“If you rent a home, it is an expense. When you buy a home, it is an expense. If you buy a home and rent it out to a third party, it becomes an investment. A better way to explain it is, when you are renting, you rent from a landlord. When you buy a home to live in, you are renting from yourself.”

This is the third and last post of this series. The first post, Should You Rent or Buy a Home?, examined what factors you should consider when renting vs buying a home. The second post, What is the True Cost of Owning a Home? , examined the true cost of owning a home. In this final post, I will be examining whether it makes sense to rent or buy a home. Numbers don’t lie, so let’s look at some real numbers.

There are many calculators available online to help you figure out whether to rent or own. Unfortunately, very few include the true costs of owning a home in their calculations. If you read the prior post, you will have some understanding of what was left out and how to calculate it. The math in this post will be relatively straightforward and a bit more eye-opening.

I will be showing you some examples of real properties that I have found in the past year to illustrate this secret that very few people know. Whether you are a real estate investor or looking to buy a home to live in, you will want to know this secret.

“You are paying someone else’s mortgage, so why don’t you pay your own?”

There is a myth out there that when you rent, “you are paying someone else’s mortgage, so why don’t you pay your own?” This is a farce. It doesn’t matter whose mortgage you are paying, what matters is your costs to live in that home. No matter where you live, the cost to live in your home is an expense. If you rent, you pay rent to a landlord. If you own, you pay a mortgage, taxes, insurance, maintenance, etc. There are costs for both options. Unless you live in a tent you will be paying for a home either way.

The reason many people think that owning is better than renting is that they equate owning a home as an investment rather than an expense. Once they make the realization that it is an expense, the picture should become much clearer.

Sorry to belabor the point, but I want to make sure you understand this point before I move on. If you rent a home, it is an expense. If you buy a home, it is an expense. If you buy a home and rent it out to a third party, it becomes an investment. A better way to put it is that when you are renting, you rent from a landlord. When you buy a home to live in, you are renting from yourself. Since you do not get any monetary gain from paying yourself, it is 100% expense.

Hopefully, that point is clear so we can move on.

Which is Cheaper? Renting vs Buying a Home

In my last post you saw that on average when you buy a home, you are not making money on it. Given the fact that you have to put down 20% you are actually losing out in opportunity costs with those funds. But the question remains… which is actually cheaper?

I will once again take a look at this renting vs buying question from a financial perspective.

Are you looking at renting vs buying a home in an upper-class neighborhood?

Everyone has to live somewhere, but most people live in a location that is affordable according to their monthly cash flow. If you make $5,000 in income, it is unlikely that you will be renting a home for $4,000 a month. This tends to limit the number of people who rent high-end homes. The limited number of renters tends to bring the monthly rent down to a more reasonable price than if they were to buy the same home. This is an opportunity for people to rent a high-end home for much cheaper than they could have bought it for. If they only knew there was such a dramatic difference.

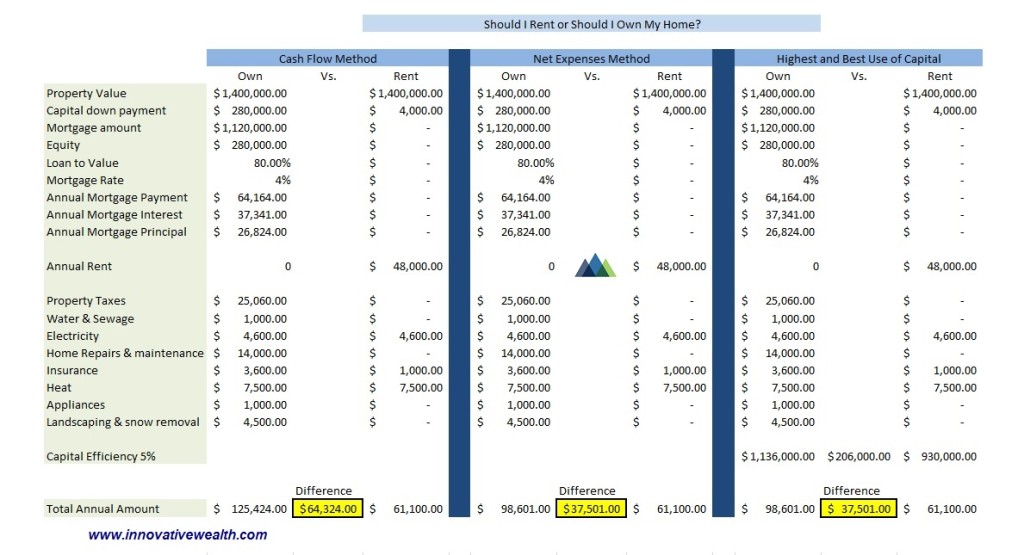

Example #1 a High-End Suburban Single-Family Home

I noticed this difference a number of years ago while comparing different homes in a financial plan for a few clients. One home I saw in the MLS list was both for sale and for rent. I was shocked at the difference. This home was listed for $1,400,000. It was also listed for rent at $4,000 per month. It would cost about $48,000 a year to live in this home plus heat, electricity, and miscellaneous items ($13,000) if you were a renter. That means it would cost you about $61,100 a year to live in the home that would cost $1,400,000 plus expenses to buy.

Buying a Home Expenses – Details

Let’s look at the numbers of what it would have cost to buy this home.

- Mortgage – To buy that home valued at $1,400,000 first, you would have to put down a minimum of 20% or $280,000. This would give you a mortgage of $1,120,000 at a 4% interest rate over 30 years. The payment for this mortgage (30-year fixed) would be about $64,160. This is already more than what it would cost to rent, and this is just the first category.

- Property Taxes – Taxes on this property were $17.9 per thousand or $25,000. In my prior post, I assumed a 1.5% tax rate. This rate was a bit higher than average.

- Property Insurance – This was estimated at about $3,600 a year.

- Heat – The estimate on heat was about $7,500 a year

- Water & Sewer – This was well and septic, so the average annual cost of maintenance and a new system was about $1,000 a year

- Electricity – This was about $4,600

- Appliances – This was estimated at about $1,000 a year on average. When you rent, this is not typically a cost you have to bear.

- Home Repairs – On average, I estimated it at about 1%, or $14,000 a year.

- Lawn Care and Snow Removal – This can vary on the size of the property, but I estimated it at about $4,500 a year.

* For the more astute readers, yes I missed the annual tax benefits, but I also didn’t include renovations, costs to sell the home, capital gains for selling the home, or other costs which inevitably come up.

The total costs each year to live in this home would have been $61,000. However, the $61,000 amount does not include the costs of the mortgage. The seller/landlord of this home did have a mortgage. The $61,000 was just to live in the home if the home was bought for all cash. If you include the $1,120,000 mortgage, it would cost $125,500 a year to live in this home. That means you would be paying double what it cost to rent to buy this home. Not much of an “investment”, is it? How again is this the American dream?

Even if you remove the principal payments, which are payments to yourself, you would still have to pay over $800,000 in interest over the life of the loan. This comes out to on average about $26,800 a year in interest.

How should you make the calculations of renting vs buying a home?

There are actually a few ways to look at this renting vs buying a home comparison. I will mention each way so that you can use the method that works best for you.

- Cash Flow Method – You could simply look at this comparison as a cash flow out-of-pocket calculation. This is what most people do… How much will it cost me each month? I don’t think this is the best approach, but the odds are that you will use this method since it is by far the most popular. Based on cash out of pocket each month, renting this home will cost you $61,000 each year, and owning will cost you $125,500. This is a difference of about $64,500 more each year if you own the home.

- Net Expenses Method – This method looks at the comparison based on the cash that doesn’t get returned. Compare expenses, and add only mortgage interest payments, since mortgage principal payments eventually get returned. This would net each year: Renting: $61,100 vs Owning: $98,600. Difference: $37,500 more each year if you own the home.

- Highest and Best Use of Capital Method – This method measures all of the capital you have to spend and compare it to what it could be used for. These numbers are similar to what I used in the last post. If you own a home, you would have to put down cash to make the purchase. In this case, you have to put down 20% or $280,000. This money will not be productively used while you own the home since you cannot take it out. It will only appreciate proportionately to the appreciation of your home. If you took this same $280,000 and invested it in something that earns 5%*, this $280,000 would be worth $1,210,000. A gain of $930,000. If you buy a home, (at a 2% inflation rate) it will appreciate to $2,536,000. A gain of $1,136,000. The difference between renting and owning is $206,000 in favor or owning. However, if you add in the annual costs of $37,500 of owning vs renting a home, you would have $919,000 (or $30,600 a year) more money at the end of 30 years if you were renting, not owning a home.

* Investment performance numbers are an example and not meant to simulate actual investment returns

The conclusion of this example is that there is no way you should consider owning vs renting, not matter what method you use to calculate the differences. Renting wins hands down on all accounts.

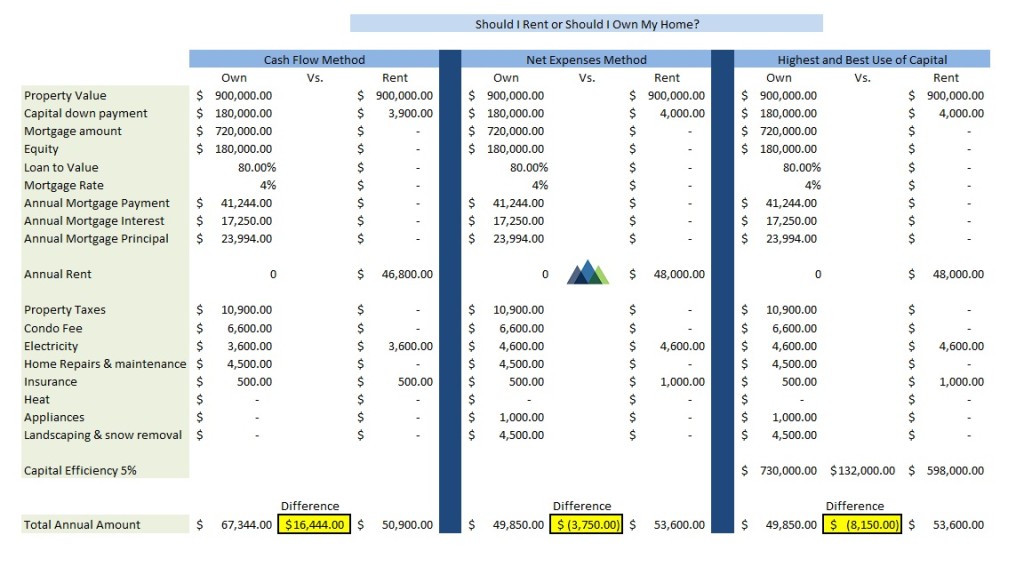

Example #2 a High-End Urban Condo

Real estate agents tend to send flyers to unit owners in condo buildings showing what their neighbors’ units sold for. I have one of these flyers for a condo building in Boston and will use these real rental rates and sale prices for this example. This second example will be brief since I have already walked you through the process with the prior one. The reason for this example is to show you that the first example was not an isolated incident. That this is a real pattern.

This condo building in Boston has a unit for sale for $900,000. An identical unit is on the market for rent at $3,900. These numbers are supported by recent sales and rentals as well.

Three Methods of calculation:

- Cash Flow Method – Using this method it would cost $16,400 more to own than rent this condo.

- Net Expense Method – Using this method, it would cost $3,750 more to rent than own this unit.

- Highest and Best Use of Capital Method – Using this method it would cost you $8,150 more to rent than own this unit.

This example is a bit more equal than the last one. However, there are a lot more assumptions which are made with the owning of a unit. Assumptions such as: inflation rates, condo fees, potential assessments (which can be alarmingly high if the property does not have adequate reserves), and more. As we decline in home values, the renting vs owning a home calculation becomes more even.

Summary of the renting vs buying a home data:

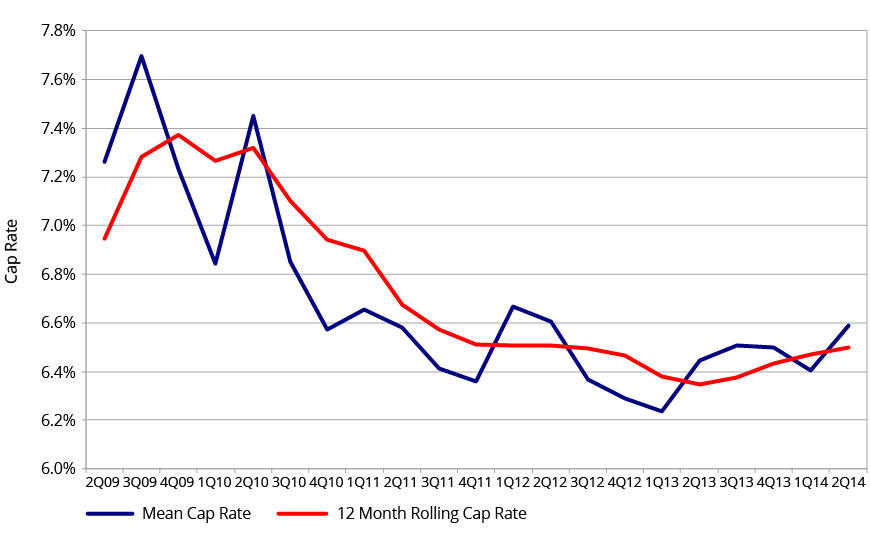

We have looked at two examples of high-end homes and it should be clear to you that higher end homes favor renters vs owners. This is not the case for all homes, just homes over a certain valuation. I have not determined what the valuation is at the moment which tilts the scale in favor of the owner, but I suspect it is around $700,000. The mid- to lower-end home prices tend to favor owning. This is mainly due to the rental rates being proportionally higher compared to home values. In higher-end homes, the rental rates tend to max out, while the valuations continue to climb. Here is a chart of the cap rates for apartments by REIS Reports. Lower cap rates tend to mean it is better to rent and higher cap rates tend to mean it is better to own.

The best way to make this determination for yourself is to run these calculations to see which choice works best for you.

As we conclude this series of posts I want to reiterate certain key points.

- Renting vs owning a home is about more than just numbers

- Buying a home to live in is not an investment, it is an expense.

- If you are looking to living in a high-end home, consider renting, it is likely that it will be cheaper than owning it.

- Always run the true costs of owning a home before buying one.

- Consider all three methods of calculations to know what renting vs owning a home means to you.

I hope you have enjoyed the last three posts as much as I enjoyed researching and writing them. You should always challenge your assumptions. In this case, “buying a home is an investment”. Clearly, this is a false assumption. Your home will always be an expense. While it may be better than renting, it is still an expense. As long as you know that, then you can make the best decisions for you and your family.

If you liked this post and want to learn more about Innovative Advisory Group and our wealth management services, you can contact us to discuss how our wealth management services can help you. You can also follow us on social media. The best way to follow us is on our private email list. Sign up here to receive weekly updates, blog posts, webinars, and more.

About Innovative Advisory Group: Innovative Advisory Group, LLC (IAG), an independent Registered Investment Advisory Firm, is bringing innovation to the wealth management industry by combining both traditional and alternative investments. IAG is unique in that they have an extensive understanding of the regulatory and financial considerations involved with self-directed IRAs and other retirement accounts. IAG advises clients on traditional investments, such as stocks, bonds, and mutual funds, as well as advising clients on alternative investments. IAG has a value-oriented approach to investing, which integrates specialized investment experience with extensive resources.

For more information, you can visit innovativewealth.com

About the author: Kirk Chisholm is a Wealth Manager and Principal at Innovative Advisory Group. His roles at IAG are co-chair of the Investment Committee and Head of the Traditional Investment Risk Management Group. His background and areas of focus are portfolio management and investment analysis in both the traditional and alternative investment markets. He received a BA degree in Economics from Trinity College in Hartford, CT.