In my last article, Compound Interest- the most powerful force in the universe… Maybe, I discussed the powerful secret of compound interest. This secret works well if you take advantage of the aspect of time. This secret is not for those who want “action” with their investments. People who “gamble” with their investments will find this concept difficult to successfully master. To learn more about investing vs. gambling, read my prior article, Investing is not gambling…if it is done correctly.

Using the element of time to your advantage allows your money to grow and also requires a bit of patience. We are bombarded on a daily basis with ideas, news and emotional triggers which urge us to react to them. The question you have to ask yourself is,

“Does this piece of news change anything?”

If you did high-quality research before investing in an asset such as a CD, stock or bond, then why does this news story affect your investment? Most likely it doesn’t.

If your reason for investing in an asset has changed with this news story, then, by all means, you should take it into consideration. However, if you invested in a US based clothing retailer, it should be very unlikely that news about a conflict in Ukraine will affect your investment. Yet people have become conditioned to immediately “react” to news stories, and this affects their ability to hold onto investments and allow compounding to work its magic.

Interest rates are at record lows, why would I invest in a CD?

The concept of compound interest does not only apply to CDs or bonds. It applies to any investment where the cash flow can be reinvested back into the investment. This reinvestment of cash flow is what allows investments to compound over time. It doesn’t matter what investment it is. It could be a CD, U.S.Treasury bond, stock, mutual fund, or any other investment that allows investors to compound their investment.

This brings me to one of my favorite types of investments in which to use this concept, dividend stocks.

Dividend stocks

Dividend stocks have been one of my favorite asset types for years. There are so many positive aspects to dividend stocks that we have a designated page on our website discussing the different aspects of dividend stocks. Here is the link if you want to read more about dividend stocks.

What is a dividend?

Dividends are distributions which a company decides to make to its shareholders. These can be in the form of cash or shares of stock. Typically dividends are paid out quarterly, although some companies pay them out on a monthly, annual or semi-annual basis. Some companies even pay out special dividends. Special dividends can be especially powerful if you know how to look for them.

Dividend Reinvestment – Compounding your dividend income

When a company pays out dividends in the form of cash, it goes to the shareholder and that person can spend it any way they want. That person could buy a new iPhone, pay their electric bill, or it can also be used to buy more shares in the company. If the investor uses the dividends to buy more shares of the company, they are reinvesting the dividends. This works in the same way as reinvesting interest from a CD in the example from the prior post, Compound Interest- the most powerful force in the universe… Maybe .

Just so you understand how this works, let’s say you have $100,000 and decide to buy 1,000 shares of Dividend Reinvestment Corporation (XYZ) (a fictional company). The stock is trading at $100 per share and it pays out $4.00 annually through 4 quarterly dividends of $1.00 each. This should give you a dividend yield of 4%. Since you have 1,000 shares of the stock, you would receive $1,000 every 3 months. You decide to reinvest the dividend back into company stock, so when you receive this $1,000, it would be used to purchase 10 shares of XYZ stock ( $1,000 / $100 = 10 shares of stock). Now you would have 1,010 shares of XYZ stock.

Next quarter when the dividend is paid out it would be based on 1,010 shares of stock rather than the original 1,000. The dividend paid out to you would be $1,010. Following the same patterns, the next quarter would give you $1,020.10 in dividends and $1020.10 shares of stock. At the end of the year, you would have a dividend of $1,040.60 and 1,040.6 shares of XYZ stock.

What is dividend reinvestment going to do for me?

The above example of XYZ stock would allow you to compound your dividends on a quarterly basis at 4%. If you assume none of the variables change for an extended period of time (which would be unlikely with most public companies), then you will see that the compounding produces enormous gains over time.

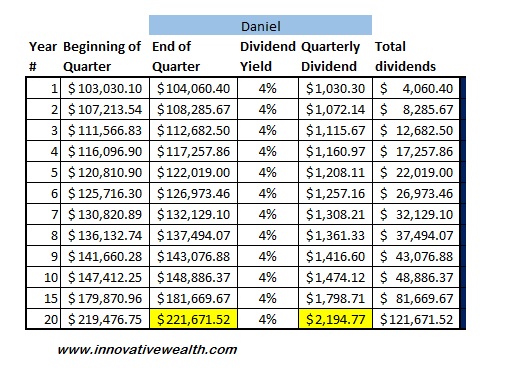

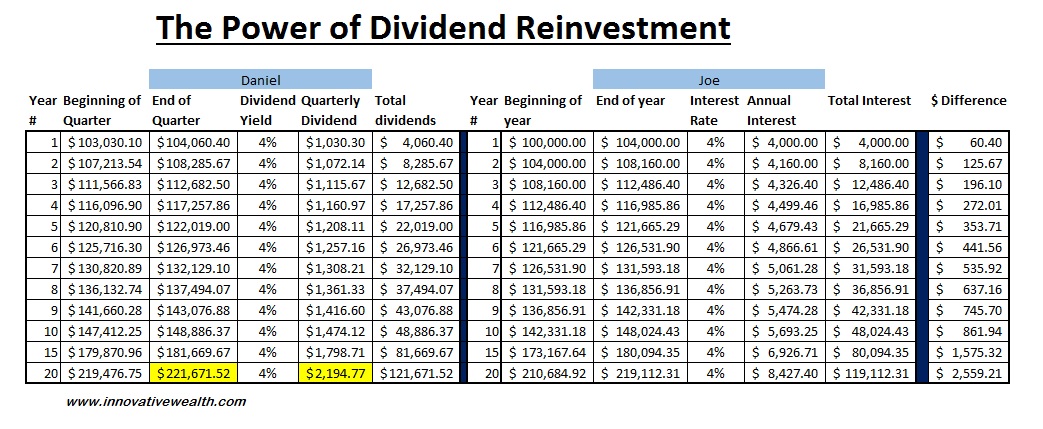

This example below is of Daniel Dividend, who is able to compound his dividends quarterly at a 4% dividend yield over the same time period. At the end of 20 years, he will have more than doubled the number of shares of XYZ that he owns. Even though the stock price is not changing in this example, the value of his investment has doubled. The amount of dividends he receives on a quarterly basis has more than doubled to $2,194.77 per quarter.

If you compare this to Joe Investor from the example in the prior article, Compound Interest- the most powerful force in the universe… Maybe, and reduce Joe’s interest at which he is compounding to 4% or equal to Daniel’s dividend yield, then you will notice there is a small advantage for Daniel.

Dividends Compounded Quarterly

This difference in interest or dividend income received is not due to dividend stocks being a better investment. This difference is due to the rate of compounding. An investment which is compounded quarterly will have an advantage over an investment with the same yield but is compounded annually because the money is compounding more frequently. While the difference may be small, it is an advantage for the investor to compound more frequently if all else is the same.

How does compound interest work in real life?

In the example of Joe Investor and Sally Saver from the previous post, the interest rate on the CD doesn’t change throughout the entire example. It is highly improbable that this would happen in real life. In real life, rates do change (see below). They are currently close to 1%, but that does not mean they will stay there. They could go higher or lower from here. They could even be negative, as we have seen with Japan or some European countries.

Which is better reinvesting interest or reinvesting dividend income?

Neither. They are the same.

The type of investment is more or less irrelevant for this concept to work properly. It doesn’t matter if the investment is a CD, corporate bond, dividend stock, or peer-to-peer lending. All that matters, assuming all else is equal, is that the cash flow paid out to the investor is reinvested back into the investment. It certainly helps if the cash flow to the investor is paid out more frequently, but the power is the reinvesting of cash flow back into the investment so it can pay more the next time.

Dividend reinvestment made easy

As great of a concept as dividend reinvestment is, it is even easier to set up. Ordinarily, if you were to try this yourself, it might be both expensive and time-consuming. However, there are a few ways to activate this strategy which only requires one phone call to set up.

DRIPs – Dividend reinvestment program

DRIPs or dividend reinvestment programs have been around for decades. Originally it was set up by the sponsoring company for investors who held the shares of the company’s stock in their name individually. It allowed the investor to choose to reinvest the dividend back into shares of the stock instead of receiving the cash. If you hold shares of a company in certificate form, you can call the transfer agent and they will set it up for you. Some company’s charge a commission for each transaction, and some do not. It would be preferable to choose companies which do not charge for transactions. If you are not sure if your company offers this service, call their investor relations department and they will direct you to the right place.

Another way to reinvest your dividends is through your broker-dealer. Not all broker-dealers provide this service, however, many are starting to for their clients. This is easy to set up and most broker-dealers who offer this, do not charge a transaction fee for each additional dividend reinvestment which is made. Some brokers even allow you to take the dividends received and reinvest them into a different stock rather than the company which paid the dividend. Please check with your broker to see if they offer this service. If they do not, you can contact me and I will provide you some names of broker-dealers who do offer this service.

Next week’s article, These three dividend secrets could make you a world-class investor, is part 3 in a 6 part series about compound interest and dividend stocks. Stay tuned to learn more about these secrets.

About Innovative Advisory Group: Innovative Advisory Group, LLC (IAG), an independent Registered Investment Advisory Firm, is bringing innovation to the wealth management industry by combining both traditional and alternative investments. IAG is unique in that they have an extensive understanding of the regulatory and financial considerations involved with self-directed IRAs and other retirement accounts. IAG advises clients on traditional investments, such as stocks, bonds, and mutual funds, as well as advising clients on alternative investments. IAG has a value-oriented approach to investing, which integrates specialized investment experience with extensive resources.

For more information, you can visit www.innovativewealth.com

About the author: Kirk Chisholm is a Wealth Manager and Principal at Innovative Advisory Group. His roles at IAG are co-chair of the Investment Committee and Head of the Traditional Investment Risk Management Group. His background and areas of focus are portfolio management and investment analysis in both the traditional and non-traditional investment markets. He received a BA degree in Economics from Trinity College in Hartford, CT.

Disclaimer: This article is intended solely for informational purposes only, and in no manner intended to solicit any product or service. The opinions in this article are exclusively of the author(s) and may or may not reflect all those who are employed, either directly or indirectly or affiliated with Innovative Advisory Group, LLC.