“Thus inflation is unjust and deflation is inexpedient. Of the two perhaps deflation is, if we rule out exaggerated inflations such as that of Germany, the worse; because it is worse, in an impoverished world, to provoke unemployment than to disappoint the rentier. But it is necessary that we should weigh one evil against the other. It is easier to agree that both are evils to be shunned.” – John Maynard Keynes

You Might Be Surprised To Learn How a Mortgage Can Destroy Your Real Estate Wealth Through Deflation

This is the 3rd in a series of 4 posts about investing in real estate. The last post, Inflation – The Secret To Building Wealth in Real Estate, is about how inflation is essential to building wealth via your real estate investments. While most people subconsciously understand that real estate has all of the features listed in that post, they may not be sure why real estate has those features. The key is inflation.

This week I will be discussing the other side of the coin, and what happens when there isn’t inflation to make your real estate the wealth building tool that it has been for over 50 years.

This week I will be discussing deflation, how it would affect your real estate investments, and how a mortgage can destroy your real estate wealth. Many notable economists have made deflation the economic boogieman. They have claimed that it is the worst possible outcome in an economy. When you hear someone talking about deflation, it is highly likely that Japan will also be mentioned in the same sentence.

Deflation is rare in the global economies of today. This is due primarily to central banks who around the world have engaged in a campaign to create a consistent inflationary environment for their own economies. This has worked for a few decades without hyper-inflation or persistent deflation in developed economies. Except for Japan.

Japan is one notable example of deflation which has taken hold in an economy and created a deflationary spiral. This is the essence of what economists fear. While this may sound scary, it isn’t, or doesn’t have to be. This week I will be discussing how deflation affects real estate, and why you should understand this if you want to protect your wealth.

What is deflation?

“Deflation is a fall in the general price level or a contraction of credit and available money (opposed to inflation).”

Deflation is generally characterized as a contraction of money and credit. This means there is less money in circulation, which generally makes holding it more valuable. Deflation is a market force that operates in the opposite direction as inflation.

While deflation generally refers to the amount of money and credit in circulation, it also references a fall in the general price level of goods and services.

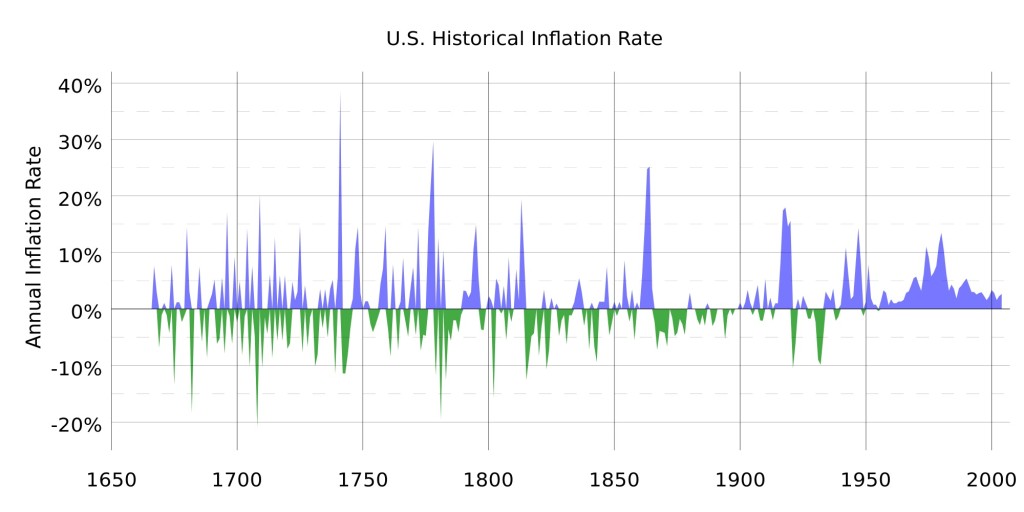

While deflation tends to be chastised by many economists, it is a natural occurrence in a non-manipulated free-market economy. It is as important to a free-market economy as night following day. Prior to the creation of the Federal Reserve in 1913, both inflation and deflation were normal market forces that counterbalanced each other and made the economy an efficient allocator of capital. While there were good times and bad times, the free-market economy always self-corrected.

Deflation in of itself is not dangerous. What makes deflation dangerous and deserving of the prejudices of many economists is the use of leverage in an economy. In a leveraged, credit-based economy (such as most developed economies of today) it can be a very dangerous outcome.

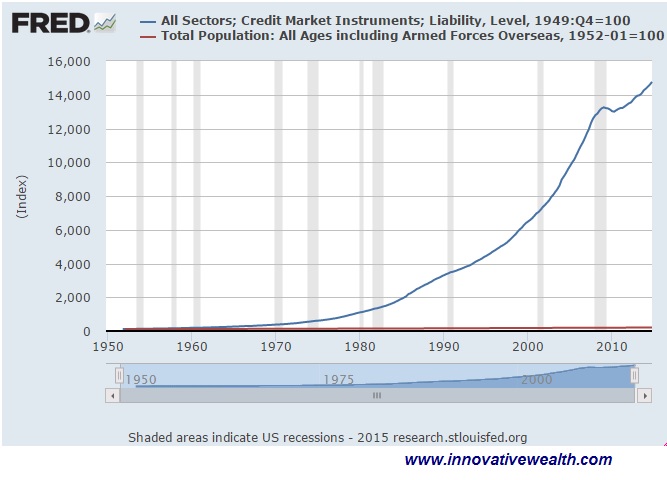

Currently, the US has a credit-based economy which is highly leveraged. This is primarily due to the amount of debt and money creation which has taken place over the past 50+ years. Here is a chart of the creation of money since 1950 compared with the population growth over that same period of time.

Both of these numbers were indexed to 100 to compare the percentage change over that period of time. Does anything here seem out of place? The population grew 2x while the credit market grew at 142x.

Another way to look at the US economy is to look at the debt-to-GDP.

The US is one of 8 countries with a debt-to-GDP over 100%. The other countries with debt-to-GDP above 100% are Belgium, Greece, Ireland, Italy, Japan, Portugal, and Singapore. I don’t know about you, but I would rather be in better company. Interestingly enough, Russia has a debt-to-GDP of only 13%, Iran is 10%, and Saudi Arabia is 2%.

Debt-to-GDP is a good indicator of the leverage employed in an economy. A higher number means more leverage, and a lower number mean less leverage. Saudi Arabia has almost no leverage with a Debt-to-GDP of 2% while Japan has the most leverage with a debt-to-GDP of 227%. This may be one of the reasons Japan’s economy has been deflationary for over 25 years. Too much debt reduces the country’s ability to grow.

You can equate the Debt-to-GDP leverage in an economy to the leverage used to buy real estate via a mortgage.

If you understand how leverage works with real estate, then you will want to pay attention to the rest of this article.

How does deflation affect real estate?

In my prior post, These Top 7 Powerful Tools can Create Legacy Wealth from Real Estate, I discussed 7 advantages of why real estate is such a powerful asset class to create wealth.

- A high degree of leverage can be used

- Real estate is inflation proof

- Creation of cash flow

- Appreciation potential

- Reduction of debt over time in real terms

- A limited supply of land

- Tax benefits

Five of these seven advantages are important when it comes to inflation or deflation because they are highly affected by it.

The hard truth that I hope to instill in you today is that if you use leverage with your real estate, you should keep a close eye on the deflationary forces in the US economy. To put it more bluntly, with zero inflation, the advantages of real estate would be limited to only the tax benefits and the limited supply of land. With negative inflation (deflation), your advantages of owning real estate with leverage would turn into disadvantages.

I want to be clear on this one point because it is important. Owning real estate in an environment with deflation is not a bad thing. It is only dangerous if you are using leverage via a mortgage. Leverage is the danger, not real estate itself. Don’t use leverage with a negative inflation rate(deflation). This would cause a negative compounding effect.

How does deflation affect your use of leverage when investing in real estate?

If you go out and buy a house and use a mortgage to do so, then you are employing leverage. Leverage is an important tool in the world of finance. It allows you to take a small amount of money and use it control an asset worth a larger amount.

For example, if you buy a $100,000 home, you can borrow up to 80% of the purchase price or $80,000 while only putting down $20,000. This is an example of someone using 5 times leverage, meaning that for every 1% the home appreciates, the homeowner’s equity goes up 5%. This works out well when home prices are going up. However, as most people know from 2008, that doesn’t always happen.

In 2008, the housing bubble burst causing home prices to drop, and in some areas, they dropped significantly. This put a lot of homeowners underwater, meaning that they had negative equity in their homes. If they sold their homes they would have had to come up with extra money at the closing. This happened in part due to the drop in home prices and partially due to homeowners putting down less than 20%. In some cases 0-5%.

Losing the equity in your home is easy to do when you use leverage. Leverage works both ways. While it might help increase your equity 5 times when home prices are rising, it also decreases the equity in the home 5 times when home prices are declining.

The morale of the story is that you should only use leverage when asset prices are increasing, and do not use leverage when asset prices are declining. Simple right?

If real estate is inflation-proof, should you buy real estate with leverage?

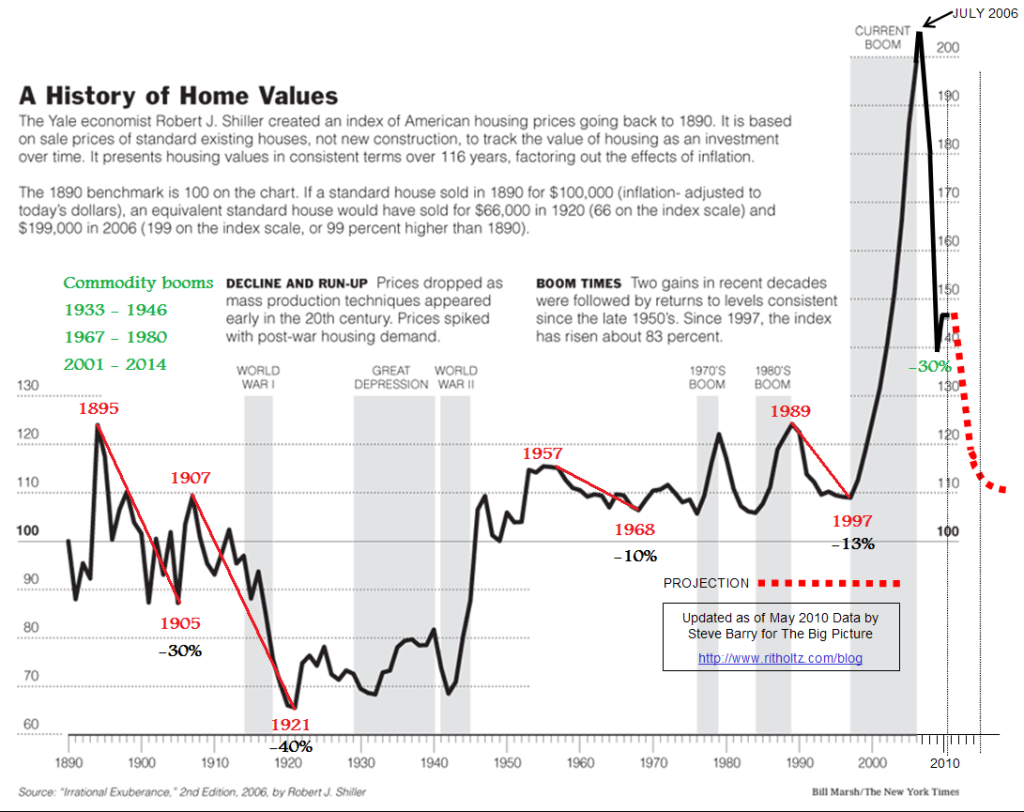

If you had bought real estate 50 years ago, you would be happy with the performance of your investment. Here is a chart Robert Shiller put together for real estate prices in the US since 1890.

Not only have real estate prices kept pace with inflation, but in the past 18 years, homes exceeded the rate of inflation by a large amount. However, if we remove the prices from 1997 to the present, then the picture seems a bit clearer. Real estate is a great hedge against inflation. It tends to move with the inflation rate.

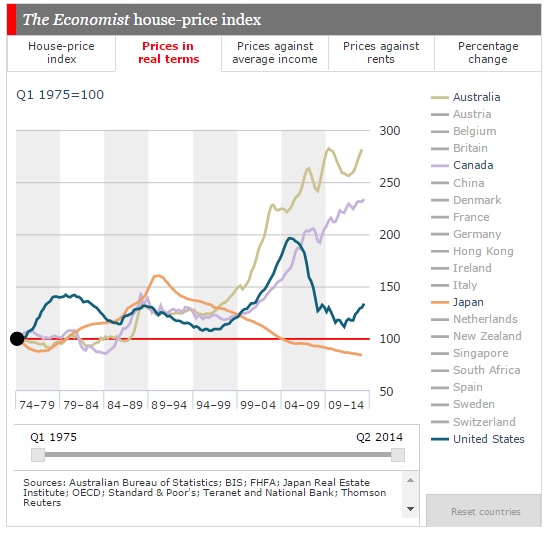

Fortunately for homeowners and real estate investors, real estate is highly correlated with inflation. If you remove the financial crisis, we have had a non-stop period of 50+ years of inflation to boost real estate prices. This is not only true in the US, but globally as well.

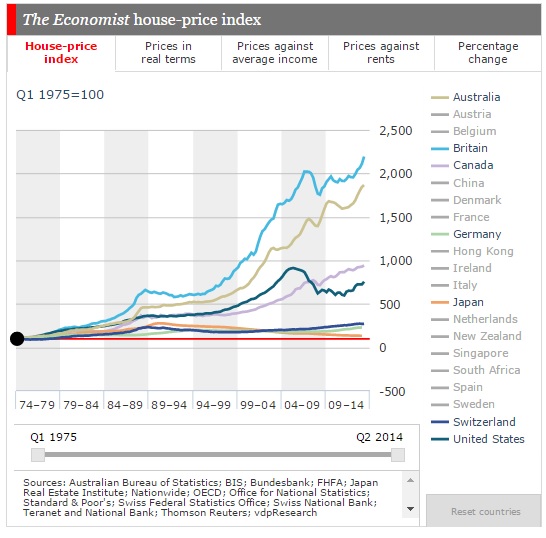

Here are some charts of global real estate prices from The Economist:

The lesson to be learned is that if we have inflation, then you should own real estate with a mortgage. But what if we don’t have inflation? What if inflation turns negative and we experience a period of deflation?

The lesson to be learned is that if we have inflation, then you should own real estate with a mortgage. But what if we don’t have inflation? What if inflation turns negative and we experience a period of deflation?

Japan is an example of how deflation can affect real estate

The above chart should give you some insight. Look at Japan (orange) on this chart of real estate prices in real terms (prices if you remove the influence of inflation). Japan’s economy and stock market peaked in 1989 and have been stuck in negative inflation (deflation) ever since. Japanese house prices in real terms have been dropping for the past 25+ years.

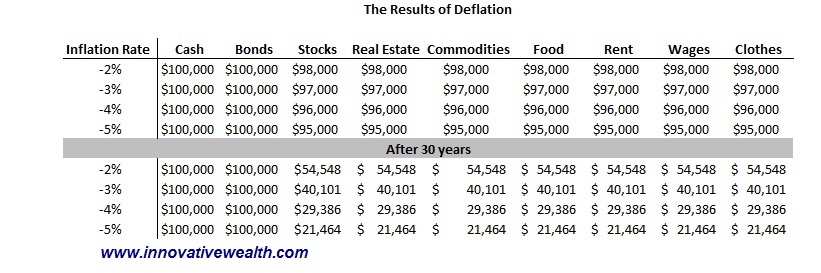

One reason for this is real estate investors have leverage on their real estate in a deflationary economy. This causes a negative compounding effect on wealth. If Japanese investors had no leverage on their real estate, then the house prices in real terms would be flat. However, it is dropping because they are using leverage. Here is a chart of how deflation can cause a negative compounding effect on your wealth (without leverage).

While most people naturally assume that inflation is a constant. It isn’t. This chart of historical inflation rates should show you that consistent inflation is a more recent phenomenon.

The main point you should take away from this section is that while real estate is a great inflation-proof asset, inflation is not always positive. Consider this when you are investing in real estate. Don’t use leverage if the US has a negative inflation rate.

Rental Income – How cash flow from real estate increases and decreases with the rate of inflation

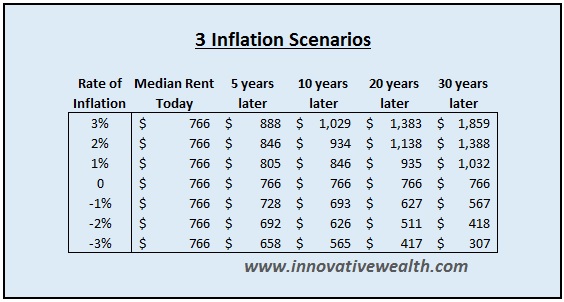

Smart long-term real estate investors invest primarily for the cash flow benefits. If a property is managed properly, the cash flow generated from an investment in real estate should be consistent. It should also be pegged to the rate of inflation.

If the rent is $1,000/mo and inflation rises 2%, then next year the rent should be $1,020/mo. This is a reasonable assumption since a rising rate of inflation typically means that wages are rising to the same degree, thus people can afford the rise in rent.

The above chart shows how positive or negative inflation can affect rents over time. When inflation is positive, this is great for real estate investors. However, negative inflation can pose a problem for investors. Rents do not always go up, they can drop to keep pace with negative inflation as well. If you do not have a mortgage, then this is just a minor problem for you. However, if you have a mortgage on your investment property, then this might pose a problem.

How can changes in inflation can affect your real estate cash flows

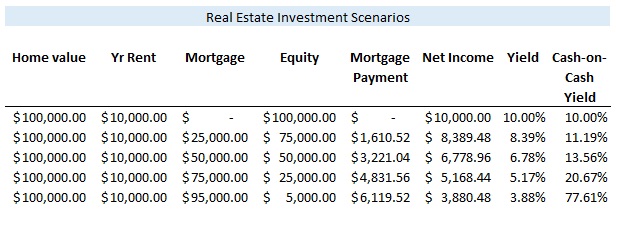

Many real estate investors use leverage when they buy investment property. When done the right way, this can improve the yields from the investment property. Here is an example of how a mortgage can affect cash flows.

*This example assumes that the mortgage is a 5% 30-year fixed mortgage. This example is a simple version that does not include all the other expenses of owning an investment property.

From this example above, it is not hard to visualize why people use leverage to buy real estate. More leverage can equal much higher returns on your equity invested. However, let’s look at how negative inflation can affect these returns.

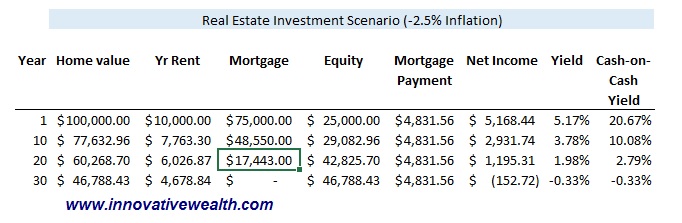

This is how deflation can hurt your cash flows

When most people invest in real estate, they don’t consider inflation into their calculations. Even if it exists in their spreadsheet, it is barely given a moment’s thought. Most people have become complacent when it comes to inflation. Here is the reason you should take a second look at the rate of inflation when you run your calculations.

Long periods of deflation can turn a good investment into a poor one. Who wants to own real estate that is costing them money every month in addition to the negative appreciation that comes with deflation? I don’t.

While it is possible that the US or other developed economies might experience a short period of deflation from time to time, the Japanese style deflation is what you should be concerned about. They have experienced 25+ years of deflation. The example above is for 30 years, so it is not out of the question that the US could experience a long period of deflation. Let’s hope this doesn’t happen in the US. If it does, then you should not have a mortgage on your real estate.

How does deflation affect debt?

In the prior post, Inflation – The secret to building wealth in real estate, I discussed one big secret that most people are not aware of when it comes to investing in real estate. That secret is: inflation causes debt to lose value over time.

If you held cash for the past 100 years, your dollar would be worth 95% less than it was in 1915. This is because the value of your cash declines over time and it can buy you less each year through inflation.

Debt works in a similar manner. The value of the debt does not change (assuming you don’t pay it off) in nominal terms. However, over time, the value of that debt declines in the same way that cash does. Over the past 100 years, the value of $100 in debt would be worth less than $10 in today’s dollars. This is why using leverage during inflationary times is such a valuable secret. It causes your debt to be worth less over time.

Deflation is different when it comes to debt

While inflation secretly erodes the value of debt over time, deflation does the opposite. It causes the debt to be worth more over time. This is how a mortgage can destroy your real estate wealth. Here is another look at one of the above charts.

While the prices of goods and services are declining in value, the price of the debt is unchanged. Actually, it appreciates in comparison. This is why it is important to reduce or eliminate your debt if there is a negative inflation rate.

Help me! Deflation is confusing

Trying to understand the difference between future dollars and today’s dollars can be a bit of a challenge. Especially when we don’t have much experience with deflation. The another way to explain how deflation can affect a mortgage on your investment property is to imagine the following:

Let’s say you were to buy an investment property today for $125,000, and you decided to take out a mortgage on the property for $100,000. Most mortgage contracts are very similar in that they require you to make static or variable payments depending on the type of mortgage you have.

There is no inflation in this example, but at the end of each year, the bank adds $3,000 to the balance of your mortgage in addition to interest payments that you owe. At the end of year one, you would pay the interest owed and your principal balance would be raised to $103,000. Does this sound like an attractive proposition to you?

This means with a 3% interest rate, you would owe a net 6% each year. 3% in interest and 3% in addition to the principal.

Hopefully, you are getting the point that deflation really hurts when you are using leverage.

To summarize, when you have deflation, the value of your real estate drops, the cash flows drop, and if you are using leverage, those drops are amplified by the amount of leverage you are using. Remember, do not have a mortgage if we have deflation.

We have had inflation for over 50 years, why should you worry about deflation?

If home prices are a good hedge against inflation, then we could also assume that they would correlate well against deflation. But why would we have to worry about deflation?

Since I have started the Innovative Advisory Group Inflation Monitor, our monthly report on inflation in the US, the trend has been in favor of deflation rather than inflation. This is just starting to show up in the CPI and other related government statistics as well. If you want to learn more about the Inflation Monitor or to automatically receive the Inflation Monitor each month in your inbox, you can sign up here.

We have had an unprecedented period of consistent inflation that has brought some benefits to the economy. Unfortunately, it has also led people to complacency. Most people assume that we will have inflation because in their experience we have always had it. 50 years of inflation is the only thing the investing public knows.

The great depression was the last time the US experienced a long period of deflation. People who lived through the great depression are in their twilight years, so very few remember it first hand. Because there are very few who remember what it is like to live in deflationary times, the impact of such an event would be devastating due to the lack of preparedness. In case you are not familiar with the great depression, one of the causes was due to high leverage in the years preceding it.

What did you learn today?

- Real estate is closely tied to the rate of inflation

- You should only use leverage when asset prices are going up.

- Do not have a mortgage if we have deflation.

What should you do?

Should you go out and sell all your real estate and rent?

Well that is up to you, but this is not a doom and gloom post, it is merely a thought experiment of what could happen if deflation wins the battle against the Federal Reserve.

There is a strong reason the old adage, “Don’t fight the fed” continues to hold true. The Federal Reserve is a very powerful institution. They directly or indirectly control the rate of inflation in the US. I am not 100% certain that this will continue to be true since they are not omniscient or omnipotent. However, they are winning the fight for now.

The best thing to do is to watch the rate of inflation in order to make sure its decline does not turn into deflation. You can do this with our monthly Inflation Monitor. It is a free service. You can sign up for our email list to receive it each month sent directly to your inbox.

One last thing you might want to consider if you are worried about deflation.

In the US, 64% of people own a home and over 70% of them have a mortgage. Most real estate is leveraged including residential, commercial and industrial sectors. The only real estate which is not highly leveraged is raw land. The reason is that virtually no banks are willing to lend on land. This makes it an interesting asset if deflation becomes the norm in the US.

I hope you found this helpful and eye-opening.

Next week I will be discussing how you can use your Self Directed IRA to invest in real estate. This next post is titled, The Real Estate Investor’s Guide: Using a Self-Directed IRA to Buy Real Estate

About Innovative Advisory Group: Innovative Advisory Group, LLC (IAG), an independent Registered Investment Advisory Firm, is bringing innovation to the wealth management industry by combining both traditional and alternative investments. IAG is unique in that they have an extensive understanding of the regulatory and financial considerations involved with self-directed IRAs and other retirement accounts. IAG advises clients on traditional investments, such as stocks, bonds, and mutual funds, as well as advising clients on alternative investments. IAG has a value-oriented approach to investing, which integrates specialized investment experience with extensive resources.

For more information, you can visit http://innovativewealth.com

About the author: Kirk Chisholm is a Wealth Manager and Principal at Innovative Advisory Group. His roles at IAG are co-chair of the Investment Committee and Head of the Traditional Investment Risk Management Group. His background and areas of focus are portfolio management and investment analysis in both the traditional and alternative investment markets. He received a BA degree in Economics from Trinity College in Hartford, CT.

Sources: