | 1 |

| Lumber | 300.60 | -1.89% | 10.07% | 21.75% | 4 |

| Aluminum | 0.70 | 1.45% | -12.50% | -38.05% | 1 |

| CRB Raw Industrials | 450.21 | 2.22% | -3.31% | -26.37% | 2 |

| Total Construction Spending (M) | 1,133,932.00 | -1.83% | 4.51% | 44.16% | 4 |

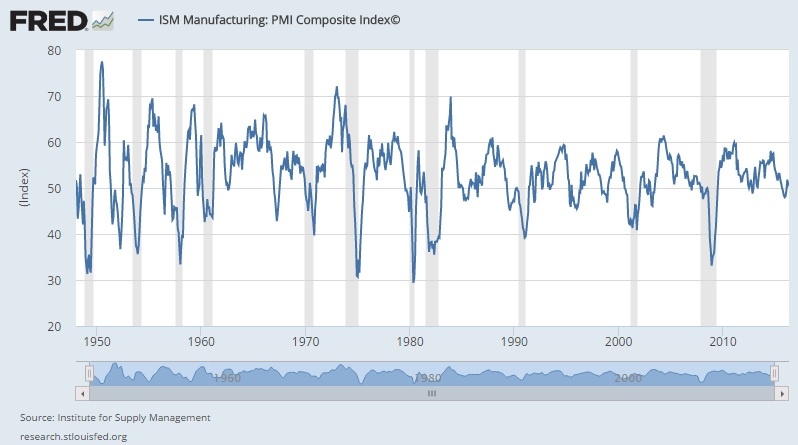

| ISM Manufacturing Index | 51.30 | 0.98% | -3.39% | -4.82% | 2 |

| IAG Construction & Manufacturing Index* | Mild Deflation | 2 | |||

| Precious Metals | |||||

| Gold | 1,217.90 | -1.31% | 2.36% | -20.74% | 3 |

| Silver | 16.02 | 3.69% | -4.04% | -58.38% | 3 |

| IAG Precious Metals Inflation Index* | Stable | 3 | |||

| Innovative Advisory Group Index | |||||

| IAG Inflation Index Composite* | Moderate Deflation | 2 | |||

* If you would like a description of terms, calculations, or concepts, please visit our Inflation monitor page to get additional supporting information. We will continually add to this page to provide supporting information.

* Our Inflation Score is based on a proprietary algorithm, which is meant to describe the respective category by a simple number. The scores range from 1-5. One (1) being the most deflationary. Five (5) being the most inflationary. These scores are meant to simplify each item and allow someone to quickly scan each item or section to see the degree of which inflation or deflation is present.

* We have also added our own indexes to each category to make it even easier for readers to receive a summary of information.

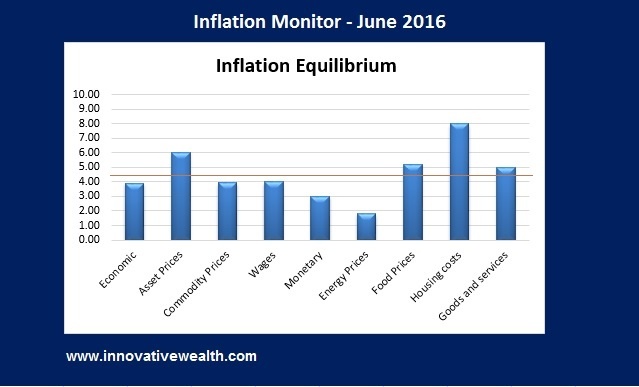

Inflation Monitor Summary – Composite Ranking

* The Inflation Equilibrium is a quick summary of the whole data series of the inflation monitor. If you don’t like statistics, this is the chart for you.

Inflation Monitor – June 2016 – Introduction

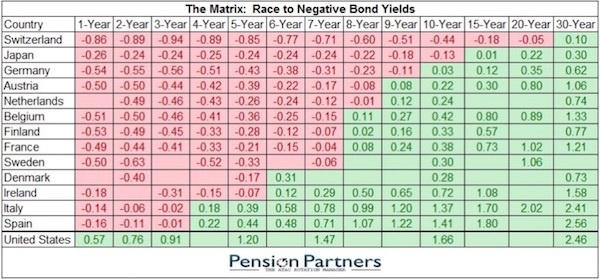

If you are older than 30 years old, then you are probably scratching your head about negative interest rates. You have spent most of your life under the assumption that positive inflation is normal. You expect it. You probably treat it as a rule of nature rather than an assumption. Well, you are probably surprised to see negative interest rates around the world. While we have not yet seen them here in the US, it is only a matter of time till we see them here.

We have seen a strong push from the central banks around the world into negative interest rate territory. On June 5, 2014, the ECB introduced its negative interest rate policy (NIRP). On January 29, 2016, Japan introduced their version of NIRP. As of March 2016, the ECB dropped their deposit facility rate to -0.40. They are also started purchasing investment grade euro-denominated corporate debt. On June 14, 2016, Germany’s 10-year bund fell below zero to -0.033%. This is historic because it has never happened before.

As of now Switzerland, Japan, and Germany, all have 10 years sovereign bonds that are yielding negative interest rates. Approximately 40% of the world’s governmental debt is currently at negative interest rates and $10 trillion is being held on central bank balance sheets. Where will this madness end? In case you didn’t think that was crazy, there’s more.

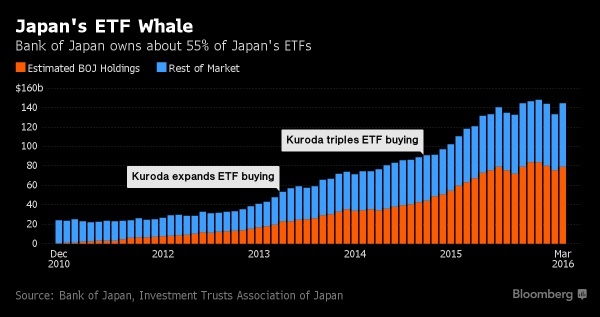

Central banks are buying corporate bonds and stocks. Japan has been buying corporate bonds, and they have also been buying equities of Japanese stocks. AS of April 2016 it was revealed that the Bank of Japan is a top 10 holder of 90% of stocks traded on the Nikkei stock exchange. Yes, you read that correctly, top 10 holders of 90% of the stock traded. If that is not enough, the Bank of Japan is also an owner of 52% of the entire Japanese ETF market.

Where does this insanity stop?

Why would you want to invest in a market where one one player owns over 50% of the shares traded? Anyone who says that markets are not manipulated is either not paying attention or is being intellectually dishonest. I’m not sure if there is a publicly traded market in the world that is not being manipulated to one degree or another.

Sure you could claim it is for the common good, but where does it stop? Will we ever have free markets again? Is there anywhere that is safe from this government insanity?

Then there is the Brexit… This is scheduled for June 23rd with results appearing around 2am EST June 24th. By the time this issue comes out it will have happened. Since no one really knows how this will affect global markets I’ll just provide a recap in the next issue.

I hope you enjoy this month’s Inflation Monitor – June 2016.

Kirk Chisholm

As always, please contact me with any questions or to send your feedback. Thank you for reading.

Join our email list to receive the Inflation Monitor sent directly to your inbox.

Charts of the Month

Negative Interest Rates

Interesting Inflation Charts

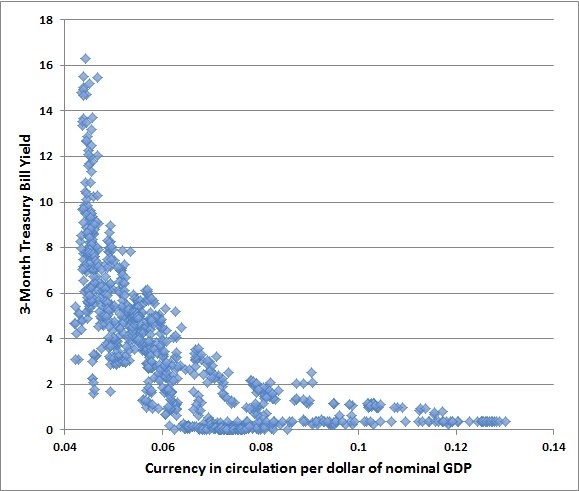

I think I am going to make this chart a permanent part of this inflation monitor so that the importance of it is not missed. John Hussman put this chart in one of his weekly reports a while ago. If I could find the report, I would link to it. You should definitely read his weekly reports. It was a great report about how interest rates relate to the amount of money in circulation. The basic idea is that as rates climb higher, there is less money in circulation, and when rates are low as they are today, there can be an enormous amount of money in circulation without causing high inflation. This idea is a basic concept in economics, however, what is most interesting is seeing this visually.

Think of it this way, if hypothetically the US government can support a debt of $100 at a 5% rate of interest ($5 a year), then how much can the US support at 0.05%? $10,000 or a 100x increase. If rates are at zero, then the number becomes infinite. Now, what if interest rates are negative, why wouldn’t the US print an infinite amount of money?

Obviously, this is hypothetical, but it is important to understand this principal. Once you do, then this is the important part you don’t want to miss. Look at the slope of the curve in this chart. While you may be able to exponentially increase the supply of money without increasing your debt service, the hard part is when you try to increase rates. You will learn very quickly that the debt is unsustainable. If you want to see why interest rates will not rise quickly around the world, this is it. Once you have created $10,000 in debt you will have to reduce it by 99% to reach the 5% rate you had originally. What are the chances of this happening?

Leading Indicators

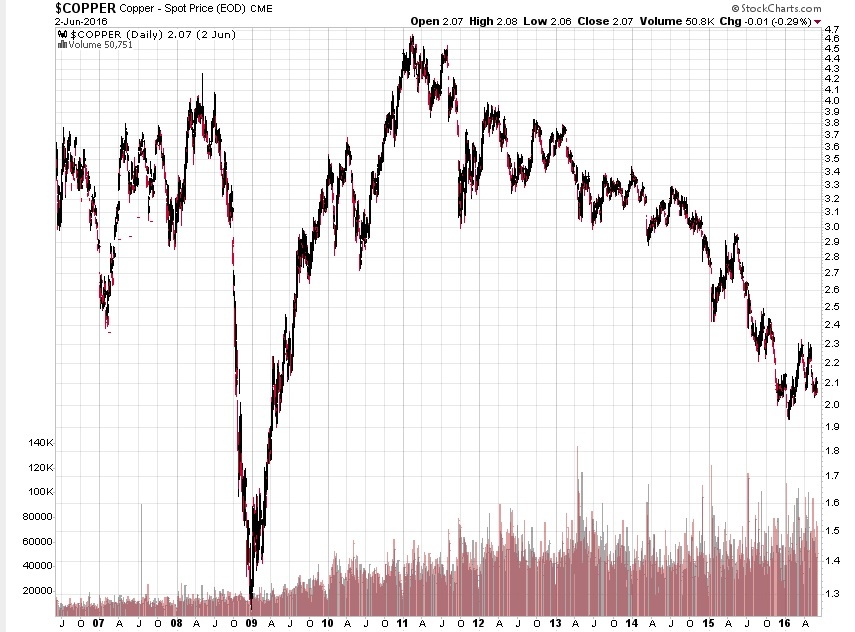

Dr. Copper

Dr. Copper is still weak, despite the recent bounce. the down trend is still in play. Much of this has to do with global demand… or the lack of it. Primarily this demand has come from China in the past 10 years. Unless China restarts its economy with a push for more manufacturing, it might be a while before copper regains its former highs.

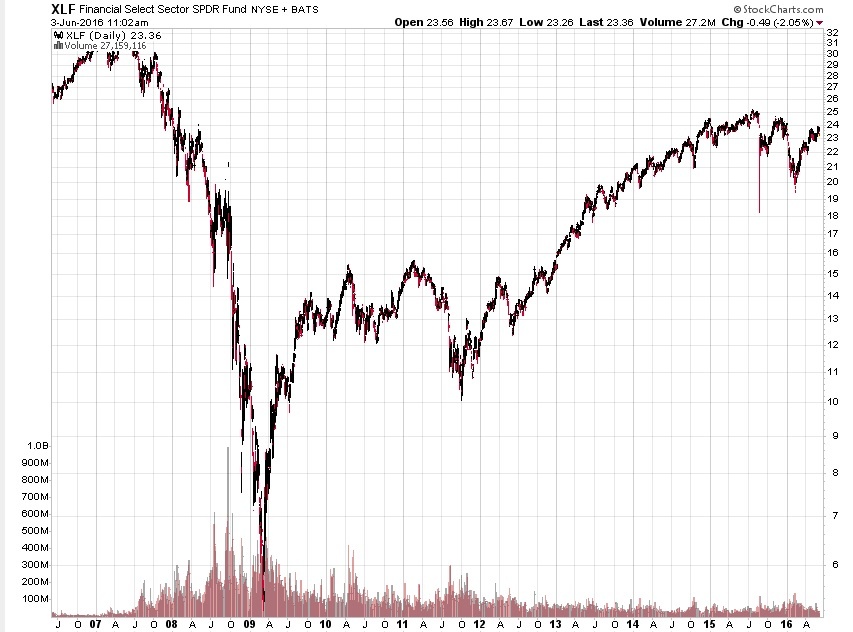

Financials

Fed decided to raise interest rates in December. While they have paused on their prior prediction of 4 rate hikes in 2016, there is still some indication that they will continue to raise rates. This should help financials. However if the US economy follows the path of Europe and Japan, and negative interest rates are in our future, then the financial sector will most likely get hurt. What incentive is there for savers to put money in the bank if banks are charging them money to keep it there? Keeping money under the mattress might not be such a bad idea. Financials tend to be a leading indicator, so watch these closely.

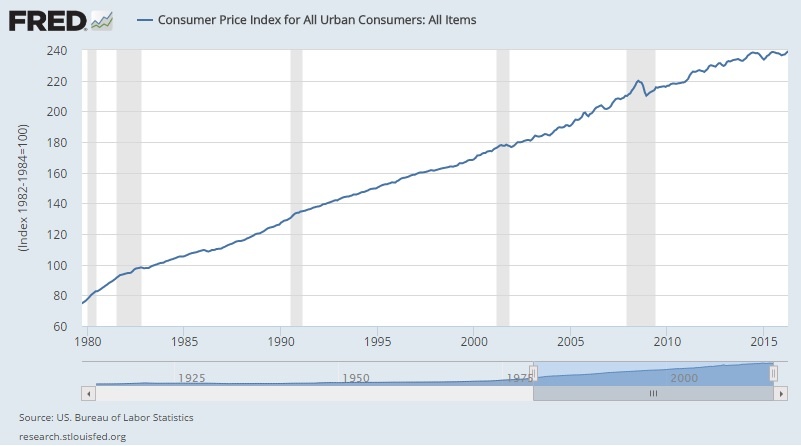

Consumer Price Index (CPI)

The CPI is flat for the year. If you have read this Inflation Monitor report for the last 12 months you will know that strong deflationary forces are here to stay. The Fed does not want deflation in the US, but can they stop it?

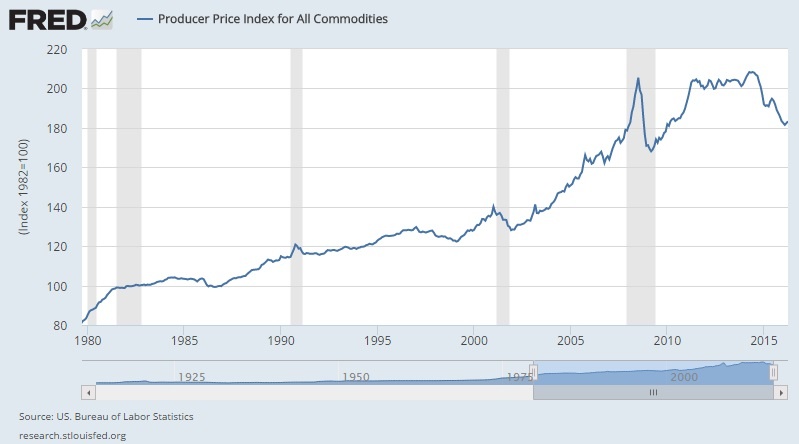

Producer Price Index (PPI)

The Producer Price Index is continuing to have a rough time this year. The declining PPI might be a reflection of the new economic conditions of producers and manufacturing with a high value of the US Dollar. This makes it harder for US companies to export goods since they will be about 20% more expensive from where they were last year.

US Velocity of Money M2

There is just no sign of stopping this falling safe. I’ll believe in the hyper-inflation tooth fairy when this starts to turn up in a meaningful way.

ISM Manufacturing

There has been a small tick up in the past month. It is back over 50, meaning that there is growth.

Oil Prices

The oil sector is approaching record levels of defaults. A Reuters article points out that that as of the time of this article, there were 59 oil and gas companies who have filed for bankruptcy creditor protection. In 2002-2003, there were 68 bankruptcy filings. Given that we are still at the beginning of the cycle, there will most likely be more to come.

“We keep thinking that lower energy prices are somehow good for the economy. That can’t be, because energy prices or commodity prices in general don’t drive economic growth. Economic growth drives commodity prices.”

~Stephen Schork

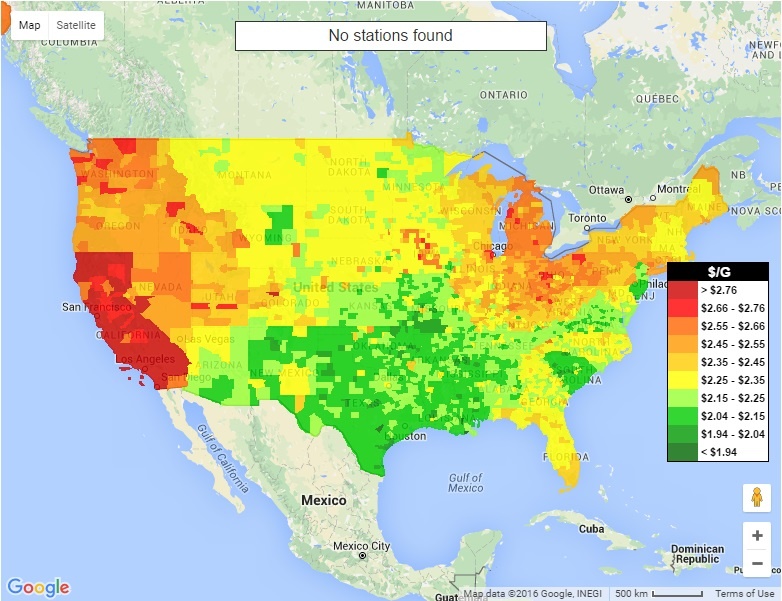

Massachusetts Gas Prices

US Gas Prices

Currency Relative Valuations to Gold

Gold is priced in the currency you use every day. If you live in the European Union, you use Euros, if you live in Japan, you use Yen, and if you live in the US you use US dollars. Each of these currencies are used to buy gold in their respective countries, so we look at gold priced in each country to see how people value it in their own currency. This can tell us a lot about the demand for gold inside and outside the US.

Gold prices are they strong or weak?

The best way to look at any commodity, especially gold, is to compare the commodity to multiple currencies. If gold is rising or falling in US Dollars, that means nothing if the other currencies are not showing the same thing. A true bullish trend in gold is when gold is rising in all (or at least most currencies).

For the past few months, gold has consolidated in the US and weakened in other currencies.

Gold Priced in Euros

Gold Priced in Yen

Gold Priced in Canadian Dollars

Gold Priced in Australian Dollars

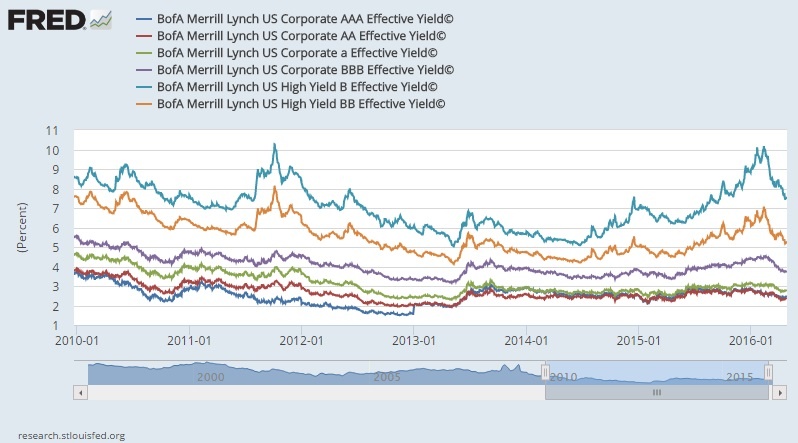

Bonds

TED Spread

A surge in the Ted Spread means a lack of trust in financial institutions. Currently, the Ted Spread is on the high side. It is far from the 2008 highs of 4.6, but the upward trend is not a good sign since it is confirming many other indicators.

10 year vs. 2 year Treasury Spread

The flattening (or inverting) of the yield curve is not good for banks and also typically shows signs on a recession. It is probably one of the best indicators of a recession we have, yet no one knows the status of whether this indicator still works since interest rates are stuck at zero… sorry 0.25% – 0.50%. What happens if the US has negative interest rates? what will the curve look like then?

Treasury vs Corp Bond Spread

The spread between 30-year treasuries and corporate bonds is climbing, as it can be in times of market distress. It will be interesting to see how this plays out as interest rates start to rise… assuming they ever do. Most markets have shown some relief from the risk off pressures earlier this year, but this number is still rising.

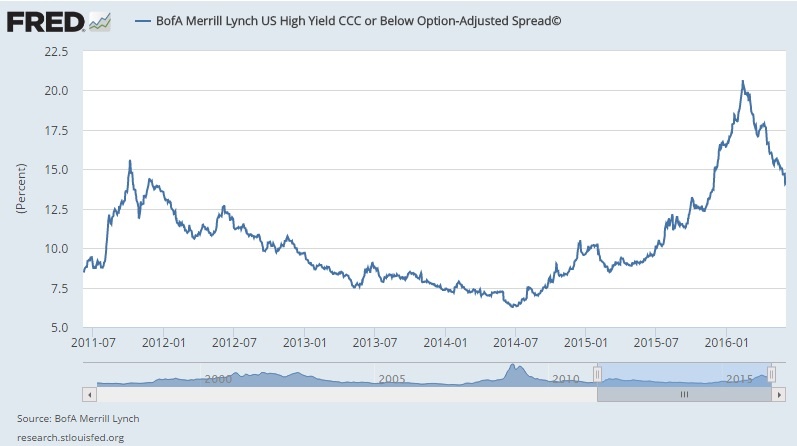

High Yield Bonds (Junk Bonds)

High yield bonds have had a good run of very low default rates. 2014 was around 1%. During recessions, these default rates tend to climb up to around 10% (1991, 2001, 2002, and 2009). This is fine unless you are getting 5% on your high yield bond income. In that case, you would net -5% a year. I’ll bet that is not quite what you had in mind when you were looking for income.

The end of 2015 and early 2016 went through a tumultuous period of time in the high yield bond market. 3 high-yield funds closed their doors in a matter of 3 days due to investors pulling their money out. You can read about this turmoil and the blueprint for financial contagion in my 2015 year end recap.

While the rebound in high yield bonds seems to suggest the worst is over, the “bad” bonds have not yet cleared. Unless oil prices continue to shoot back to $100/ barrel, I would suggest that there is still more bad news to come from the oil sector.

This shows the price of 30-year treasuries vs high yield bonds. The difference has continued to narrow. This is a good sign for the high yield bond and market and US economy in general. The spread is still high, but as long as it is declining, we should have less to worry about.

Bond Yield Spread

High Yield Bond Spread

The high yield bond market is continuing to cool down. This is a good sign for the overall market.

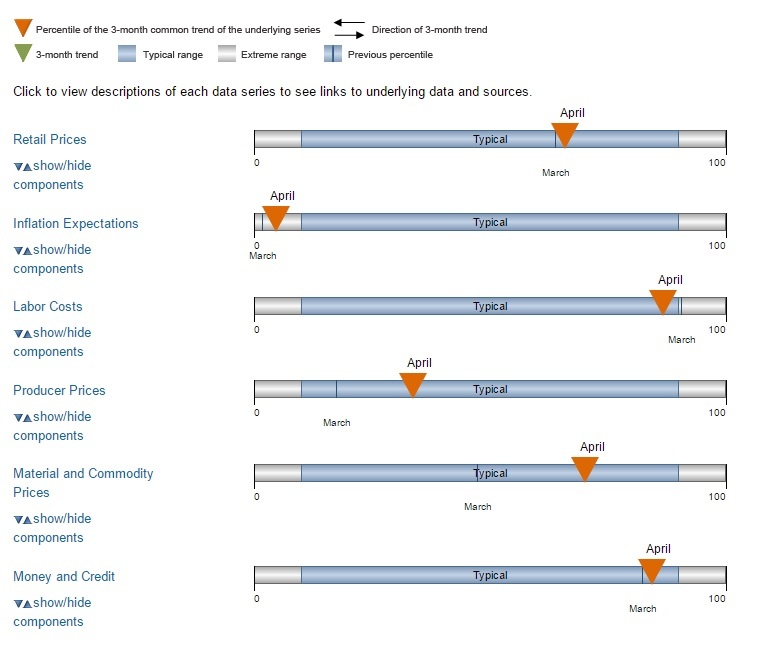

Inflation Dashboard

I like this view from the Federal Reserve because it gives more of a visual perspective of the data presented above.

Corporate Debt as a Percentage of Equity

Baltic Dry Index

After breaking below the index all-time lows late last year, it has rebounded since then. It could be the rise in oil prices, or just that the index can only go so low, where any increase in activity would push it up. While this indicator is not all that important, it is just another piece of information that the global economy is not doing well. Until we see a sustained pickup in dry shipping, the global economy is still not strong.

I hope you enjoyed this month’s Inflation Monitor. See you next month.

Cheers,

Kirk Chisholm

The IAG Inflation Monitor – Subscription Service

We have been publishing this Inflation Monitor as a free service to anyone who wishes to read it. We do not always expect this to be the case. We expect to charge a small fee for this service starting in 2017. The high amount of interest in this service has put constraints on us to provide more, so this small fee should cover our costs for providing this excellent resource. Our commitment to our wealth management clients is to always provide complimentary access to this research. If you would like to discuss becoming a wealth management client, feel free to contact us.

If you would like to automatically receive the Inflation Monitor in your email inbox each month, click here to join our subscription service.

Sources:

- Federal Reserve – St. Louis

- U.S. Energy Information Administration

- TD Ameritrade

- National Association of Realtors

- The Economist

- The Commodity Research Bureau

- Gurufocus.com

- Stockcharts.com

- GasBuddy

* IAG index calculations are based on publicly available information.

** IAG Price Composite indexes are based on publicly available information.

About Innovative Advisory Group: Innovative Advisory Group, LLC (IAG), an independent Registered Investment Advisory Firm, is bringing innovation to the wealth management industry by combining both traditional and alternative investments. IAG is unique in that we have an extensive understanding of the regulatory and financial considerations involved with self-directed IRAs and other retirement accounts. IAG advises clients on traditional investments, such as stocks, bonds, and mutual funds, as well as advising clients on alternative investments. IAG has a value-oriented approach to investing, which integrates specialized investment experience with extensive resources.

For more information, you can visit: innovativewealth.com

About the author: Kirk Chisholm is a Wealth Manager and Principal at Innovative Advisory Group. His roles at IAG are co-chair of the Investment Committee and Head of the Traditional Investment Risk Management Group. His background and areas of focus are portfolio management and investment analysis in both the traditional and non-traditional investment markets. He received a BA degree in Economics from Trinity College in Hartford, CT.

Disclaimer: This article is intended solely for informational purposes only, and in no manner intended to solicit any product or service. The opinions in this article are exclusively of the author(s) and may or may not reflect all those who are employed, either directly or indirectly or affiliated with Innovative Advisory Group, LLC.