| Index | Value | 1mo change | 1yr change | 5yr change | Inflation Score |

|---|---|---|---|---|---|

| Economic Inflation | |||||

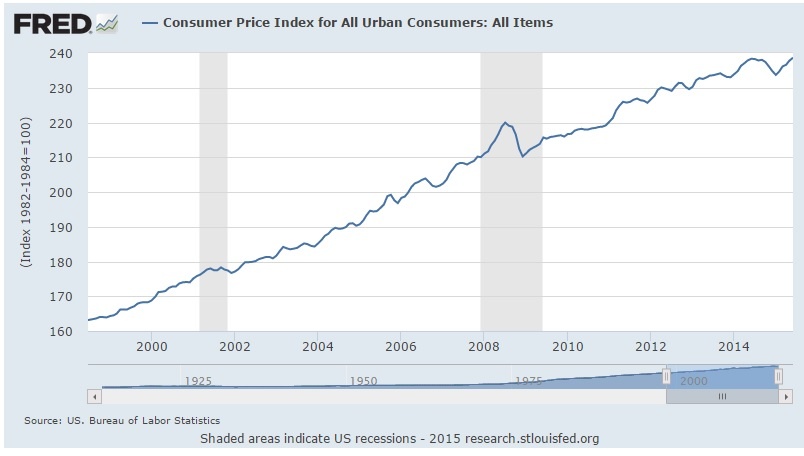

| Consumer Price Index (CPI) | 238.64 | 0.35% | 0.12% | 9.48% | 2 |

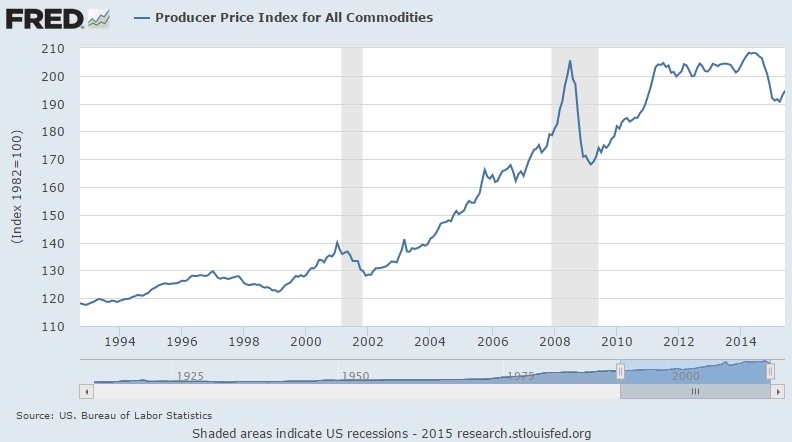

| Producer Price Index (PPI) | 194.7 | 0.93% | -6.53% | 6.10% | 1 |

| 1 Yr Treasury Bill Yield | 0.28% | 0.04 | 0.18 | -0.04 | 2 |

| 10 Yr Treasury Note Yield | 2.34% | -0.03 | -0.20 | -0.67 | 2 |

| Real Interest Rate | 0.43% | 0.11 | 2.27 | 2.22 | 3 |

| US 10 yr TIPS | 0.51% | 0.01 | 0.23 | -0.73 | 2 |

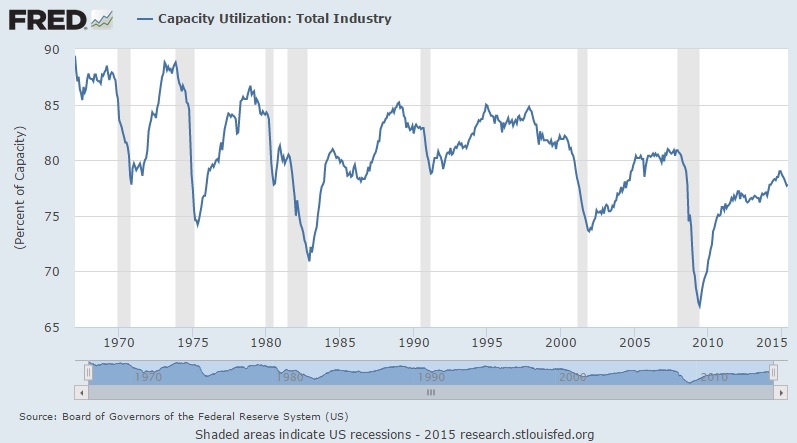

| Capacity utilization | 78.40 | 0.38% | -1.01% | 5.80% | 2 |

| Industrial Production Index | 105.71 | 0.58% | 1.54% | 16.36% | 3 |

| Personal Consumption Expenditure Index | 12,295.01 | 1.11% | 3.97% | 21.65% | 3 |

| Rogers International Commodity Index | 2724.70 | 7.60% | -0.14% | -17.15% | 3 |

| SSA COLA | 0.00% | 1.70% | 3 | ||

| Median Income | $51,939.00 | 1.81% | 3.25% | 3 | |

| Real Median Income | $51,939.00 | 0.35% | -4.56% | 3 | |

| Consumer Interest in Inflation | Stable | 3 | |||

| IAG Inflation Composite | Mild Deflation | 2 | |||

| IAG Online Price Index | Mild Deflation | 2 | |||

| US GDP | 17693.30 | 0.16% | 2.11% | 18.84% | 3 |

| S&P 500 | 2128.28 | 0.93% | 7.86% | 97.10% | 5 |

| Market Cap to GDP | 126.60% | 121.20% | 74.30% | 5 | |

| US Population | 321,062 | 0.05% | 0.73% | 4.03% | 2 |

| IAG Economic Inflation Index* | Stable | 3 | |||

| Housing Inflation | |||||

| Median Home price | 228,700.00 | 4.24% | 7.88% | 30.99% | 4 |

| 30Yr Mortgage Rate | 3.98% | 0.14 | -0.18 | -0.76 | 4 |

| Housing affordability | 159.70 | -3.74% | -0.93% | 2 | |

| US Median Rent | 799.00 | 4.31% | 16.64% | 4 | |

| IAG Housing Inflation Index* | Mild Inflation | 4 | |||

| Monetary Inflation | |||||

| US Govt debt held by Fed (B) | 2,793.40 | 0.94% | 26.47% | 259.70% | 1 |

| US Debt as a % of GDP (B) | 102.59% | -0.16% | 0.84% | 13.92% | 2 |

| M2 Money Stock (B) | 11,946.8 | 0.48% | 5.76% | 39.22% | 4 |

| Monetary Base (B) | 3,945.71 | -0.24% | 0.50% | 95.20% | 2 |

| Outstanding US Gov’t Debt (B) | 18,152.056 | 0.06% | 3.13% | 42.11% | 4 |

| Total Credit Market Debt (B) | 59,045.73 | 0.56% | 3.42% | 14.00% | 4 |

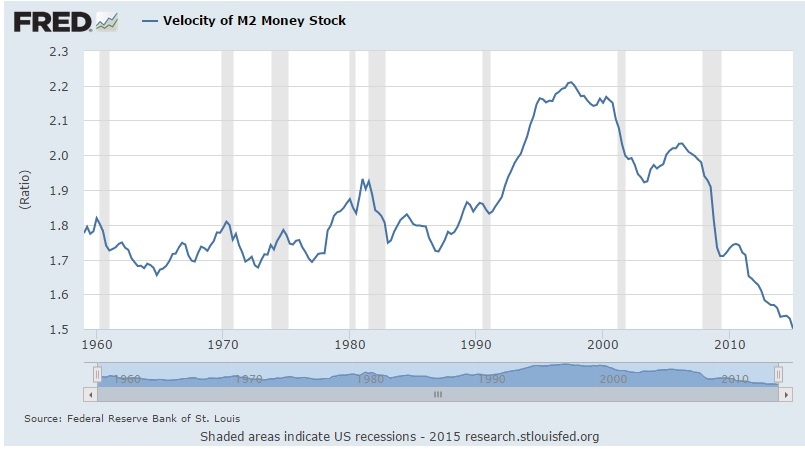

| Velocity of Money [M2] | 1.50 | 0.13% | -2.41% | -13.74% | 1 |

| US Trade Balance | -41,871.00 | -2.43% | 3.15% | -1.30% | 1 |

| Big Mac Index | Expensive | 1 | |||

| US Dollar | 95.39 | -3.15% | 19.88% | 16.29% | 1 |

| IAG Monetary Inflation Index* | Mild Deflation | 2 | |||

| Energy | |||||

| Electricity (cents / KW hour) | 13.18 | 6.72% | 7.68% | 4 | |

| Coal (CAPP) | 54.80 | 3.89% | -8.74% | -21.99% | 2 |

| Oil | 50.54 | -16.78% | -52.20% | -36.01% | 1 |

| Natural Gas | 2.87 | 8.60% | -29.03% | -37.40% | 1 |

| Gasoline | 1.91 | -10.80% | -36.79% | -9.23% | 1 |

| IAG Energy Inflation Index* | Strong Deflation | 1 | |||

| Food and Essentials | |||||

| Wheat | 614.50 | 28.56% | 6.41% | 28.22% | 4 |

| Corn | 429.25 | 22.47% | 1.24% | 18.32% | 3 |

| Soybeans | 1034.75 | 11.14% | -10.22% | 14.40% | 1 |

| Orange Juice | 118.05 | 4.40% | -19.34% | -20.59% | 1 |

| Sugar | 12.04 | -0.08% | -33.26% | -24.51% | 1 |

| Live Cattle | 148.40 | -2.74% | -1.31% | 64.89% | 3 |

| Cocoa | 3251 | 5.24% | 3.40% | 10.39% | 4 |

| Coffee | 130.00 | 1.40% | -25.80% | -26.17% | 1 |

| Cotton | 67.68 | 5.29% | -7.92% | -12.10% | 2 |

| Stamps | $0.49 | 0.00% | 6.52% | 11.36% | 4 |

| CRB Foodstuffs Index | 375.96 | 0.73% | -15.80% | 5.67% | 1 |

| IAG Food and Essentials Inflation Index* | Strong Deflation | 1 | |||

| Construction and Manufacturing | |||||

| Copper | 2.6145 | -4.16% | -18.37% | -10.15% | 1 |

| Lumber | 289.00 | 5.82% | -13.71% | 34.73% | 1 |

| Aluminum | 0.75 | -2.09% | -15.73% | -17.58% | 1 |

| CRB Raw Industrials | 462.00 | -1.04% | -13.34% | -2.40% | 1 |

| Total Construction Spending (M) | 1,035,763.00 | 2.95% | 6.47% | 26.55% | 4 |

| ISM Manufacturing Index | 52.80 | 2.52% | -5.04% | -9.43% | 2 |

| IAG Construction & Manufacturing Index* | Strong Deflation | 1 | |||

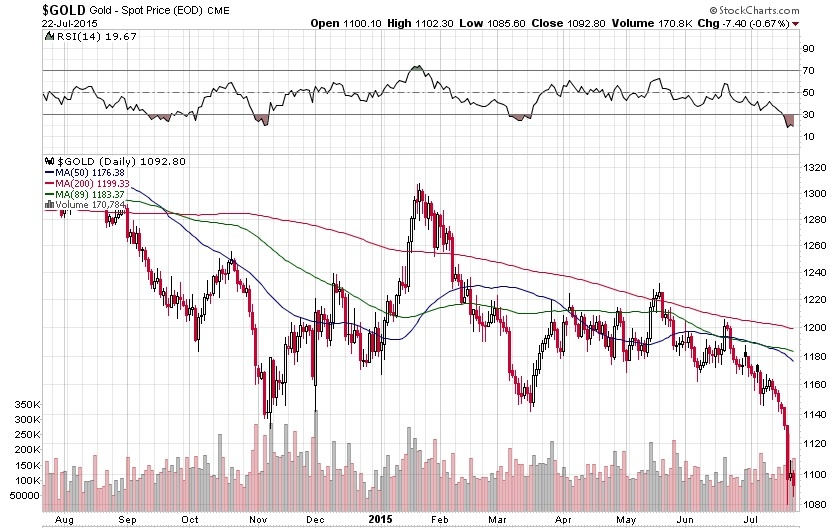

| Precious Metals | |||||

| Gold | 1,172.40 | -1.46% | -11.68% | 5.68% | 1 |

| Silver | 15.62 | -6.47% | -25.89% | -16.32% | 1 |

| IAG Precious Metals Inflation Index* | Strong Deflation | 1 | |||

| Innovative Advisory Group Index | |||||

| IAG Inflation Index Composite* | Mild/Strong Deflation | 1 / 2 | |||

* If you would like a description of terms, calculations, or concepts, please visit our Inflation monitor page to get additional supporting information. We will continually add to this page to provide supporting information.

* Our Inflation Score is based on a proprietary algorithm, which is meant to describe the respective category by a simple number. The scores range from 1-5. One (1) being the most deflationary. Five (5) being the most inflationary. These scores are meant to simplify each item and allow someone to quickly scan each item or section to see the degree of which inflation or deflation is present.

* We have also added our own indexes to each category to make it even easier for readers to receive a summary of information.

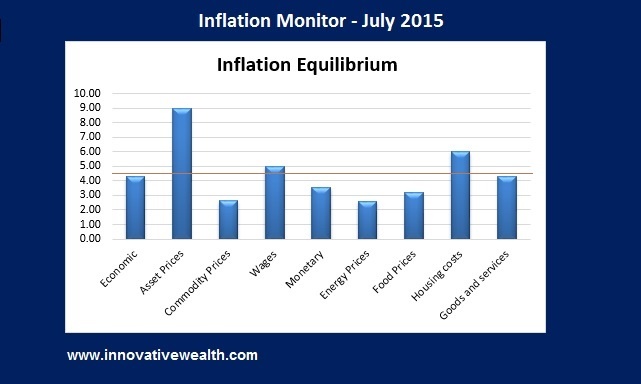

Inflation Monitor Summary – Composite Ranking

* The Inflation Equilibrium is a quick summary for the whole data series of the inflation monitor. If you don’t like statistics, this is the chart for you.

Inflation Monitor – July 2015 – Introduction

I hope you enjoyed your Independence Day. While Greece may not have the same appreciation of our holiday, they had one of their own… A Bank holiday. While the Greek Crisis in Europe seems to be solved??? The greater problem persists. The Greek people voted a resounding “NO” on the terms and the Greek PM moved forward with it anyway. Apparently, Greece is happy kicking the can down the road, and I can’t blame them. They can never pay back the debt they owe and they are getting additional loans to pay the interest in the loans they already have. Europe seems to want to keep them in the EU for other reasons, but the end result is that they eventually will have to deal with this. I’m sure the politicians would rather this problem breaks loose on someone else’s watch. Everyone wins by prolonging this and everyone loses eventually by letting this happen.

The US Markets continue to be quiet with no additional QE and a prospective tightening in the near future. The economy continues to be strong, but some signs are cropping up in small amounts showing that caution is warranted.

In case you missed it the NYSE halted trading for half the day a few weeks ago. If you want to learn more about how you can reduce your risk of this happening to you, I wrote a post about it that you can read here. I have added a few charts to this issue that I found interesting this month.

I hope you enjoy this month’s Inflation Monitor – July 2015.

Kirk Chisholm

As always, please contact me with any questions or to send your feedback. Thank you for reading.

Join our email list to receive the Inflation Monitor sent directly to your inbox.

Charts of the Month

Leading Indicators

Dr. Copper

Traditionally copper is a good leading indicator. Dr. Copper is still weak. There is too much global supply of copper for this to get much traction. However this seems to be true for many commodities. It is not clear if the supply glut in copper is causing it is produce false signals as to a weakening economy. time will tell.

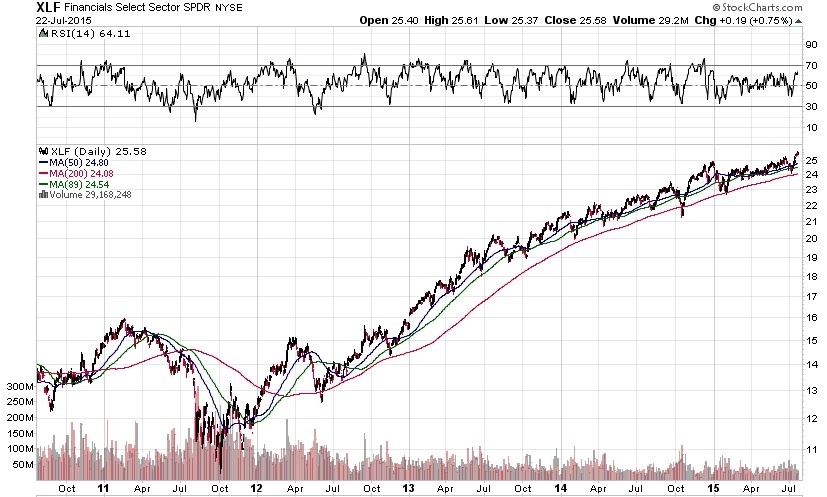

Financials

Financial are still going strong.

Pension Problems in the US

These are the 10 most underfunded state pension plans. These are times where I love living in Massachusetts. It makes me so proud <end sarcasm>

PPI

Consumer Price Ratio (CPI)

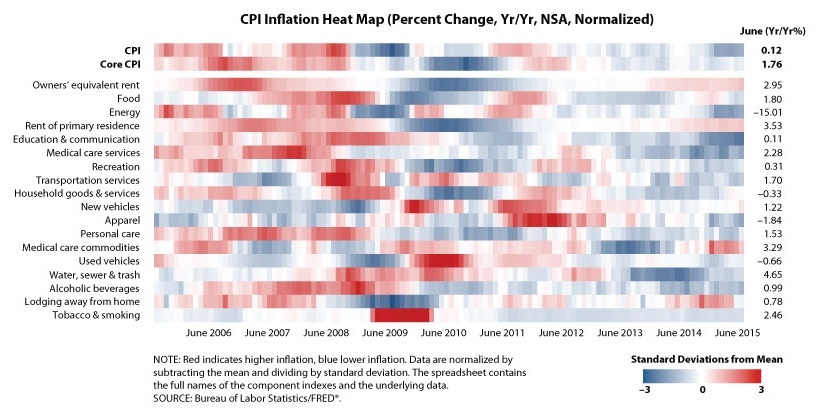

Hot and Cold Running Inflation

This is a chart put together by the Fed showing different components of the CPI and how they compare to each other.

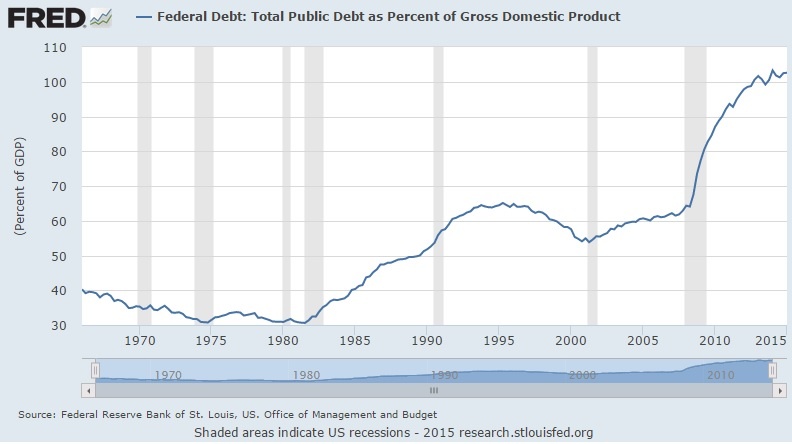

Federal Debt as a percentage of GDP

The US is at dangerous levels, but as the world’s reserve currency, it really doesn’t matter. But if you care about the productivity of the economy, then it makes a whole lot of difference.

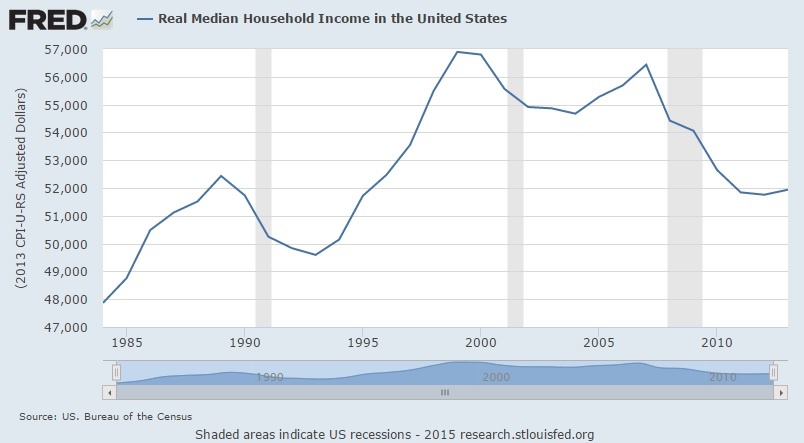

Real Median Household Income

Income is not rising. this is another reason inflation has not kicked in.

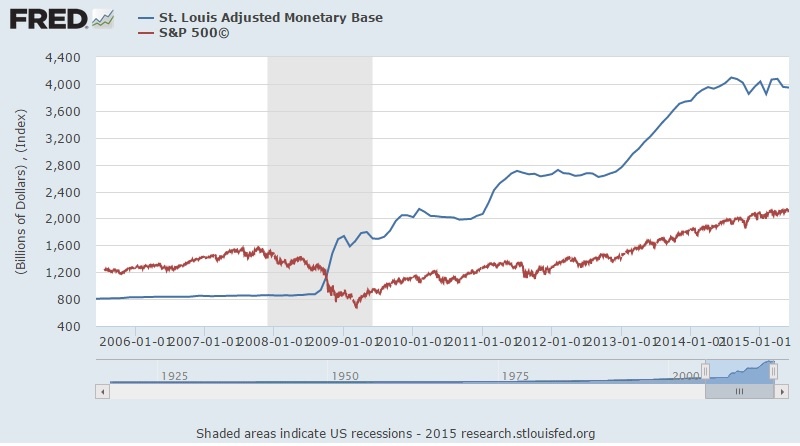

Monetary Base in US vs. S&P 500

It is hard to see on this chart, but the expansion of the monetary base has correlated with the rise in stock prices. Maybe a coincidence, but probably not.

S&P 500 Index Performance

The end of QE seems to have flattened the index. Let’s see what happens.

US Velocity of Money M2

This is not turning up. This is a bad sign since it means people are not spending money… thus no inflation.

China

China has hit a bit of a rough patch. Actually a really bad week for those invested in the FXI or other China-related indexes. Things seem like they are starting to unravel over there. Caution would be advised.

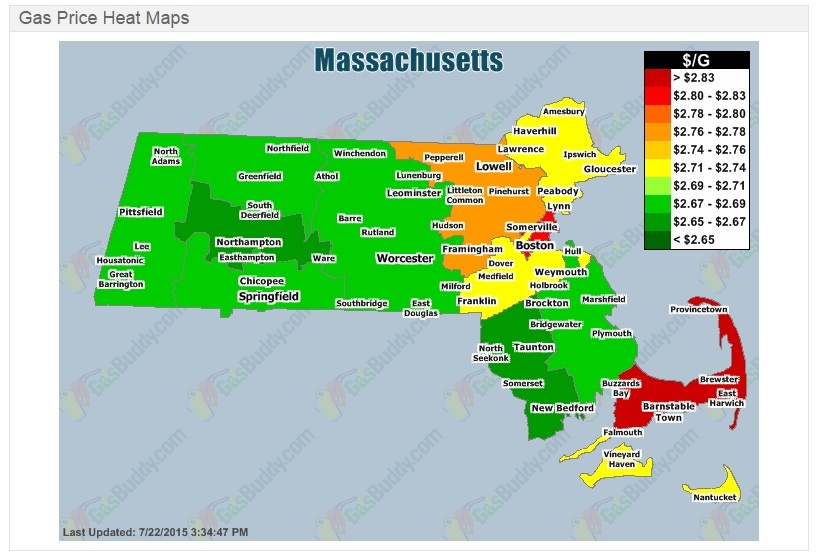

Gas Prices in Massachusetts

Massachusetts gas prices are still rather high compared to the rest of the country, but much better than California. The price scale changes each month, so don;t compare the colors.

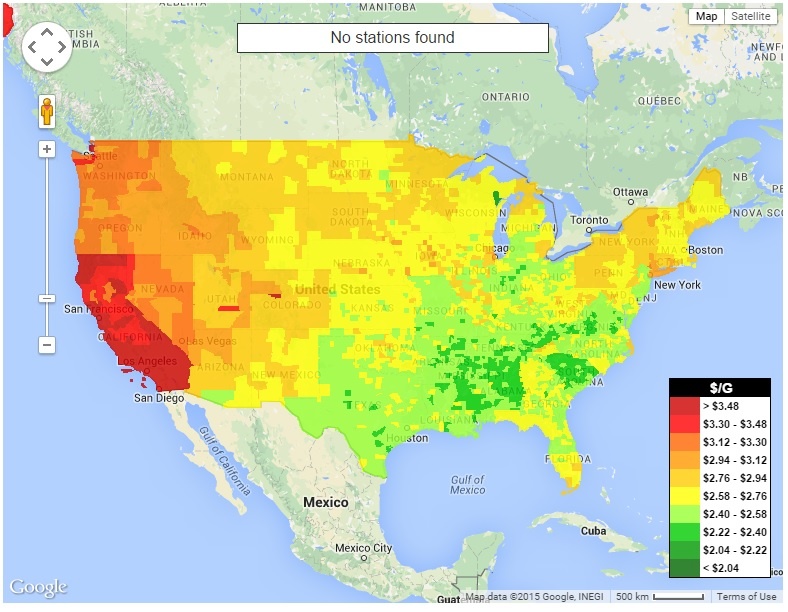

Gas Prices in the US

California is still out of touch with the rest of the country. I guess that may always be true. The price scale for the US map has changed from last month as well, so don’t compare the colors.

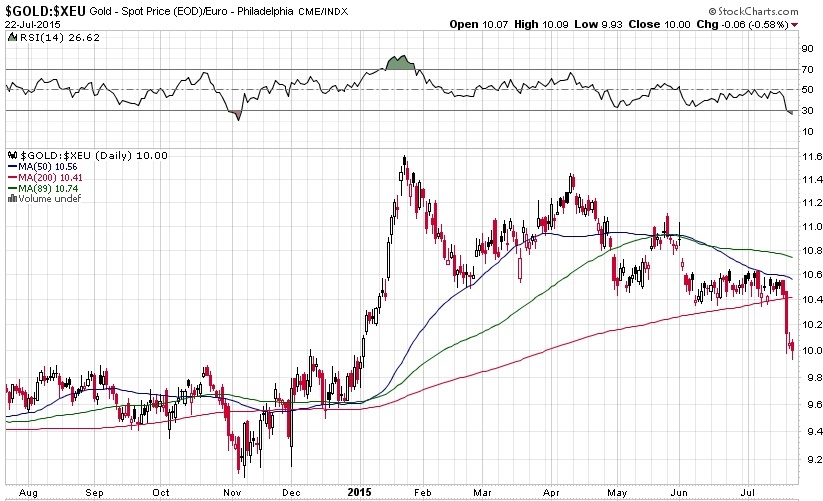

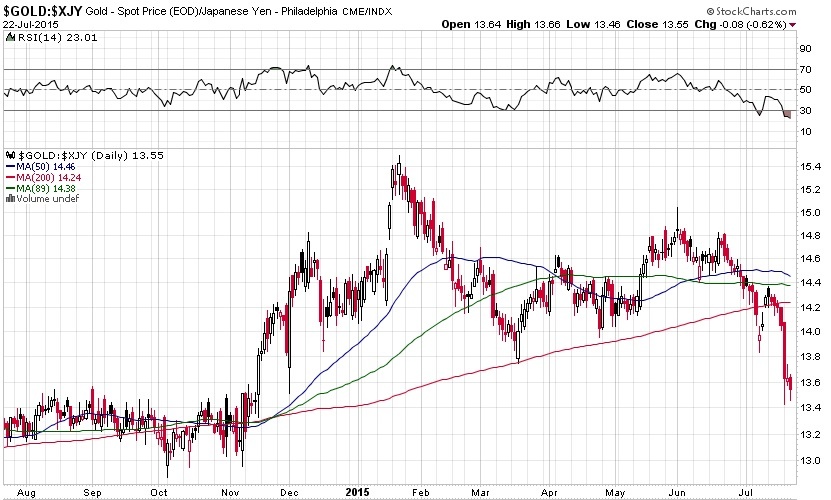

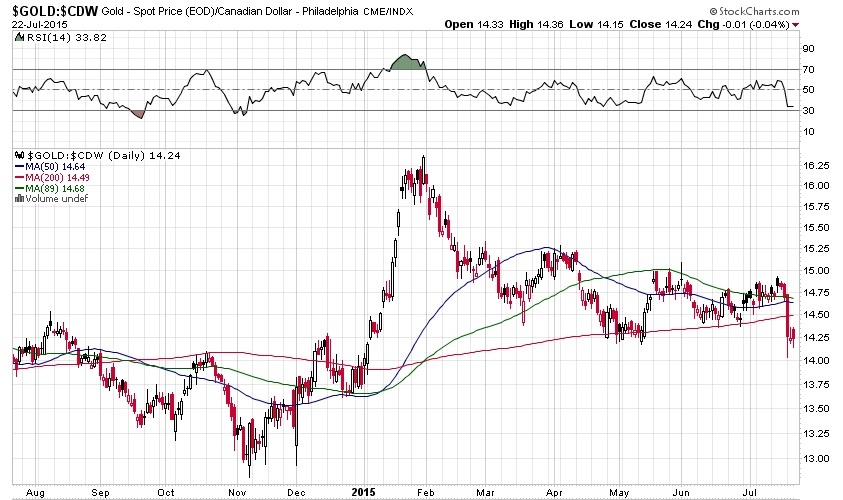

Currency Relative Valuations to Gold

Gold prices are they strong or weak?

Gold Priced in Euros

Gold Priced in Yen

Gold Priced in Canadian Dollars

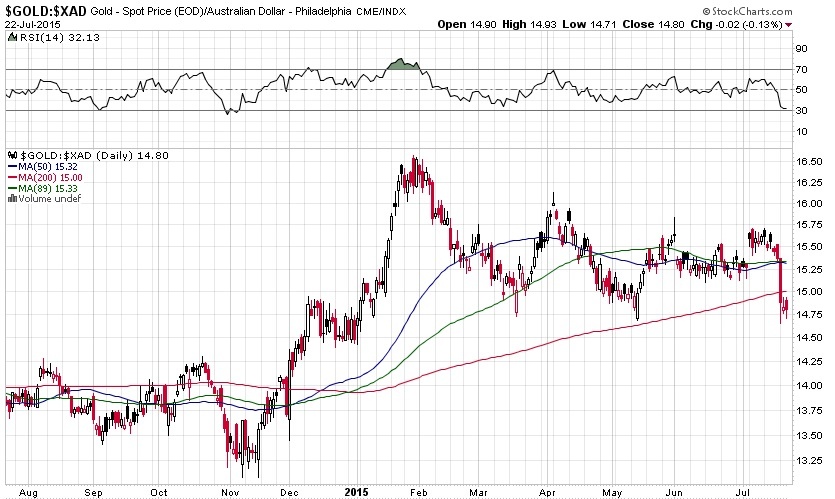

Gold Priced in Australian Dollars

Bonds

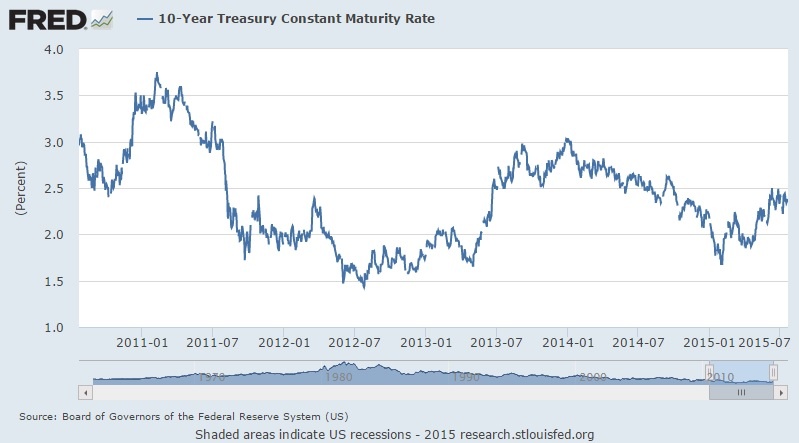

US Treasuries

The whole world runs on this chart. While rates are higher, it is stalling out. Probably waiting to hear better guidance from the Fed.

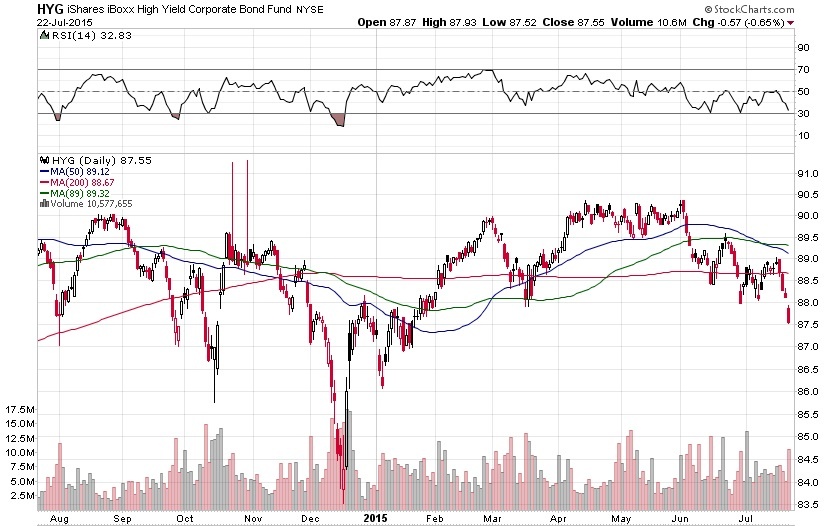

High Yield Bonds (Junk Bonds)

This can be a leading indicator for the equity markets

Baltic Dry Index

The Baltic Dry Index has continued to pick up in the past few months, but it still has a long way to go. While this index tends to be volatile, it is going in the right direction

Capacity Utilization

This is showing some signs of slowing keep watch on this.

I hope you enjoyed this month’s Inflation Monitor. See you next month.

Cheers,

Kirk Chisholm

The IAG Inflation Monitor – Subscription Service

We are initially publishing this Inflation Monitor as a free service to anyone who wishes to read it. We do not always expect this to be the case. Due to the high demand for us to publish this service, we plan to offer it free for a while and when we feel we have fine tuned it enough, we do plan on charging for access. Our commitment to our wealth management clients is to always provide complimentary access to our research. If you would like to discuss becoming a wealth management client, feel free to contact us.

If you would like to automatically receive the Inflation Monitor in your email inbox each month, click here to join our free subscription service.

Sources:

- Federal Reserve – St. Louis

- U.S. Energy Information Administration

- U.S. Post Office

- National Association of Realtors

- The Economist

- The Commodity Research Bureau

- Gurufocus.com

- Stockcharts.com

- Bloomberg

- GasBuddy

* IAG index calculations are based on publicly available information.

** IAG Price Composite indexes are based on publicly available information.

About Innovative Advisory Group: Innovative Advisory Group, LLC (IAG), an independent Registered Investment Advisory Firm, is bringing innovation to the wealth management industry by combining both traditional and alternative investments. IAG is unique in that we have an extensive understanding of the regulatory and financial considerations involved with self-directed IRAs and other retirement accounts. IAG advises clients on traditional investments, such as stocks, bonds, and mutual funds, as well as advising clients on alternative investments. IAG has a value-oriented approach to investing, which integrates specialized investment experience with extensive resources.

For more information, you can visit: innovativewealth.com

About the author: Kirk Chisholm is a Wealth Manager and Principal at Innovative Advisory Group. His roles at IAG are co-chair of the Investment Committee and Head of the Traditional Investment Risk Management Group. His background and areas of focus are portfolio management and investment analysis in both the traditional and non-traditional investment markets. He received a BA degree in Economics from Trinity College in Hartford, CT.

Disclaimer: This article is intended solely for informational purposes only, and in no manner intended to solicit any product or service. The opinions in this article are exclusively of the author(s) and may or may not reflect all those who are employed, either directly or indirectly or affiliated with Innovative Advisory Group, LLC.