US Shale vs Saudi Sand?

You are probably aware that the price of oil has dropped over 50% from its peak. The reasons why it has dropped this much are interesting. Hopefully after reading this post you will have some insight into my thoughts about why it has dropped as well as the future direction of oil prices.

Commodity prices in general have been declining for years. According to the Rogers International Commodity Index, the commodity super-cycle peaked in Jun 2008. While it is still possible that we could break those all-time highs, it is highly unlikely given all the deflationary forces in global markets. If you have been reading the Inflation Monitor for a number of months you know which side of the inflation-deflation fence I sit on. The future of commodity prices will most likely continue on the path that they are currently on. There does not seem to be inflation on the horizon for commodity prices.

Investing in a commodity is a difficult task since it produces no cash flow. So how do you price a commodity? What should be its market price?

Many smart investors have raised this point before. You cannot say what is the correct price of a commodity unless you have a free market determining the price based on supply and demand. This is basic Economics 101. While reality should be driven by data and facts, in some cases it isn’t. One of these cases is Oil.

Oil the “Political Commodity”

Oil is what I would call a “political commodity”. What this means is that the price is not necessarily driven by supply and demand, but rather a desire for a political outcome. Sure at some level it is supply and demand driven, but it is also driven by the “powers-that-be”.

Oil is a political commodity because it is THE most important commodity in the world. Many countries especially the US have gone to war for it. Given current technology it is a requirement to keep the world working, so it will continue to be important. What makes things worse is that oil is run by a cartel of countries which hold the largest oil deposits on the planet. Ask yourself this question. How many wars would have been fought after WW2 if oil was not so important? Would the US really care about the Middle East if it didn’t have large deposits of oil? Probably not enough to send armies over there to dethrone dictators.

Why did the price of oil drop 50% in the past few months?

No one can truly know the answer to this, but I have a few theories:

- Comparable prices with other commodities

- Supply and Demand

- The “conflict” with Russia

- Currency prices

- OPEC and Saudi Arabia

- Hedges

- Reversion to the mean theory

How is oil related to other commodities?

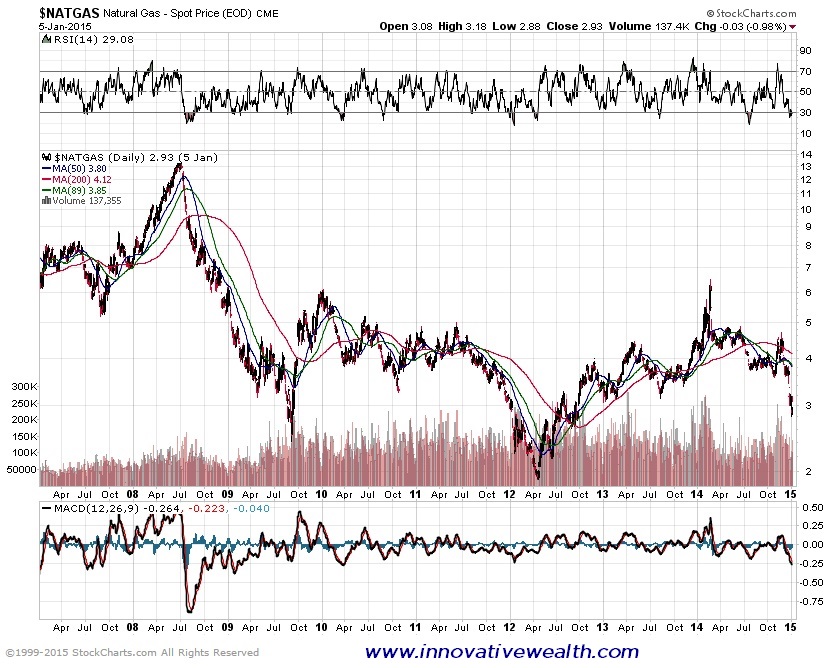

The price of oil seems to be following the price of gold. In general these two commodities are not closely related, but I suspect that the fall in the price of gold in 2013 will closely resemble the price of oil, or natural gas. While this does not explain why the price of oil dropped, it may provide some insight into where it goes next.

If you consider that commodity prices in general have dropped over the past year, it is not surprising that oil prices are dropping as well.

Drowning in Oil

I am always amazed at how irrational some otherwise very smart people can be when it comes to disrupting their thesis. It was only a few months ago when the the “consensus” was that oil prices would stay at $100 or higher for years to come. The explanation being that the world was growing and needed more oil and the US Shale oil boom would create more demand for oil. Huh? Adding more supply of oil would create more demand for it? A number of developed economies around the world are on the edge of or are entering a recession and deflation and yet somehow the demand for oil will go up?

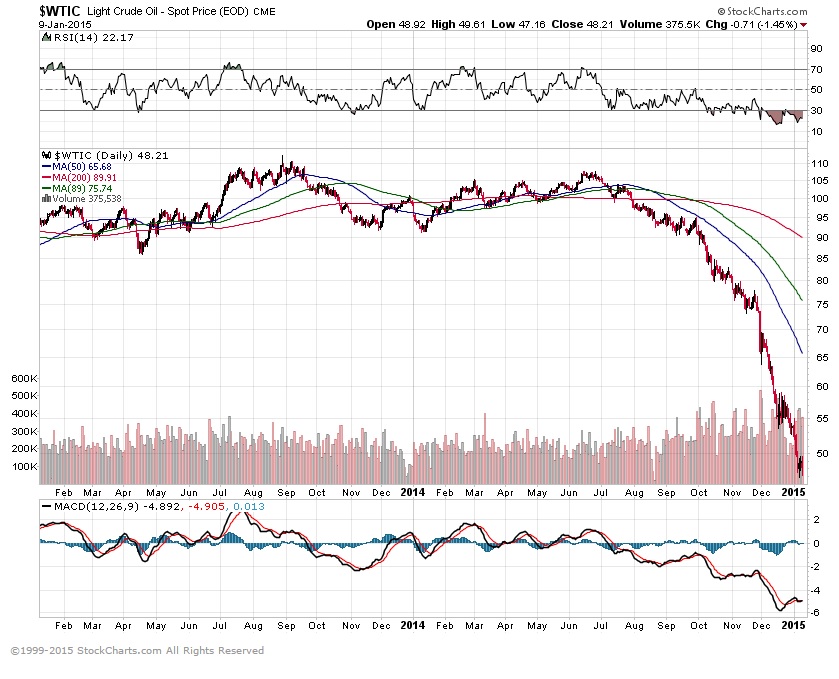

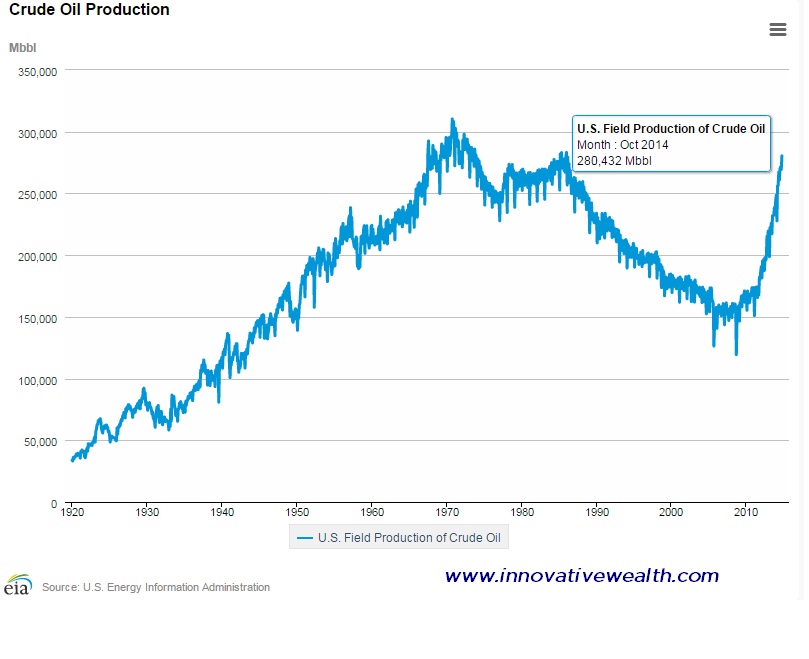

Well it appears as if the theory of supply and demand does eventually win the day. Oil prices have dropped below $50 a barrel after topping out above $110 in 2013. This is a drop of about 55%. Obviously something is amiss.The US oil production chart above should give you some insight into the supply side of the equation.

Conflict with Russia

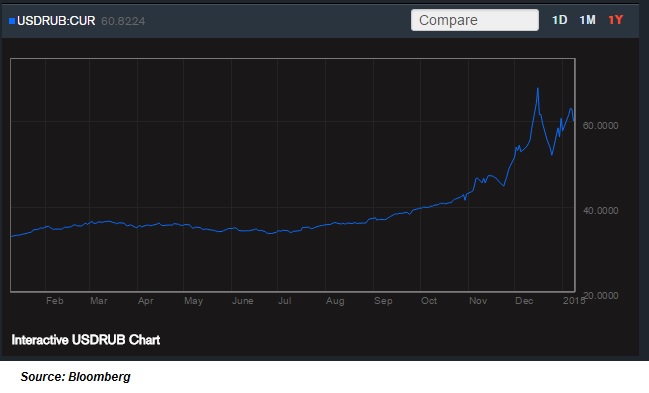

This topic may require you to adorn yourself with a tinfoil hat. However this is not to say that I am incorrect in my thinking. It is just not the accepted view by most people. When the US “conflict” with Russia began in early 2014, the US started imposing sanctions, which most people laughed at. Yes the initial sanctions were a bit silly, but I guess you have to start somewhere. As time progressed, the sanctions became more onerous. They are still a bit laughable, but originally I thought if the US really wants to hurt Russia, imposing sanctions is not the way to do it. The best way is to have low oil prices. Oil revenues make up 16% of the Russian GDP, 52% of the federal budget revenues, and over 70% of total exports. Cutting the price of oil in half would definitely hurt Russia’s economy and internal political capital.

Is it possible that the US engineered this decline with the help of its oil producing allies? Possibly. I know that is what I would do if I wanted to make an impact. I cannot say for sure without the US government disclosing the truth of this, but it is an interesting coincidence that the oil prices dropped as much as they have with the “conflict”. It is also not a stretch that this move would be considered since it was used at the end of the cold war to bring down the Russian economy.

If this is the primary driver of declining oil prices, then stay alert for talks of a truce. This will be a catalyst for oil price to rise.

The Russian Ruble has also fallen dramatically compared to the US Dollar

This drop in the value of the Ruble has also harmed the Russian economy. However, this is not the first time this has happened in Russia. What is interesting is that it is happening now. The Russian Debt to GDP is 13.41. Compare this to Italy (132.60), Japan (227.20), and the US (101.53) . Worrying about Russia defaulting on their debt should not be a top priority for most investors. They should be more worried about Japan.

Currency Prices – US Dollar

The rapid rise of the US dollar can cause prices of commodities to fall, but in this case, I don’t see it being a primary driver. The drop in the price of oil does line up with the climb in the value of the US Dollar. What should be noted though is that the US Dollar has climbed higher than its prior peak in 2008 -2009. The US Dollar has to rise more than 20% in order to reach the highs of 2001-2002.

Whether the US Dollar climb continues higher is anyone guess, but it is deflationary to the US economy. A higher US Dollar will help the economies of other countries with exports and hurt US exports. At least it will make a trip to Europe much cheaper.

OPEC and Saudi Arabia

Last month OPEC released a statement at their meeting on Thanksgiving that they would maintain their rate of production. Saudi Arabia specifically stated via their oil minister, Ali al-Naimi, “It is not in the interest of OPEC producers to cut production, whatever the price, whether it is $20, $40, $50, $60 it does not make sense… If Saudi Arabia lowers its production prices will rise again but the Russians, Brazilians, and US shale oil producers will take market share from us.”

This is a very true statement. US Shale oil producers have been causing some issues with the supply of oil due to their rapid increase in production over the past few years. Nigeria, Venezuela, Russia, and US oil shale producers will be hurt the most due to this price drop. It is entirely possible that this drop in prices was engineered by OPEC (more specifically Saudi Arabia) to stabilize their market share.

Oil Hedges

This one point is an important one. I have not seen any aggregated data on what the US oil shale producers or producers outside the US have on for hedges. In general it is standard practice for commodity producers to hedge the price of their commodity to both stabilize and predict their revenues. They also use them to speculate on the price movements in the future. For this, they use the futures markets to hedge the price of a certain commodity. Most oil producers use this hedging strategy. What is not fully clear to me is the length of these hedges for each producer.

For example, if you wanted to invest in an oil producer who had its prices hedged for the next year, then your investment might be fine if oil prices bounce back quickly. However, if oil prices stay low for a while, then once the hedges expire, the drop in oil prices will start to show up in the company’s bottom line. This is another known factor by anyone in the oil industry. If OPEC has engineered this decline, then they will want it to stay low for a while until the hedges run out. This would mean 1-2 years of low oil prices. I would suspect that we are looking at 24 months before prices start to climb again, if not longer. However, if the global economy doesn’t pick up again right away, it might be even longer.

Reversion to the Mean

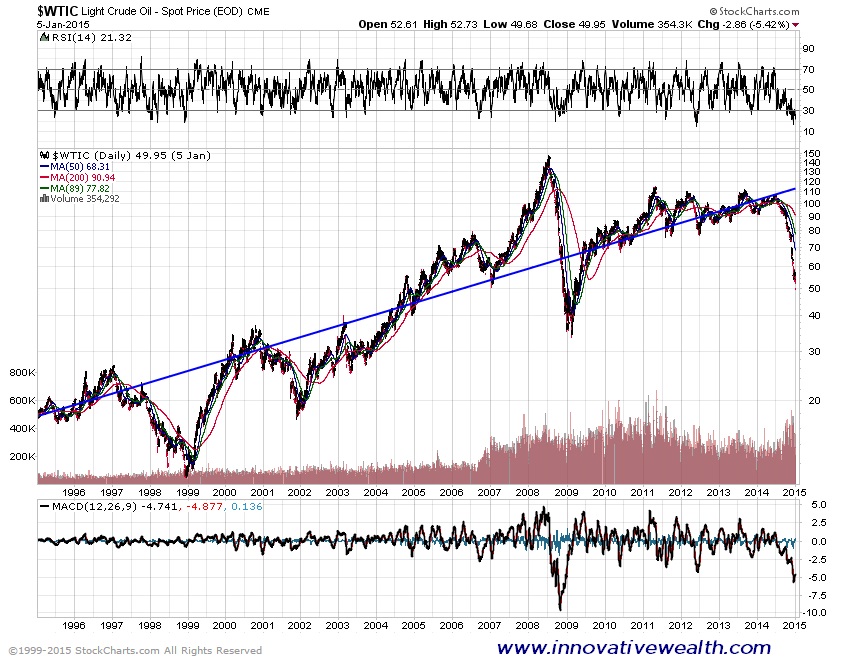

I subscribe to the theory of reversion to the mean. This means that if a market over-extends to the downside or upside, the market will tend to revert to back to a mid-point, but only after over-extending the other way. Here is an example using oil prices.

This line is not drawn to show that oil prices should revert back to $110 on a longer scale, but rather to show the periods from 2007 to 2010. Oil prices started 2007 at $50 a barrel and climbed above $145 before dropping back down below $40 and finally settling at around $75. If you remember in 2007 the fear surrounding the theory of “peak oil”. The fear was that the world would run out of oil. This caused a frenzy pushing oil prices to unsustainable levels.

If you consider that oil prices have gone from $110 to now $50, it would put the realistic number at around $80. The number I have heard for a more realistic price of oil rests around $65 a barrel. We won’t know for a while because huge disruptions in prices cause massive changes in behavior. When oil was at $110 a barrel, capital expenditures were being pushed as quickly as possible and many oil companies became highly leveraged. Now that oil is at $50 a barrel, companies have shelved these expenditures or temporarily stopped drilling until prices become more economic. This is the nature of supply and demand.

On the Funny Side

Before I sign off this post I thought I would add this funny parody video of BP executives during the oil spill. BP has absolutely nothing to do with this post other than it is an oil company, but it is a classic.

About Innovative Advisory Group: Innovative Advisory Group, LLC (IAG), an independent Registered Investment Advisory Firm, is bringing innovation to the wealth management industry by combining both traditional and alternative investments. IAG is unique in that they have an extensive understanding of the regulatory and financial considerations involved with self-directed IRAs and other retirement accounts. IAG advises clients on traditional investments, such as stocks, bonds, and mutual funds, as well as advising clients on alternative investments. IAG has a value-oriented approach to investing, which integrates specialized investment experience with extensive resources.

For more information, you can visit www.innovativewealth.com

About the author: Kirk Chisholm is a Wealth Manager and Principal at Innovative Advisory Group. His roles at IAG are co-chair of the Investment Committee and Head of the Traditional Investment Risk Management Group. His background and areas of focus are portfolio management and investment analysis in both the traditional and non-traditional investment markets. He received a BA degree in Economics from Trinity College in Hartford, CT.