What is deflation?

Deflation is a frequently misunderstood term and in general chastised by the economic establishment. Websters Dictionary says deflation is:

Deflation - "a fall in the general price level or a contraction of credit and available money (opposed to inflation)".

I would say this is a fair description. Deflation is the opposite of inflation. However, you should compare this to the definition of inflation.

Inflation: “a continuing rise in the general price level usually attributed to an increase in the volume of money and credit relative to available goods and services.”

Notice how inflation is characterized as the norm and deflation is characterized as something that happens... compared to inflation.

- Inflation is "a continued rise in the general price level". Deflation is "a fall in the general price level". - Why not a continued fall? Why a "fall"? why not a decline?

- The reason for deflation seems to be finite "a fall in the general price level or a contraction of credit and available money." Where inflation is, "a continuing rise in the general price level usually attributed to an increase in the volume of money and credit relative to available goods and services.” what is deflation "attributed to"?

The reasons I am pointing these things out is not to show you my grasp of the English language, but rather to show that the accepted view of deflation is that it is not normal. It is the black sheep of economics. This view of deflation as the enemy is pervasive in the economic and financial community and filters out into the public for general consumption.

Deflation is not bad. Inflation is not good. Both are conditions that exist during various economic cycles. One cannot exist without the other. It would be like characterizing day as good and night time as bad. Yes... it is that absurd.

Is deflation normal?

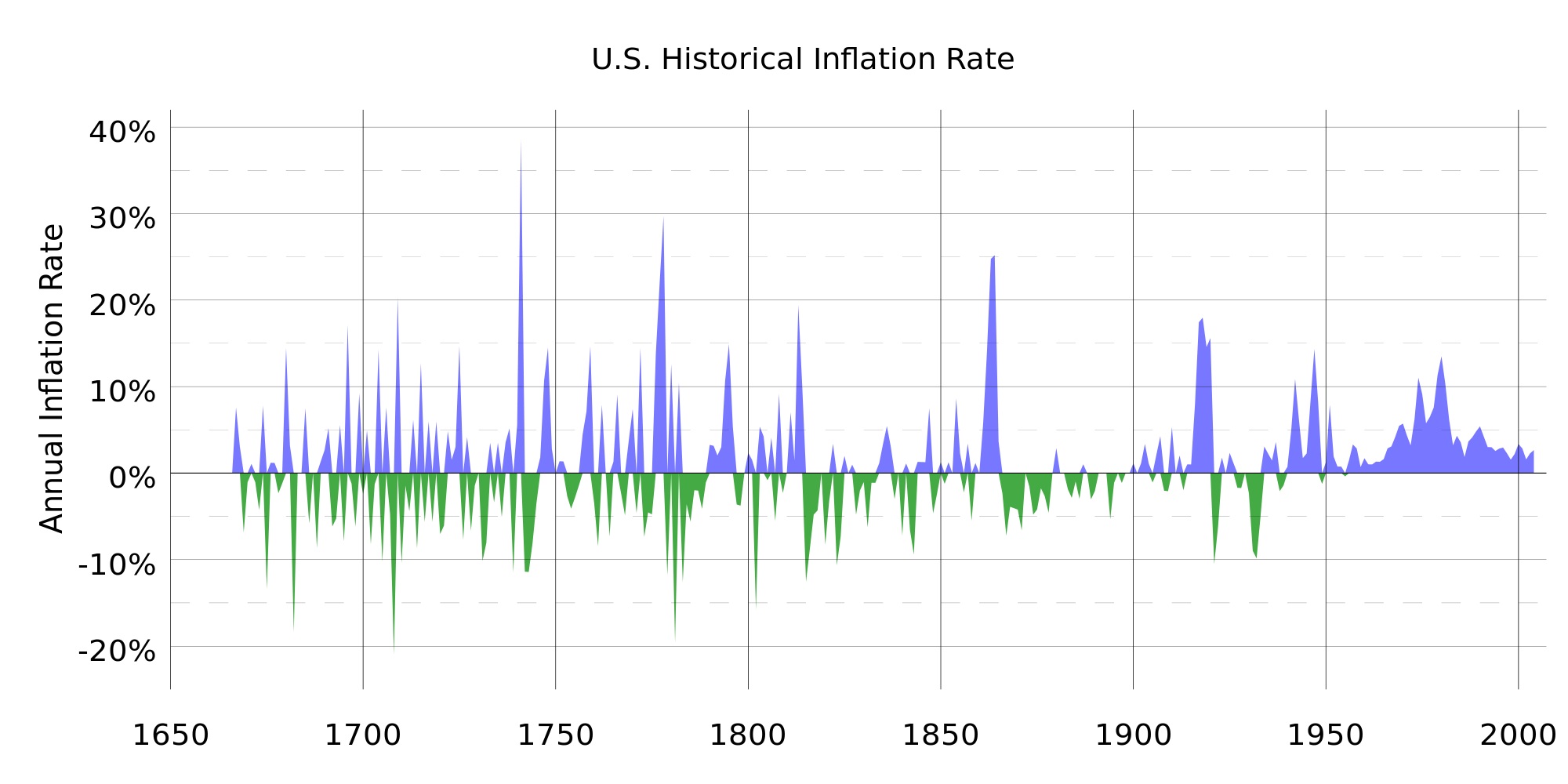

Deflation is as normal as inflation in a typical economic cycle. High or hyperinflation and extreme cases of deflation are not normal. However, these extreme cases of hyper-inflation or extreme deflation only happen when there is a disconnect in the economy. This disconnect could happen, in the case of hyper-inflation, from excessive money printing by the government or central bank, or it could come from disastrous fiscal policies from the government. Two more well-known cases of this are Zimbabwe and post-WWI Germany. Extreme cases of deflation are typically caused by monetary and/or fiscal policies which attempt to continuously pursue inflationary policies or try to eliminate the normal economic cycles. Although Japan's case of deflation is not extreme, it has been in a deflationary period since the 1990s.

The best way to think about inflation and deflation is to picture a beach ball floating in the ocean. The waves carry it up and down with normal wave movements. Sometimes the waves are large and sometimes they are small, but typically large swells involve a large up wave and large down wave. It is not normal to have a large up wave and small down wave. If the beach ball is floating without assistance, these up and down waves will move as your would expect them to move. Now consider what would happen if you took the beach ball and exerted an 'outside force" (in this case your hand) and you forced the ball under water. The ball cannot normally sustain a balance under the water without this outside force since its natural equilibrium is on the surface. The ball's natural direction to move is up. Once you release the "outside force" (your hand), the ball shoots upwards and overshoots the surface into the air. After some overshooting up and down it will eventually settle on the surface to resume its normal wave patterns. This is akin to how inflation and deflation work in a normal economic environment.

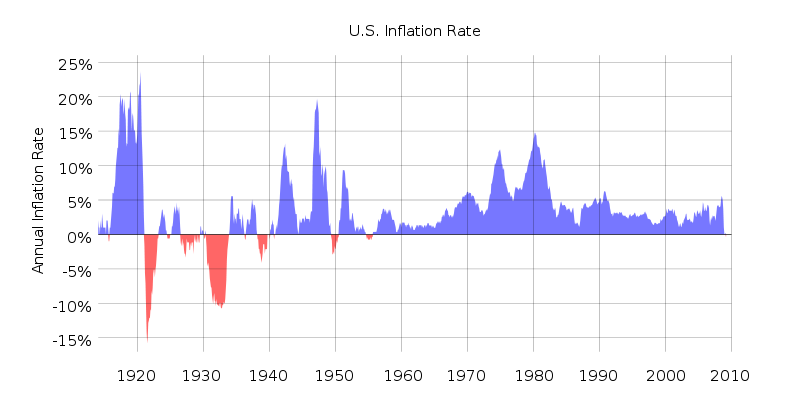

Consider that deflation has been suppressed for the past 60+ years in the US. How will the beach ball react to being held underwater for 60 years? We have seen some signs of what can happen after the tech bubble and the housing bubble burst. Japan is in a situation where inflation was followed by deflation, but they didn't allow deflation to run its natural course, so it has persisted for 25+ years.

Is deflation worse than inflation?

Deflation is not worse than Inflation. Prior to the creation of the Federal Reserve December 23, 1913, inflation and deflation were normal states of the economy and occurred frequently. Subsequently, the US went on a credit-based expansion.

A credit-based economy relies on inflation and expansion of credit to sustain itself and continue to grow. Without inflation, the growth rate of credit will have limitations as to how much the economy can sustain.

Deflation in of itself is not bad, however, when it occurs in a credit-based economy, the results are undesirable. Deflation causes the economy and credit to contract. The amount of credit outstanding will determine how much contraction needs to happen in order to find an equilibrium.

The problem is not deflation, rather it is credit. When solutions are created to solve the credit problem, the deflation problem will also be solved.

If you want to learn more about deflation and how to track it, check out our Inflation Monitor for monthly updates.

You can also join our email list and have the Inflation Monitor sent directly to your inbox.