“The major fortunes in America have been made in land.”- John D. Rockefeller

After more than 75 years John D. Rockefeller is still considered the richest man in history when you adjust for inflation.

According to the New York Times as of 2007, his net worth reached $192 Billion. Compare this with Bill Gates whose fortune was only $82 Billion. This shows how enormous the fortune of John D Rockefeller actually was. Only Commodore Vanderbilt and John Astor have even come close with $143 Billion and $116 Billion.

Rockefeller at one time controlled 90% of the nation’s oil and his fortune was approximately 1.5% of the nation’s economy. That is legacy wealth. Wealth that is hard to lose or destroy.

Even though all his wealth was made from oil, he still attributes major fortunes being made in land or real estate. That is a powerful statement.

What I am going to discuss here is one of the reasons why building wealth in real estate can create legacy wealth for you and your family. Wealth that can last for many generations… If it is managed properly. Interestingly enough this is also one of the least understood benefits of owning real estate.

This post is the second part of a four-part series about real estate. The last post, These Top 7 Powerful Tools Can Create Legacy Wealth from Real Estate, briefly touches on the importance of inflation to your real estate assets. I plan on going into much more depth this week.

The Advantages of Building Wealth in Real Estate

Real estate is one of my favorite asset classes. Here is why.

In the prior post of this series, I touched on a few of the reasons that real estate is such a favorable asset to invest in.

- You can easily use leverage to buy it,

- there is a limited amount of real estate

- Tax benefits

- It can create cash flow

- Appreciation potential

- It is inflation Proof

- You can reduce the debt in real terms over time.

Just one of these alone would be a good enough reason to consider building wealth in real estate, but all 7 make it especially powerful. Except for of the tax benefits and the limited supply of real estate, all of the other benefits rely on inflation to enhance the performance of real estate over time. While I will discuss these in more detail, let’s first discuss what inflation is and how it works.

What is Inflation?

“Inflation is a continuing rise in the general price level usually attributed to an increase in the volume of money and credit relative to available goods and services.”

This is the Webster’s dictionary definition and it is a reasonable way to describe it. Most people attribute inflation to an increase in the supply of money. However, it can also be due to other factors: reduction of interest rates, changes in demographics, increase in the velocity of money, and more.

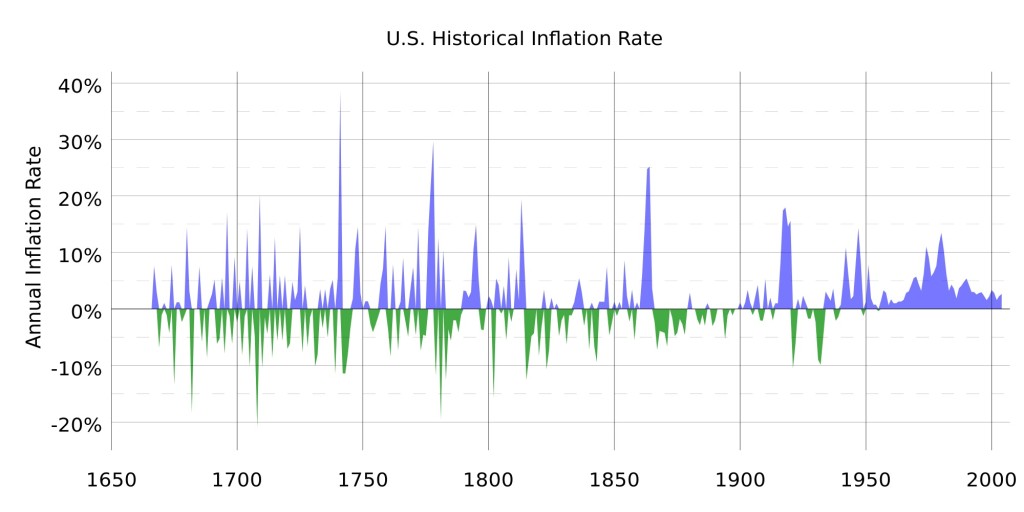

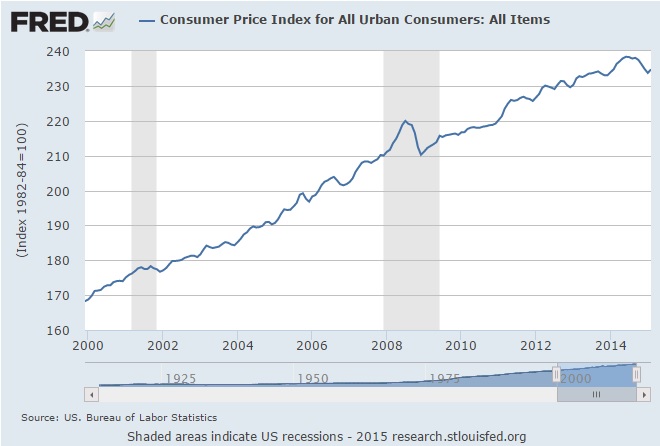

There are many reasons why inflation happens, but what is more important is that over the past 50+ years it has been consistently positive. Compared to the historical rate of inflation in the US, this past 50+ years is an anomaly.

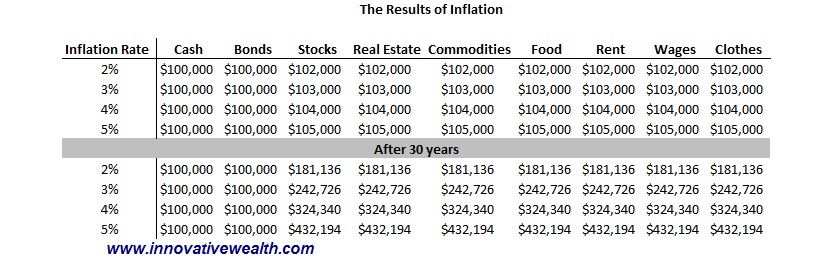

Inflation causes the price of goods and services to rise over time. This includes food, rent, wages, real estate prices, stocks, and other items. Many items rise with inflation. What does not rise is your cash and bonds. This is because the rise in goods and services is caused by a reduction in the “value” of your cash. Most people just think that prices of goods and services rise over time, but what is actually happening is that your cash is worth less over time. This is one reason that holding cash for long periods of time is not an optimal strategy with inflation.

If you want to track inflation, you can read our monthly Inflation Monitor to see how inflation varies from the CPI. You can also sign up to automatically receive the Inflation Monitor in your Inbox.

Why is Real Estate Inflation-Proof?

Most assets, goods, and services act independently of inflation to some extent. Look at this chart of commodity prices for example and compare it to the CPI, which is the most commonly used measure of inflation. There obviously is not much correlation between these two charts.

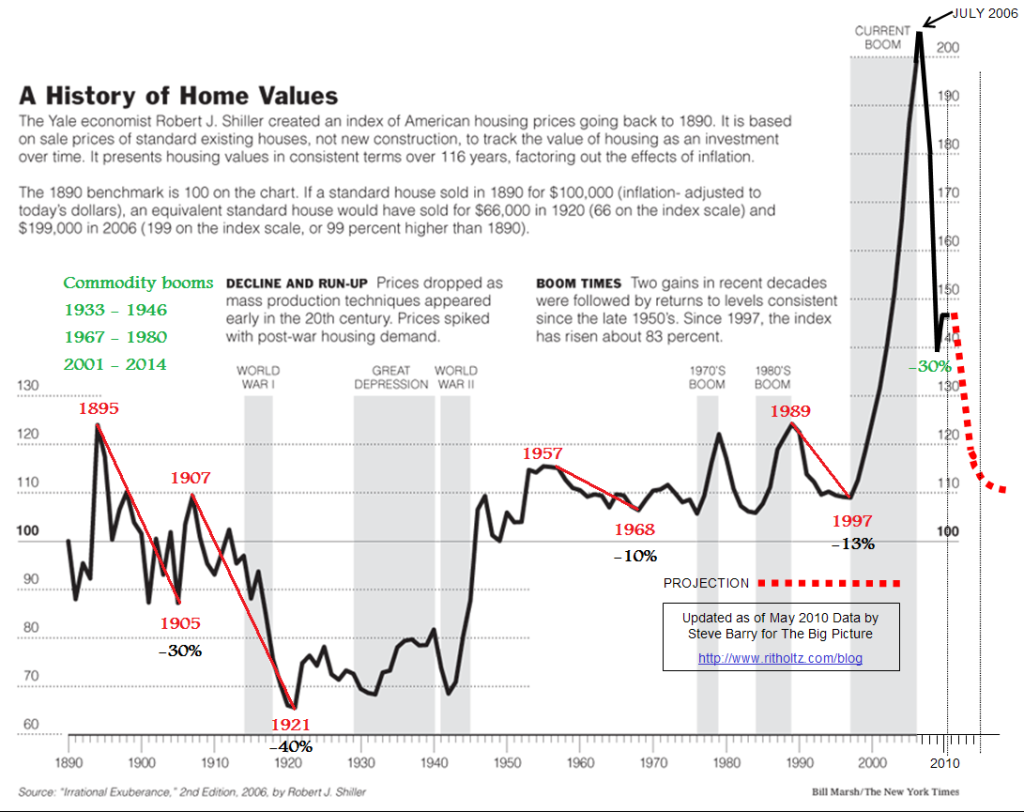

Generally, the prices of goods and services follow the CPI, but not all the time and not at the same time. However, you may be surprised to know that real estate does follow it quite well. The recent real estate bubble is obviously an anomaly in this chart.

This chart, created by Robert Shiller, a notable Yale economist, shows how real estate home prices have reacted to inflation over the past 120 years. This chart shows the real value of homes, meaning that if you remove the effects of inflation from home prices, this is how the price of homes would look.

Another way to describe this chart is that any number higher than 100 means that homes are rising more than the rate of inflation. Any number below 100 means that the price of real estate is not rising as much as inflation. In the past 120 years, real estate has done very well at keeping pace with inflation. This means that if you bought a home in 1897 it would be just as affordable to the average person as it was in 1997 (prior to the recent run-up in prices).

The reason it is so easy for real estate to keep pace with inflation is that it is a primary human need. People need shelter and a place to sleep. This will always be a need and will never go out of style. In order for people to be able to afford a place to live, the prices and costs need to keep pace with wages, taxes, expenses and all other related areas of real estate. Since the CPI is made up of many of these goods and services, it is easy to see why they are closely correlated.

How Inflation Affects Real Estate Asset Appreciation

In the Case-Shiller Home Price Index above, US home prices have risen at a similar rate as the rate of inflation, or CPI. If you are a real estate investor, and you expect the trend of the past 50+ years of inflation to continue, then you should invest in real estate. Inflation is one of the primary requirements to invest in real estate for price appreciation.

Having positive inflation is the most important requirement to invest in real estate. All of the other advantages discussed in this post require positive inflation to work or else they are not effective. In some cases, it is even possible that without inflation this advantage could even become detrimental to your real estate investments.

Investing in real estate is relatively easy to analyze because most of the advantages that this asset holds are predictable. Tax benefits, rents, debt reduction are all predictable. The one thing that is not predictable is price appreciation. In general, I don’t think that investing in real estate for price appreciation is a good strategy. 2006-2011 showed us the flaws in this approach to investing.

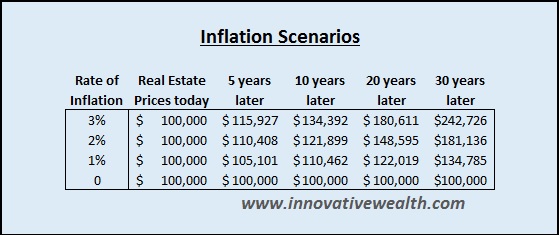

Since you can clearly see that inflation is probably the most important factor in the price appreciation of real estate, let’s take a look at how this impacts the price of a home.

This chart shows how inflation can help home prices appreciate over time. Obviously, it is very important to have positive inflation in order to have price appreciation over time.

It should be noted here that if real estate appreciation does match the rate of inflation, then you are not actually making money on your real estate. All the real estate price appreciation is doing is keeping the real value of your wealth static. However, when all of the advantages of investing in real estate are combined together, they can give a meaningful benefit to own real estate over other assets.

If you want to know more about how deflation affects real estate, then you should read the next post in this series, Deflation – How a Mortgage Can Destroy Your Real Estate Wealth.

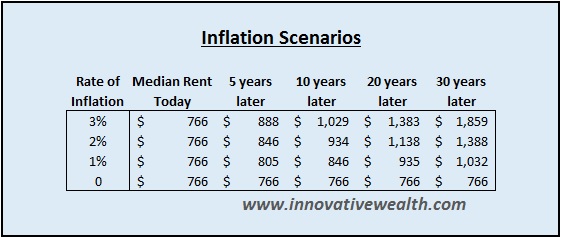

How Inflation Affects Real Estate Cash Flow (Rent)

Cash flow from real estate should be an investor’s primary consideration when they are considering buying rental property. Real estate cash flows primarily come from rent paid by the tenants. These rents come from people who work for a living. Over time wages have gone up at a rate close to the rate of inflation. Subsequently, workers have more money to pay rent, thus rents have gone up as well. The whole economy moves in unison because every part is interdependent on many other parts. This is why raising the minimum wage rate does very little for workers. although it does make for a good soundbite for your local politician.

If you want to know more about wages over the past 100 years, you can read my earlier post, A Visual History of Income Inequality in the US.

The above chart shows why inflation is important to your real estate investments. Today’s median rent in the US is $766 per month or $9,192 annually. The median home price is $199,600. If you were to buy this median house and rent it for the median rent, you would get a yield of 4.61%. In my opinion, this is not a great yield, but after 20 years the yield rises to 8.32% which is almost double your original yield. Inflation is a powerful tool to increase your cash flows over time.

This is Why it is Important to Only Use Leverage with Inflation

Leverage is one of the best tools to create wealth if it is used properly. Unfortunately, if it is not used properly, it can also destroy wealth. Since we are assuming that inflation is going to continue, let’s focus on this scenario.

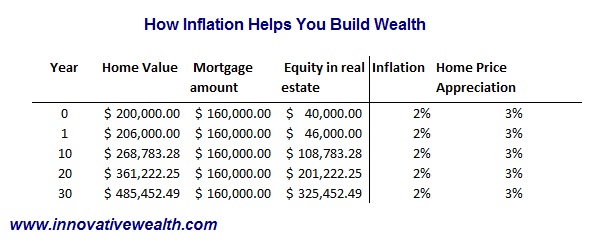

If you are buying a home to live in for $200,000, you can generally put down $40,000 in cash and finance the rest with a $160,000 mortgage. This means you are using 5x leverage. For every 1% that the value of the house rises, your equity in that house rises 5%. This is a great way to increase your wealth.

In this scenario, the price of the home is appreciating at 3%. As you can see below, after 30 years this leverage has allowed the owner of the real estate to grow their equity more than 700% of their original investment, while the value of the home has only grown 140% of the original value.

This begs the question if home prices are going up with positive inflation, why would you put down more cash than the minimum required amount?

The past 50+ years have shown consistent positive inflation. Since inflation is highly correlated to real estate and tends to cause home prices to rise, you should hope for continued inflation. If this trend continues, then leverage is the best tool to use to grow wealth in real estate through appreciation.

Positive leverage can also cause cash flows from your real estate investment to be amplified as well. With 30 fixed mortgages hovering around 4% or less, it is much easier to amplify the yields on your equity investment.

However, 50 years is a long time. This long period of time tends to cause a recency bias in the mindset of investors. Recency bias actually starts at a much shorter period of time, so 50 years is well beyond what is necessary.

In addition to the recency bias, most people who would have lived through the last deflation in the US have now passed on or are close to doing so. The real estate investors of today have no memory of what happens with persistent deflation. there is no experience to draw upon other than the stories which we heard as kids.

Let’s hope that this inflationary trend continues. If it doesn’t, unfortunately, most people will not recognize the switch and will not understand why it is a problem. But you will if you read my next post, Deflation – How a Mortgage Can Destroy Your Real Estate Wealth.

Debt Reduction – Why Having a Mortgage is One of the Most Important Benefits of Inflation

In the US, 64% of people own a home and over 70% of them have a mortgage. Outside of residential real estate, most of the industrial and commercial property is leveraged with a mortgage as well. The only real estate which is not highly leveraged is raw land, and that is because virtually all banks do not lend on land. This makes it an interesting asset if deflation becomes the norm.

As discussed in the above section having a mortgage is essentially using leverage to buy real estate. This can amplify the appreciation and cash flow from the property. However one of the other benefits of using a mortgage with inflation is that the real value of the debt is reduced over time. Look at this chart below.

In this chart over a 30 year period, home prices appreciated at 3% annually causing the value of the property to appreciate from $200,000 to $485,452. Approximately a 140% gain. Your equity would have grown more than 700% from your original investment. These are huge gains from using leverage.

What you should notice in this chart is that while the equity and values increase, the amount of debt stays the same. This is a simple example, so we are assuming that the principal of the debt is not being paid down, so you can visualize how this works.

Inflation causes the prices of goods and services to rise over time. However, certain things do not rise to accommodate the inflationary forces, cash, and fixed debt. Mortgages are fixed debt (generally), so while the value of your property is increasing the debt stays the same.

At the start of the mortgage, the debt was 80% of the value of the property. After 30 years it is only 33% of the value of the property. This is what is called debt reduction via inflation. While this topic is rarely discussed as a benefit, it is a huge benefit to owners of real estate.

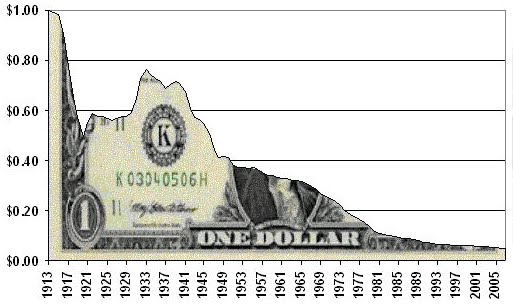

Think of it from another perspective. Instead of inflation causing prices to rise each year, it causes the value of your cash and fixed debt to decline. So each year you are getting the benefit of your debt declining 2% (the current rate of inflation).

Here is a chart that shows you the value of your cash over the past 100 years. The same would apply if this was debt. After 100 years of inflation, your $1 in 1913 would now equal $0.05.

Using inflation to reduce your debt over time is a powerful technique. This technique makes real estate one of the best assets to invest in.

Next in the series of how real estate can make you wealthy…

We will be taking a week off between posts to make room for our monthly inflation monitor next week. After that, we will continue this series on real estate with, Deflation – How a Mortgage Can Destroy your Real Estate Wealth. This is a very important post considering the deflationary trend that has started in the US. It is also important because very few people are talking about it, and even fewer understand how it will truly affect their wealth in the years to come. You do not want to miss this next post…

About Innovative Advisory Group: Innovative Advisory Group, LLC (IAG), an independent Registered Investment Advisory Firm, is bringing innovation to the wealth management industry by combining both traditional and alternative investments. IAG is unique in that they have an extensive understanding of the regulatory and financial considerations involved with self-directed IRAs and other retirement accounts. Innovative Advisory Group advises clients on traditional investments, such as stocks, bonds, and mutual funds, as well as advising clients on alternative investments. IAG has a value-oriented approach to investing, which integrates specialized investment experience with extensive resources.

For more information, you can visit http://innovativewealth.com

About the author: Kirk Chisholm is a Wealth Manager and Principal at Innovative Advisory Group. His roles at IAG are co-chair of the Investment Committee and Head of the Traditional Investment Risk Management Group. His background and areas of focus are portfolio management and investment analysis in both the traditional and alternative investment markets. He received a BA degree in Economics from Trinity College in Hartford, CT.