“Buying real estate is not only the best way, the quickest way, the safest way, but the only way to become wealthy.”

– Marshall Field

Marshall Field was an American Entrepreneur who lived in the 1800’s. His quote was obviously made in an era before tech stocks, hedge funds and excess money printing by the Federal Reserve. However, the principal of owning real estate to become wealthy still holds true.

Real Estate is arguably the best asset class if you want to build enormous wealth. While you may have heard of real estate investors such as Donald Trump, or Sam Zell, there are countless more who are relatively unknown and are just as wealthy. Many of these investors prefer to live in relative obscurity.

What I want to show you are the 7 powerful tools that these real estate tycoons were able to use to build legacy wealth from real estate. While most of these tools apply to both real estate investors and homeowners, there are more benefits from owning real estate as an investor rather than a homeowner.

This post is the first in a four-part series on real estate. The subsequent posts will be:

- Inflation – The Secret to Building Wealth in Real Estate

- Deflation – How a Mortgage Can Destroy Your Real Estate Wealth

- The Real Estate Investor’s Guide: Using a Self Directed IRA to Buy Real Estate

The 7 Reasons You Should Own Real Estate as an Investment:

Leverage

Real estate is one of the few assets where you can use enormous amounts of leverage to own the asset, and banks will happily lend it to you. Leverage is a way to amplify the returns you receive on that asset, in both directions. Leverage is both beneficial and dangerous, so make sure that leverage is working in your favor.

If you want to buy a home to live in, most lenders will allow you to put down only 20% of the purchase price in cash. If you are buying a $100,000 home, then this means you are only putting down $20,000 and getting a mortgage for $80,000. This provides you with 5x leverage, so if the value of your home goes up 2%, from $100,000 to $102,000, then your equity in that home goes from $20,000 to $22,000. This is a 10% rise. Nice right?

It is hard to imagine that a low 2% rise in the value of your asset can produce double-digit returns, but that is why leverage is a great tool for building wealth.

Here is the downside. It also works in reverse. A 2% drop in the value of your home causes a 10% drop in your equity. The golden rule is don’t use leverage unless the asset price is going up. Simple right?

Debt Reduction via Inflation

The Federal Reserve’s monetary policy has led to decades of consistent inflation. This inflation has also created an enormous opportunity for real estate investors to profit with their mortgage. This next technique is one of the most powerful and misunderstood benefits of owning real estate. It is a form of compound interest which takes time and the right conditions to work.

Debt reduction via inflation can also be referred to as debt reduction in real terms. Many real estate tycoons have benefited from the inflation which took place in the past 50 years. But not in the way you might think. I will describe this in more detail next week in my post, Inflation – The Secret to Building Wealth in Real Estate.

Essentially what happens is during times when inflation is constant (as it has been for the past 50+ years) the real value of $1 US Dollar declines. If you have $100 Dollars and inflation is 2%, then next year your $100 will buy you $98 worth of goods and services. The following year it would be worth $96.

This concept carries over into debt as well. Debt is a fixed amount in nominal terms, just like your Dollars. Let’s say for example that you have a 30-year interest-only mortgage of $100,000 with a 2% inflation rate and you never pay principal during that 30 year period. At the end of 30 years, you would have to pay back the full $100,000 principal in order to pay off the loan.

However, after 30 years, the value of the mortgage will be worth 45.5% less in real terms due to inflation.

The concept we are discussing here is that you are essentially paying back the debt with inflated dollars. If you want to learn more about this powerful concept, you can read my next blog post, Inflation – The Secret to Building Wealth in Real Estate.

Limited Supply and Constant Demand of Real Estate

“Buy land. They’re not making it anymore.”

– Mark Twain

This Mark Twain quote has been sound advice for centuries. There is a static supply of land and an increasing demand for it. The world population is continuing to grow, and with the exception of the new island recently created in the pacific near Tongatapu, new land is non-existent.

If you use the simple economic principle of supply and demand, a static supply of something with an increasing demand causes prices to rise. This combined with the basic need for people to live somewhere ensures a future need for real estate. Assuming you are not looking to sell you home located in a place like this, there should be a market for it.

The slow rise in the population, should over time increase the price of that real estate. This is why real estate has for over 100 years been one of the best hedges against inflation.

Inflation Proof Asset

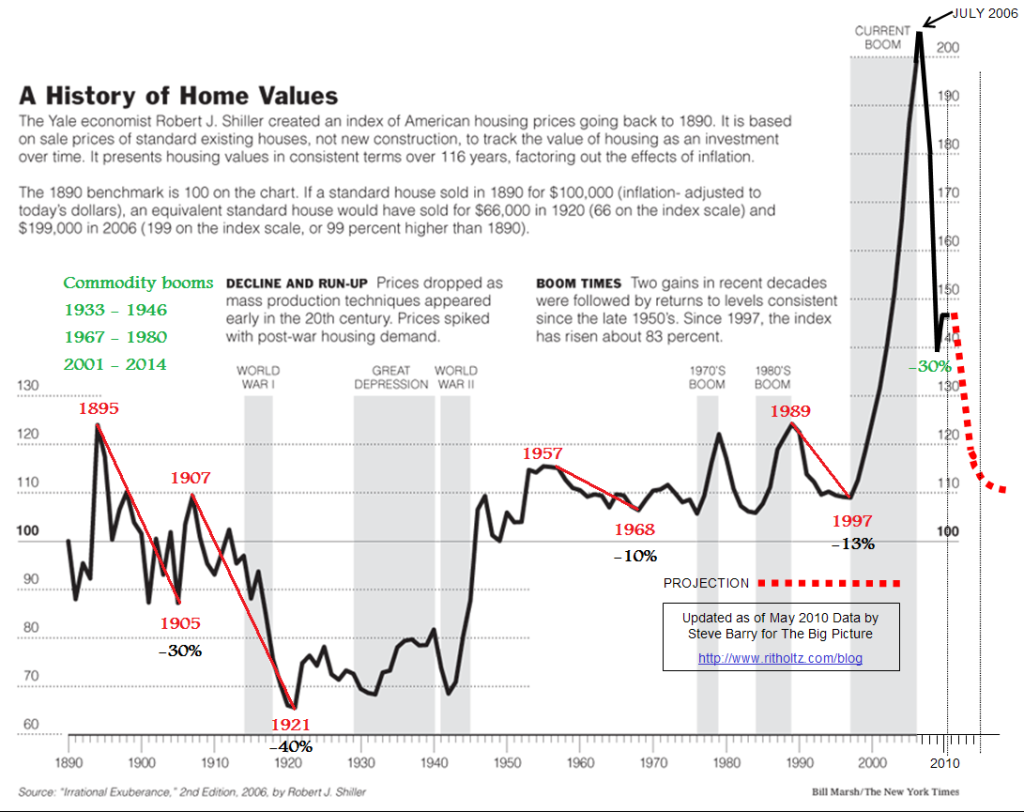

Robert Shiller, a Yale economist famously known for his Case-Shiller Home Price Index, put together this historical chart of American home prices back to 1890 and how they have changed compared to inflation. This is the real value of real estate. It means that if the line is above 100, then real estate has increased more than inflation, and a value below 100 means that real estate is increasing less than inflation.

What is important to note in this chart is that while people have owned real estate for centuries, the value of their primary asset has not been devalued by the invisible tax known as inflation.

Tax Benefits

Every country has different tax rules for its citizens, so we will focus on the US. In the US, there are many tax benefits available to owners of real estate: deductions for mortgage interest payments, depreciation, and property expenses.

The best way to look at real estate is the same way as you would for a business. Owning a business provides that business with certain tax deductions. These tax deductions are intended to provide incentives for that business to grow and reinvest in ways to improve the business.

Real estate is much the same as a business. The tax incentives available to owners of real estate are available to incentivize the owners to reinvest in the property and improve it. These tax benefits also incentivize people to buy property, which helps increase the demand for homes. Tax incentives are one way the government tells you what to do with the carrot (rather than the stick).

Tax incentives can be quite substantial when it comes to real estate, so find out how they can benefit you. You can be sure the wealthy real estate tycoons know them all.

Cash Flow

If you are buying real estate as an investment, then cash flow is one of the benefits you should be considering. It is not as sexy as capital appreciation, but it is consistent and as inflation rises, it should increase each year. This means the passive income from real estate is pegged to inflation. I don’t know of many other investments that have that type of income benefit.

If you are investing in real estate, cash flow should be at the top of your list.

Asset Appreciation

Asset appreciation is essentially growth of the value of the real estate. Over time this tends to be the case as long as inflation is a consistent trend. Since real estate tends to keep pace with inflation, it is important for inflation to be present.

Asset appreciation is the one variable with real estate that you cannot predict with a high degree of certainty. While the current trend is that home prices will rise slowly over time, 2006-2011, 1989-1994, and the first 20 years of the 20th century have shown us that it is not always the case.

As an investor, you should consider the appreciation as a bonus, not their primary goal. Asset appreciation is nice, but not the primary thing you should be considering. Unfortunately, this is what most people gravitate towards with their investments, how to get appreciation in real estate.

Learn More About How You Can Build Legacy Real Estate Wealth

This post is part one of a five-part series I am writing on real estate. I know you will benefit tremendously from the future posts I have planned.

Have you considered investing in real estate with your self-directed IRA? Sign up for our email list and get our free report, 9 Common Mistakes Investors Make With Their Self Directed IRA. Click the button below to get your free report.

About Innovative Advisory Group: Innovative Advisory Group, LLC (IAG), an independent Registered Investment Advisory Firm, is bringing innovation to the wealth management industry by combining both traditional and alternative investments. IAG is unique in that they have an extensive understanding of the regulatory and financial considerations involved with self-directed IRAs and other retirement accounts. IAG advises clients on traditional investments, such as stocks, bonds, and mutual funds, as well as advising clients on alternative investments. IAG has a value-oriented approach to investing, which integrates specialized investment experience with extensive resources.

For more information, you can visit http://innovativewealth.com

About the author: Kirk Chisholm is a Wealth Manager and Principal at Innovative Advisory Group. His roles at IAG are co-chair of the Investment Committee and Head of the Traditional Investment Risk Management Group. His background and areas of focus are portfolio management and investment analysis in both the traditional and alternative investment markets. He received a BA degree in Economics from Trinity College in Hartford, CT.