Nothing to see here.

I just got back from the TD Ameritrade 2015 annual conference in San Diego. They always put on a high qualify event. At this event was a luncheon hosted by TD, where keynote speaker, Craig Alexander, Chief Economist at TD Bank spoke about his view of the world. I make a point to listen to him each year at the conference and I am always impressed. He is a very smart and accomplished economist. However, this year was a bit different. I am still trying to make sense of it. The majority of Craig’s speech was about how the US does not have deflation and will not have it in the foreseeable future.

The first thing that popped into my mind was this clip from the movie Naked Gun.

There is nothing to see here. Move along.

It wasn’t until Craig mentioned that he had just met with some members of the FOMC that it clicked for me. Craig is a “deflation denier”. This excessive denial about deflation in the US plus his recent meeting with FOMC members leads me to believe that the Fed is VERY worried about deflation. Whether it is a planned attempt at disinformation, which the Fed is very good at, or whether Craig is stuck in the classic recency bias is unclear. What is clear is that there is a deliberate attempt to psychologically whisk away the idea of deflation from the public’s lexicon. This should be no surprise to you readers of the Inflation Monitor. We have seen deflation as an encroaching trend since October when the Inflation Monitor began.

The balance of inflation or deflation is a large issue at the moment. One that has been controversial for the past 15 years. What I found puzzling was that the majority of Craig’s speech was about inflation and his support that it exists in the US and will not falter into deflation for quite some time, if ever.

I do not agree. If you have been following the Inflation Monitor (which I may have to re-title the “deflation monitor”) for a while, you will know my opinion of inflation. In short, we don’t have any.

Craig is a very smart guy but it makes me wonder why some smart people believe in things which don’t make sense logically. I know there are also people who believe in the Loch Ness Monster, Santa Clause, and ghosts, but I have not seen any proof that they exist. If the Fed has its way, deflation may soon fall into the category of urban legend or myth. We will find out soon enough.

Deflation vs deflation expectations

Reading between the lines of his speech gave me more conviction that deflation is worrying a lot of economists. He even made mention of the fact that deflation was less of a problem than deflationary expectations. I should clarify here that he did say that he expects the US to experience deflation at some point for a very brief period of time, but not deflationary expectations. This is a bit complex, so I will try to explain since I expect to see this distinction in the media as deflation takes hold of the economy.

Deflation

If the US experienced deflation, the price of goods and services would show an overall decline in prices. This in itself is not a danger from the economists perspective. Many prices drop due to seasonal sales, cheaper input (raw commodity) costs, technological advances, demographic shifts or changes in currency rates.

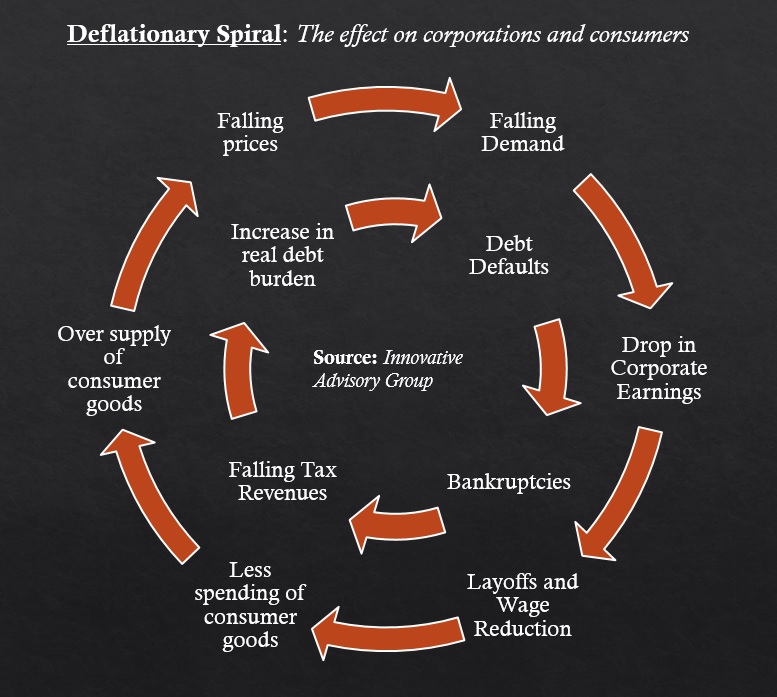

The danger is with the change in deflationary expectations. This change will alter the behavior of the consumer and that is a danger to a system. A system that relies on inflation to survive in its current state.

Deflationary expectations

For over 70 years the global economy has in large part been inflationary in nature. The goal of central banks is price stability via consistent and low inflation. This condition feeds upon itself, reinforcing inflation as a natural state of the economy. This also conditions the consumer to expect certain inflationary reactions, such as prices continuing to rise over time. When a consumer expects inflation their reaction is to buy goods today otherwise, the goods will be more expensive tomorrow.

Deflation expectations have the opposite effect. If the consumer expects deflation, then they don’t buy the goods because they expect they will be cheaper tomorrow. Both inflation and deflationary expectations feed upon themselves and perpetuate the expectations of the consumer. While these expectations are difficult to change, when they do, they are hard to change back. The US has had an almost uninterrupted period of 70 years without deflation.

Once the deflationary expectations set in, the cycle builds upon itself. As the Japanese people can tell you, it can last a long time (25+ years and counting). This chart shows the deflationary spiral that so many economists fear, but deny it will ever happen in the US.

Why does deflation happen?

Inflation just like deflation happens due to a variety of factors. Here are some of the more common causes (or effects) of inflation and deflation:

- Inflation

- Excess printing of money

- Expansion of credit

- Monetary dysfunction

- Rapid growth of the labor force

- Lowering of interest rates

- Changes in currency rates (a drop in the US dollar vs other currencies)

- Higher input costs

- A lack of trust in the currency

- Increased leverage of assets

- Deflation

- Withdrawing money from the economy

- Reduction of available credit

- Raising interest rates

- cheaper input (raw commodity) costs

- technological advancements

- demographic shifts (an aging population, or shrinking of the productive labor force)

- Changes in currency rates (a rise in the US dollar vs other currencies)

- decreased leverage of assets

- A high debt burden on an economy

Deflation is seen as a positive effect when it comes from technological advances (i.e. lower costs), but negative when it comes from demographic shifts or consumers paying off their debts. Deflation is not the enemy. Too much debt and over-leverage is.

Deflation in the eyes of an economist

I don’t expect to attend any economic conventions in the near future. If I did attend such a convention I would not expect to hear someone discussing the idea that deflation is going to win out in this battle between inflation and deflation. It isn’t going to happen.

I wasn’t surprised to hear Craig Alexander chastise deflation (deflation expectations) so publicly, but I was a bit surprised at the amount of time he spent on it. Back in 2008, I said that I expect we will have very low-interest rates much longer than anyone expects. So far that seems to be true. Given that the US still has one of the interest highest rates in the world among developed nations, It would be hard to imagine that that condition persists for long. While the US does not yet have negative interest rates as many of the European countries do, it might not be long if the US heads into a recession.

Deflation is here to stay. The question is just how long it will take economists to admit it.

Source:

photo credit: London City Hall Staircase via photopin (license)

About Innovative Advisory Group: Innovative Advisory Group, LLC (IAG), an independent Registered Investment Advisory Firm, is bringing innovation to the wealth management industry by combining both traditional and alternative investments. IAG is unique in that they have an extensive understanding of the regulatory and financial considerations involved with self-directed IRAs and other retirement accounts. IAG advises clients on traditional investments, such as stocks, bonds, and mutual funds, as well as advising clients on alternative investments. IAG has a value-oriented approach to investing, which integrates specialized investment experience with extensive resources.

For more information, you can visit www.innovativewealth.com

About the author: Kirk Chisholm is a Wealth Manager and Principal at Innovative Advisory Group. His roles at IAG are co-chair of the Investment Committee and Head of the Traditional Investment Risk Management Group. His background and areas of focus are portfolio management and investment analysis in both the traditional and alternative investment markets. He received a BA degree in Economics from Trinity College in Hartford, CT.